The promise of a federal tax credit for a used electric vehicle purchase often sweetens the deal, making EV ownership more accessible.

However, as one recent Chevy Bolt buyer discovered, the path to claiming that credit can be fraught with unexpected bureaucratic hurdles, often stemming from dealer negligence.

This particular buyer's experience, detailed on social media, exposes a significant flaw in the implementation of the used EV tax credit program, leaving consumers in a precarious financial position.

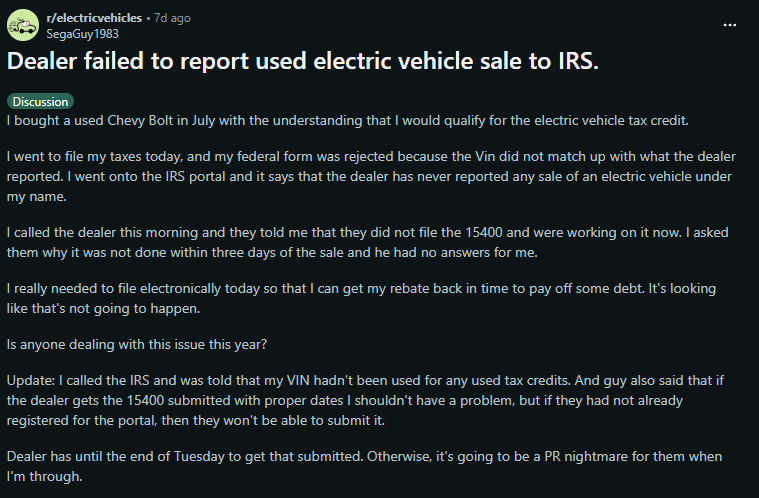

The user, posting under the handle SegaGuy1983 on r/electricvehicles, shared their frustrating ordeal:

"I bought a used Chevy Bolt in July with the understanding that I would qualify for the electric vehicle tax credit.

I went to file my taxes today, and my federal form was rejected because the Vin did not match up with what the dealer reported. I went to the IRS portal, and it says that the dealer has never reported any sale of an electric vehicle under my name.

I called the dealer this morning, and they told me that they did not file the 15400 and were working on it now. I asked them why it was not done within three days of the sale, and they had no answers for me.

I really needed to file electronically today so that I could get my rebate back in time to pay off some debt. It's looking like that's not going to happen.

Is anyone dealing with this issue this year?

Update: I called the IRS and was told that my VIN hadn't been used for any used tax credits. And the guy also said that if the dealer gets the 15400 submitted with proper dates, I shouldn't have a problem, but if they have not already registered for the portal, then they won't be able to submit it.

The dealer has until the end of Tuesday to get that submitted. Otherwise, it's going to be a PR nightmare for them when I'm through."

This scenario is not an isolated incident; it represents a systemic failure in the information pipeline designed to facilitate these incentives. The onus is placed squarely on the dealer to accurately and promptly report the sale, a responsibility many seem ill-equipped or unwilling to handle. For a buyer relying on a $4,000 credit to manage personal finances, this oversight transitions from a minor inconvenience to a major financial setback, revealing the critical need for robust, transparent processes from the outset.

Chevrolet Bolt EV: Navigating the Used EV Tax Credit Maze

- The used clean vehicle tax credit, established by the Inflation Reduction Act, offers up to $4,000 for eligible vehicles purchased from a dealer. To qualify, the vehicle must be at least two model years old, cost $25,000 or less, and meet specific battery capacity and weight requirements.

- Dealers are legally required to report the sale of an eligible used EV to the IRS via the Energy Credits Online portal within three calendar days of the transaction. This includes providing the buyer with a copy of the IRS Form 15400, "Seller Report for Clean Vehicle Credits," at the time of sale.

- For a buyer to claim the credit, their modified adjusted gross income (MAGI) must not exceed $75,000 for single filers, $112,500 for heads of household, or $150,000 for joint filers. The credit is non-refundable, meaning it can only reduce a taxpayer's liability to zero.

- The Chevy Bolt EV, particularly older model years, is a popular choice for the used EV tax credit due to its affordability and range. However, eligibility is contingent on strict adherence to both vehicle and seller requirements, revealing the importance of dealer compliance.

One commenter, CauliflowerTop2464, articulated a sentiment that resonates with many in the EV community: "This was a common problem with the EV credits. It was recommended that if they didn’t deduct at the point of sale, they avoid that dealer. Either they weren’t going to do the submission correctly, or they were lying about the car's eligibility."

This assessment cuts to the heart of the issue: either dealers are genuinely ignorant of the regulations surrounding these credits, or they are deliberately sidestepping their obligations. The recommendation to avoid dealers who don't offer point-of-sale deductions, while practical advice for consumers, is a damning indictment of the industry's preparedness. It suggests a lack of trust that should alarm any manufacturer or regulator hoping to accelerate EV adoption through such incentives.

The complexity of these regulations is further highlighted by user compulov, who recounted their own struggle with a 2025 Kia EV6 GT-Line purchase: "It required two days of fighting with the dealer to convince them that there was electronic paperwork with a ticking clock that needed to be taken care of on their end in order to qualify for the tax credit. I told them that if I don't get the form I need, they don't have a sale (they were supposed to give you the form 15400 at the time you signed the paperwork). So there are clueless dealers out there, and it's easy to get screwed if you didn't know any better (and how on earth would anyone be expected to know this?)."

This experience reveals the profound knowledge gap that exists between the regulatory framework and the point of sale for the Chevy Bolt. Expecting the average car buyer to be an expert in IRS tax codes and dealer reporting requirements is absurd. The fact that a customer must threaten to walk away from a sale just to ensure a dealer fulfills a basic, time-sensitive administrative task speaks volumes about the current state of affairs. This is not merely a "clueless dealer" problem; it's a structural weakness that undermines consumer confidence in the entire EV incentive program.

The regulatory implementation itself drew criticism from supercargo: "Wow, what an awful implementation of that regulation…in my experience, dealers have a hard enough time filing paperwork with the DMV within three days, let alone some obscure IRS thing that only applies to a fraction of their vehicles…"

This perspective, while perhaps sympathetic to the dealer's administrative burden, fundamentally misses the point. The difficulty of compliance does not excuse non-compliance, especially when a significant financial benefit for the consumer is at stake. If the system is too complex for dealers to manage, then the system itself needs an overhaul, not a lowering of expectations for consumer protection. The comparison to DMV paperwork, already a low bar for efficiency, only points to the depth of the problem.

The responsibility for ensuring these credits are properly processed falls on the dealer. Their failure to register for the IRS portal or submit Form 15400 within the mandated three days is not a minor oversight; it's a dereliction of duty that directly impacts the buyer's financial well-being. The threat of a "PR nightmare" from the buyer, while understandable, should not be the primary motivator for a dealership to fulfill its legal and ethical obligations.

This situation reveals a critical disconnect between the federal government's intent to incentivize Chevy Bolt EV adoption and the practical execution at the retail level. Until dealers are held more accountable or the process is significantly streamlined and automated, consumers will continue to face unnecessary stress and potential financial loss. The promise of a tax credit should be a clear benefit, not a bureaucratic minefield that requires buyers to become amateur tax lawyers just to claim what they are owed.

Image Sources: Chevrolet Media Center

Noah Washington is an automotive journalist based in Atlanta, Georgia. He enjoys covering the latest news in the automotive industry and conducting reviews on the latest cars. He has been in the automotive industry since 15 years old and has been featured in prominent automotive news sites. You can reach him on X and LinkedIn for tips and to follow his automotive coverage.

Set Torque News as Preferred Source on Google