There are few rites of passage in modern American life more bittersweet than buying your first dream car. It’s not just a purchase, it’s a declaration of arrival, a rolling embodiment of years spent clawing your way through the grind. So when Zah Naderi bought a C8 Corvette in full, no lease, no finance, just keys and cash, it was a milestone.

When Your Brand-New C8 Corvette Is Ruined Overnight

Five days later, that dream lay twisted and broken thanks to a hit-and-run, parked on a street that might as well have been a battlefield. But the greater wound came not from the impact, but from what followed: a lesson in how auto insurance companies work, not with compassion or logic, but with spreadsheets and soulless algorithms.

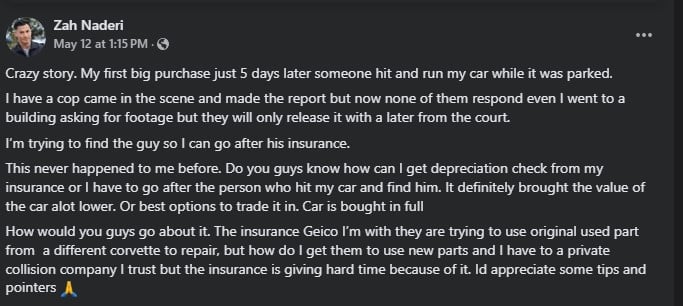

“Crazy story. My first big purchase, just 5 days later, someone hit and ran my car while it was parked.

I have a cop who came to the scene and made the report, but now none of them responded, even though I went to a building asking for footage, but they will only release it with a letter from the court.

I’m trying to find the guy so I can go after his insurance.

This never happened to me before. Do you guys know how I can get a depreciation check from my insurance, or do I have to go after the person who hit my car and find him? It definitely brought the value of the car a lot lower. Or the best options to trade it in. The car is bought in full.

How would you guys go about it? The insurance I’m with they are trying to use an original used part from a different Corvette to repair, but how do I get them to use new parts? I have to use a private collision company I trust, but the insurance is having difficulty because of it. I'd appreciate some tips and pointers 🙏”

The Facebook group C8 Corvette Owners (And Friends) quickly rallied to Naderi’s side, and in doing so, peeled back the curtain on an industry few fully understand until it’s too late. Zah wasn’t just dealing with the loss of an unsullied sports car, he was fighting a faceless economic machine programmed to calculate risk, minimize payout, and move on.

How Insurers Profit: Premiums, Investments & the Quest to Minimize Claims Costs

- Insurers collect premiums from policyholders, aiming to set rates that exceed the expected cost of claims and operating expenses. Effective underwriting, assessing, and pricing risk accurately is crucial to ensure that the premiums collected lead to profitability.

- The premiums collected are invested in various financial instruments, such as bonds and stocks. The returns from these investments, known as investment income, provide a significant source of profit for insurance companies, supplementing their underwriting income.

- Insurance companies strive to minimize their expenses by efficiently managing operational costs and carefully handling claims. This includes efforts to reduce fraudulent claims and negotiate settlements effectively, which helps in maintaining profitability.

Insurance companies today operate on actuarial science and profit-driven algorithms, not human sympathy. Your car’s condition, value, and uniqueness don’t mean a thing to the code running the claim.

As several commenters pointed out, “pre-crash condition” is one of the great lies told by the modern insurer. Gregory Khanjian, a fellow enthusiast, summed it up,

“Most insurance companies claim to ‘repair your car to pre-crash condition.’ Tell them the pre-crash condition did not involve used or aftermarket parts.”

But as Luke Short quickly replied, there’s a catch,

“GEICO doesn’t offer an endorsement for new OEM parts… OP agreed to use aftermarket parts when he bought the policy.”

Why OEM Parts Matter for Your C8 Corvette

The true absurdity is that the C8 Corvette isn’t a Honda Civic or a base Malibu; it’s a bespoke, performance-focused American supercar. Every panel, sensor, and structural component is part of a carefully tuned system, and even minor deviations can compromise its performance or safety.

“Most parts will only be OEM, even the headlight.”

Noted, Mike Meglino, in the comments, and he’s right. Yet Geico’s solution was to slap in salvaged bits from another totaled C8, as if your car's soul could be reassembled like a Lego kit on clearance.

This kind of treatment also undermines long-term value. Diminished value, the real, lasting financial hit your car takes even after repairs, isn’t just a nuisance; it’s the central concern in enthusiast ownership. Zah was right to ask about it.

Protecting Your C8’s Resale After an Accident

A C8 with an accident history is permanently marked, and unless you force your insurer’s hand, you’ll eat that loss at trade-in. Many companies will fight these claims with the vigor of a courtroom drama, hoping you don’t know what you’re entitled to. As Insurance Journal noted in a 2022 report,

“Less than 10% of insured drivers pursue diminished value claims.”

Mostly due to ignorance or fear of confrontation.

Adding insult to literal injury, some users even questioned Zah’s integrity. Alex Edwards commented,

“I don’t think this was parked,”

Implying that insurance companies were investigating for fraud. Zah’s reply:

“The car was parked and pushed forward and above the curb. The insurance company has tools that show the car was in motion, and it wasn’t. lol.”

That’s the reality. Not only are you fighting for repairs, you’re fighting for your credibility in a system built to distrust you by default.

From Clay Models to Fighter-Jet-Inspired Aerodynamics

- The shift from a front-engine to a mid-engine configuration was a significant departure from previous Corvette designs. This change aimed to enhance performance by improving weight distribution and handling dynamics, aligning the Corvette with other high-performance sports cars.

- The design team employed a combination of traditional sketching, clay modeling, and advanced digital tools to develop the C8's aesthetics. Multiple full-scale clay models were created, each exploring different styling directions, allowing designers to refine the vehicle's appearance meticulously.

- Drawing inspiration from modern fighter jets, the C8's design features sharp lines, large air intakes, and a low, aggressive stance. These elements not only contribute to the car's striking appearance but also serve functional purposes, such as improved aerodynamics and cooling efficiency.

There’s also the galling reality that while Zah was scrambling for courthouse letters to get security footage, his insurer, who technically has more legal standing and resources, refused to help. Glenn Murphy rightly noted,

“Your insurance company should be able to obtain any surveillance video… Demand new OEM parts.”

But unless it saves them money, most won’t lift a finger. These companies aren't in the business of finding justice. They're in the business of risk management, at your expense.

The lesson here isn’t just for C8 owners, it’s for anyone who still believes that buying a dream car means you’ve crossed some invisible finish line.

The modern insurance landscape doesn’t care whether you’re driving a Bugatti or a beat-up Buick. If it costs more to fix than an algorithm finds palatable, you’re just a number waiting to be reconciled.

Until the industry adapts to recognize the unique status of enthusiast vehicles, where function, form, and emotion are inseparable, owners like Zah will continue to face a world where passion is irrelevant, and a junkyard part is considered "good enough."

Image Sources: Chevrolet Media Center

Noah Washington is an automotive journalist based in Atlanta, Georgia. He enjoys covering the latest news in the automotive industry and conducting reviews on the latest cars. He has been in the automotive industry since 15 years old and has been featured in prominent automotive news sites. You can reach him on X and LinkedIn for tips and to follow his automotive coverage.

Set Torque News as Preferred Source on Google

Comments

You could have paid for an…

Permalink

You could have paid for an OEM parts endorsement, and since you didn't you get what you paid for. Not even a new worthy article.

you can show my coment…

Permalink

In reply to You could have paid for an… by Austin (not verified)

you can show my coment publicly. I think there is a misconception as to used parts from the wreakers for the new corvet.The new team is aut recycling that part must be acquired from a mew corvette to match as well 7as meet the team of insurancece quality. Once removed from the doner car it is shipped to the repair shop where your car awaits the part is inspected by no less then 4 pepole The first manager of distribution at the recycling yard 2nd manager at the shop usually accompanied by your insurance adjuster and finaly but in my opinion the most inportant your repair technician any of those 4 can refuse the part if it is below , ( insurance quality) Your role in this event should be making sure you know where your vehicle is you are comfortable with the repair facility you have seen the certificate that qualifies your repair technician and finally before you accept delivery that your 100% satisfied and you car has passed a body safety with certificate when all this is followed you are good to go atleast that's how we roll in Canida Chris mallett licenced inerprovencial Automotive collection repair technician. Thanks

Love the comment! A friend…

Permalink

In reply to you can show my coment… by Chris mallett (not verified)

Love the comment! A friend went through the same thing. Her repairman rejected obviously broken parts sent from the junk yard. But please, spell check! 😊

After spending decades in…

Permalink

In reply to You could have paid for an… by Austin (not verified)

After spending decades in the insurance industry, I am considered to be an expert in the industry. With this in mind, I am offering the following advice with the hope that it may be helpful:

1) Read the policy including the fine print in order to determine your rights under the policy as well as the insurers obligations. This should serve as the basis for any subsequent actions.

2) Provided the policy contains language that obligates the insurer to cover repairs to its condition prior to the hit and run ("the event"), given that this is a new car by definition, likely has an obligation to reimburse for new OEM parts and the cost of skilled labor to repair. Again, keep in mind that this should be spelled out or specifically excluded within the policy.

3) The insurer may likewise be financially responsible for diminished value to your vehicle as it will now show that the vehicle was involved in an accident & repaired. This fact will negatively impact the value of the car at time of resale.

4) Without having the benefit of reviewing the policy, the above is a summary of your rights as a policyholder.

5) Appeal the insurers position, specifically referencing the portions of the policy that support your position.

6) In the event the event that the insurer refuses to cover repairs, including the cost of new OEM parts as well as diminished value, ask them for the specific basis as it relates to their position and what specific portions of the policy support their position. Keep in mind that the insurer my only portions of the policy that when taken at face-value may be interpreted out of context. Therefore, be sure the entire clause and any subsequent clauses which may refute their "justification ".

7) If you find the end of #6 to be the case, be sure to point this out to them, seeking their direct response.

8) In the event that the the insurer remains adamant on their position, ask them about their specific appeal process beyond what has already taken place. Provided that there are appeal processes beyond what has already been done, follow them in an effort to fully resolve the matter.

9) BE SURE TO DOCUMENT ALL COMMUNICATIONS INCLUDED ANY VERBAL COMMUNICATIONS. KEEP ALL RELATED DOCUMENTS TO SUPPORT YOUR ASSERTIONS OF COMMUNICATIONS (E.G.- phone records, emails, etc.). Always ask for everything in writing.

10) As it relates to your suing the responsible party, this is NOT your responsibility regardless of what your insurer may state. This is unless what is covered under the terms of your policy. YOUR insurer has a direct responsible to you with regard to covering all costs related to the event to the extent that it is covered under the terms of your policy.

11) The insurer may choose to seek reimbursement from the responsible party and its insurer. In the industry, this process is known as subrogation and is very common. Regardless of whether your insurer is successful in its subrogation, it is not your problem, it is your insurer's.

12. As you are doing all of the above contact any regulators in your state who have jurisdiction over insurers that are licensed within your state. The regulators may be able to offer assistance and/or guidance in the matter.

13. If you have exhausted all of the above, try negotiating directly with the insurer to increase the amount in order to settle the claim. If the insurer is willing to do so, their offer will likely fall between the full cost (your position) and their position. You can then elect to accept their offer or not.

14. If your policy includes an arbitration clause, you may also pursue the unsettled matter through that process.

15. If you go to arbitration, be prepared to provide whatever documentation the arbitrator is seeking. This is typically in advance of the arbitration. Carefully check to check whether you are required to retain legal counsel for this process and how that works. Some arbitration clauses have this requirement, some may forbid the insurer to have legal counsel present at the arbitration unless you do.

16. The above will require significant time and effort on your part, so you must decide if it's worth it. If not, you may consider trying some of the steps above, but not all.

17. Keep in mind that unless explicity stated under the policy, you can choose who you want to repair the car. Regardless, get an estimate of the repair costs, sharing this with the insurer if it supports your position. I would suggest getting two estimates- one with new OEM parts, the second with used OEM parts so that you have a sense of the cost.

18. Typically, if you are not afforded the ability the ability to have the car repaired by the shop of your choosing, you must be afforded the opportunity to examine the repaired vehicle to assure the vehicle is repaired to your satisfaction. I would suggest that you take or hire an "expert" to examine the vehicle at the same time in order to assure that everything has been repaired correctly and to OEM specifications. If the vehicle is not repaired to your satisfaction, be prepared to document and share the reason(s) why you are unwilling to accept the vehicle in its current state.

19. Insist that warranties for the worked performed is in writing are provided to you. The warranties should be in line with typical industry standards and likewise provide instructions for filing a warranty claim including extending the warranty to the extent of the OEM warranty and any extended warranty.

20. Check with Chevy as well as any extended warranty company (if you have one) to determine how these repairs will impact any claims made under their policy(ies). Get it in writing and share with the insurer as this likewise may impact the cost of the claim in the event that certain parts or all of the warranty(ies) is/are voided.

Keeping in all of the above in mind as well as any helpful suggestions that others have provided, if you are not successful, you could check to see what the limits are for filing a claim in small claims court, provided that the difference in cost is less than the amount in dispute.

If the case is not edible for small claims court, you could consider retaining legal counsel. HOWEVER, unless you have a friend that is willing to take this on a pro-bono basis, I WOULD NOT RECOMMEND DOING SO as the cost of doing so will be multiples of the disputed amount, and potentially the cost of the car. Further it will likely be a protracted matter if you decide to pursue through the legal system with no guarantees on the outcome.

Instead you may want to consider the cost difference between used OEM & used OEM, paying the difference out of pocket. Regardless I would not suggest conceding on #20.

Best of luck obtaining a refund.

PS: If someone can copy & paste this to Facebook in the proper string, I would appreciate it. Likewise, I do offer the provision of advice and/or pursuing matters on behalf of an insured on a consultative basis should anyone wish to retain my services. If so, email me at [email protected].

The man who bought this car…

Permalink

In reply to You could have paid for an… by Austin (not verified)

The man who bought this car clearly has a lack of experience with high end cars. Delete this post. Massive waste of time.

I'll admit, I skimmed this…

Permalink

I'll admit, I skimmed this article but who owns a car such as that but insures it with the Government Employee Insurance Company. There are reputable insurance companies that offer coverage for a vehicle that described but you won't find advertising on television.

Lol you know most insurance…

Permalink

In reply to I'll admit, I skimmed this… by Skoler (not verified)

Lol you know most insurance companies such as the one you complained about him using is usually underwritten by a large insurance company like Geico, Narionwide etc...?

The coverage is what is important and not the brand name of the company.

I know you probably are not educated in insurance companies like that judging by the comment.

Yeah, it’s odd seeing…

Permalink

In reply to I'll admit, I skimmed this… by Skoler (not verified)

Yeah, it’s odd seeing someone with a high-end car go with a more budget insurance option.

"Until the industry adapts…

Permalink

"Until the industry adapts to recognize the unique status of enthusiast vehicles, where function, form, and emotion are inseparable." BE CAREFUL WHAT YOU WISH FOR!

The insurance industry already "adapts" that's why my car insurance in FL has almost doubled over the last 4 years and I'm driving the same vehicle for 8 years with no accident and a clean 3 decade driving record. Called around to try and switch others were even higher.

If the insurance industry "adapts" on your recommend reasons expect those individuals to be paying double or triple for there insurance! But hey if that's what it takes for you to get OEM parts..well that's on you.

Weill don't buy cheap…

Permalink

In reply to "Until the industry adapts… by Mr. Buddah (not verified)

Weill don't buy cheap insurance policy's. I feel for them to get away with it it must of been in the policy.. .and if it wasnt in the policy we'll then ur good but there's alot of cheap polices these days and we'll thats what u get when u don't wanna pay the increased prices

Yeah, cheap policies can be…

Permalink

In reply to Weill don't buy cheap… by Ben (not verified)

Yeah, cheap policies can be risky. If it's not covered, they’re definitely out of luck.

If your car is LESS-THAN a…

Permalink

If your car is LESS-THAN a year old and has LESS-THAN 12,000 miles you can DEMAND NEW OEM PARTS!

I used to work for Gerber…

Permalink

In reply to If your car is LESS-THAN a… by Perry Laspina (not verified)

I used to work for Gerber Collision, I grew up in a body shop, 90% of the repair is aftermarket and/or junkyard parts. The prices insurance companies set are OEM prices and aftermarket parts, then average them.

Interesting

Permalink

In reply to I used to work for Gerber… by Diesel (not verified)

Interesting

Depends on the state you…

Permalink

In reply to If your car is LESS-THAN a… by Perry Laspina (not verified)

Depends on the state you live in. Some states have laws in place that do state oem (not always new OEM) parts depending on year of your vehicle.

You can't just demand OEM parts if the use of aftermarket or recycled parts is written in the policy you accepted.

Yeah, state laws definitely…

Permalink

In reply to Depends on the state you… by Chris Dwyer (not verified)

Yeah, state laws definitely vary

Exactly, it is State…

Permalink

In reply to Depends on the state you… by Chris Dwyer (not verified)

Exactly, it is State specific and based on mileage and year of vehicle. It was 12000 and same year for the longest. In states where it isn't that way, there's usually the option to pay more for that coverage. The problem is most people want to talk about it after they need it. Do.your homework before even buying the car. Why would you spend 100k, then worry about the details later. Seems crazy to me, but then 2025 happened.

Good to know

Permalink

In reply to If your car is LESS-THAN a… by Perry Laspina (not verified)

Good to know

I’m in Ohio and the law was…

Permalink

In reply to If your car is LESS-THAN a… by Perry Laspina (not verified)

I’m in Ohio and the law was under two years all OEM parts. Anything older was considered a used car. I don’t know if that has changed. State Farm was sued years ago for using aftermarket parts because that’s not putting the vehicle back to pre accident conditions.

As someone who works for one…

Permalink

In reply to If your car is LESS-THAN a… by Perry Laspina (not verified)

As someone who works for one of these insurance companies, if the vehicle is the same year model year (a 2025 Corvette in 2025) AND has less than 12,000 miles, it won't allow us to select anything other than OEM parts.

However, the comments I read earlier about recycled or salvaged parts is almost mind numbingly dumb.

If you have a 2023 Corvette Stingray for example and the left dender gets demolished, they can use an undamaged left fender from another Corvette Stkngray that is exactly the same. If the 2022 - 2024 fenders for these vehicles are all identical and come from the same assblyline, it still is OEM. They aren't giving you a Hyundai Accent fender that doesn't fit.

Also, in many cases, the panel you are getting is newer than the one that came off. People hear junkyard and think old rusty parts. But that brand new Corvetter that got totalled from a front end impact likely has 2/3 of thr car that are undamaged and still in perfect condition.

They also come with the same warranties because they ARE OEM parts from the same manufacturer.

Also, a lot of times on vehicles, parts are on backorder with no ETA and the only option is a recycled part. I'd rather have a 1 year old recycled part put on my car to get it repaired than have my vehicle sit and possibly be undrivable for up to a year (have seen that happen a few times already).

You do always have the option to pay the difference between the recycled and new OEM part cost if you're neurotic enough.

Exactly... my 25 ram was…

Permalink

In reply to If your car is LESS-THAN a… by Perry Laspina (not verified)

Exactly... my 25 ram was side swiped with only 5500 miles and 4 months old... insurance wanted my body shop to put used parts on it! He refused, when i started questioning the insurance they claimed vin said its a 24... i said bs, heres the window sticker and registration info.... its brand new. They came back saying oh sorry somebody here made a mistake. 1 year old and under 12k miles. It gets all new panels. Buyers beware, insurance companies will try to scam you any way possible to save a couple bucks.

Yep - it was likely in the…

Permalink

Yep - it was likely in the terms of your policy that you signed (agreed to).

Guess Pete Seger was right. " Education is what you get when you read the fine print. Experience is what you get when you don't.

This issue isnt on Geico, …

Permalink

This issue isnt on Geico, its on you. Learn to read your policy. The policy clearly states they have that option to use Used parts. Some insurers have options for all new Oem parts, you pay extra and often will depend on a States laws, otherwise stop whining about this, find reputable shop that can repair it well and learn your lesson.

This is noted

Permalink

In reply to This issue isnt on Geico, … by c. smith (not verified)

This is noted

Brother got his dream car…

Permalink

Brother got his dream car and insured it with Geico, LMAO

Haha, guess he’s all about…

Permalink

In reply to Brother got his dream car… by Shane (not verified)

Haha, guess he’s all about those low premiums!

Enough already with the …

Permalink

Enough already with the "insurance companies are evil". Look to your left and to your right, those are the people that are committing fraud to insurance to the tune of 308 billion dollars a year. If I was an insurance company I'd ask some questions too before paying any claim. To comment on GEICO. Those NFL commercials that you laughed at with that funny gecko with the English accent cost money , a lot of money

No not enough with …

Permalink

In reply to Enough already with the … by Johan (not verified)

No not enough with 'insurance companies are evil'. When my Regal got totalled, they looked for comparable vehicles within 250 miles... extrended it to 500 when they couldn't find ones cheap enough. Pretended a car listed with a blown transmission was 'comparable'. Then subtracted 10 or 20% off that price. So $750 for a $3000 vehicle. Then the adjuster quipped I was lucky to get that!

Insurance companies ARE evil.

Insurance companies, like…

Permalink

Insurance companies, like most corporations, operate under the primitive laws of nature: greed and ruthless self-interest.

There is no compassion or altruism in nature, just ruthless self-interest.

Still sucks though.

The insurance industry is…

Permalink

In reply to Insurance companies, like… by David (not verified)

The insurance industry is controlled by state farm and they dictate everything that is done with the repair of vehicles from how much a body shop charges per hour to parts used. You can fight and cry but you will not get what you want or think you should have being repaired. I went to Hunter school and my instructor was a former insurance adjuster for said company. Hunter makes automotive alignment machines, wheel balancing and anything to do with the wheels and alignment of vehicles. They have a tire machine just for Corvette wheels... place the wheel in a certain spot and it does the rest... breaking down of the tire and replacing it without a scratch. Run flats are a bitch to replace . Shop labor rates vary from 100$-200$-300$ per hour but body shops....35$ish.... well when it comes to insurance claims. Some custom paint shop is different... insurance claims are ran at such a low cost shops barely are able to pay the technician and turn a profit on any claim

Pagination