As the electric pickup segment accelerates into the next phase of mass adoption, American automakers are staking out very different strategies to capture buyers’ attention and wallets. Legacy brands like Ford Motor Company and General Motors are rolling out product lines that promise to blend utility, price, and range, while disruptors like Tesla continue pushing the boundaries of performance and design. For consumers and fleet buyers alike, understanding how these varying approaches stack up against one another isn’t just about specs on paper. It’s about real-world value, future resale, charging networks, and everyday capability. This comprehensive comparison puts the three major U.S. EV pickup philosophies head-to-head so you can see where each excels and where compromises might be hiding.

At the center of this discussion is Ford’s newly announced Universal EV platform: a ground-up architecture engineered for cost efficiency, performance, and scalability. In our earlier deep dive on that platform, we broke down how Ford is targeting a $30,000 mid-size electric pickup with a structural LFP battery, impressive efficiency improvements, and a radically simplified parts count that could redefine what “affordable” means in an EV truck (see “Ford’s New EV Platform Promises a $30K Pickup With 4.5-Second 0–60 and 15% Better Efficiency”). That article lays the groundwork for understanding the ambitious engineering and pricing strategy that makes this comparison critical.

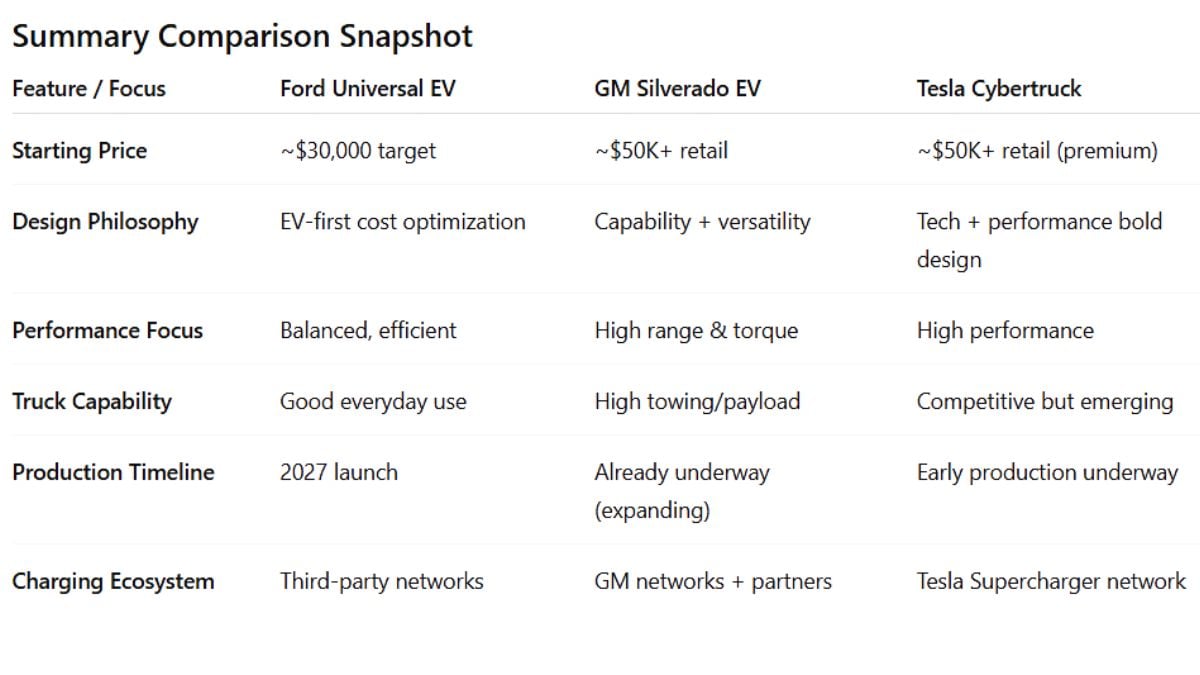

On the other end of the spectrum, our previous article contrasting Ford’s approach with Tesla’s Cybertruck (see “Ford’s New Universal EV Platform vs. Tesla Cybertruck: A Realistic Comparison of EV Pickups”) highlighted some of the most meaningful differences between Ford’s cost-centric design and Tesla’s tech-forward, high-performance pickup philosophy. Pulling those threads together with GM’s yet-another approach, one rooted in the Ultium platform and traditional truck capability, gives a more complete picture of where the EV pickup market is heading, and how each brand’s strategy could influence who wins in what segment.

1. Pricing Strategy and Market Role

Ford: Accessibility First

Ford’s Universal EV platform aims squarely at affordability. The initial vehicle - a mid-size electric pickup - is targeted at around $30,000 for U.S. deliveries in 2027. That’s an aggressive price point compared to current EV trucks and a major selling point if Ford can actually deliver it without sacrificing too much in capability or range.

GM: Premium and Capability Focused

GM’s Silverado EV lineup today sits much higher in price. For the 2026 model year, the standard trims start in the mid-$50,000 range and go substantially higher into the $70K–$90K territory for more equipped versions. Retail pricing varies a lot by trim, battery, and options, but it is clearly not an entry-price truck like what Ford is pitching.

Tesla: Premium & Distinctive

The Cybertruck also goes premium (historical estimates above $50,000+ for the base trim), and continues to emphasize unique design and performance over mainstream affordability. Final pricing is still somewhat in flux as Tesla ramps production, but it’s clearly positioned above Ford’s $30K target.

Bottom Line:

- Ford = targeted at mainstream buyers and affordability

- GM & Tesla = positioned above $50,000, aimed at capability and higher-end buyers

2. Engineering and Platform Design

Ford’s Universal EV Architecture

Ford’s platform is being built from the ground up as an EV architecture. It incorporates:

- Structural LFP battery packs to cut cost and increase rigidity

- Zonal electronics for simpler wiring and future upgrades

- Gigacasting and other manufacturing simplifications aimed at part count reduction and cost efficiency

- Aerodynamic refinements (claimed 15% efficiency gain)

This is an all-new EV foundation designed to scale to different vehicle types, not built atop a legacy internal-combustion layout.

GM’s Ultium Platform (Silverado EV)

GM’s electric trucks are built on its Ultium battery and drive platform, which also supports the GMC Sierra EV, GMC Hummer EV, and the upcoming Cadillac Escalade IQ: meaning it’s a shared architecture across a broad range of vehicles. The Silverado EV is engineered for:

- Long range and performance (up to ~450 miles in some trims)

- High towing and payload specs that rival gas trucks

- Multiple motor configurations and power levels

This is a premium-capability EV platform that reflects a more traditional GM engineering approach - flexible but built for higher performance and option content.

Tesla’s Cybertruck Architecture

Tesla’s structure is famous for its stainless steel exoskeleton and minimalist interior. While details are evolving as production ramps, Tesla’s core strengths include:

- Integrated vehicle software and controls

- High-efficiency powertrain design

- Shared tech ecosystem (Autopilot, Supercharging)

But its unique materials and manufacturing have reportedly complicated production, slowing deliveries.

Bottom Line:

- Ford = cost-optimized EV first platform

- GM = capability-oriented, adaptable EV platform

- Tesla = tech-centric with bold, unconventional engineering

3. Performance & Capability Benchmarks

Ford’s Performance Targets

Ford has publicly targeted figures like ~4.5-second 0–60 mph acceleration and aerodynamic efficiency gains around 15% over current EV pickups - credible but modest if performance is your primary metric.

GM Silverado EV

The Silverado EV (in trims like Trail Boss) already delivers:

- High horsepower (up to ~760+) and torque levels

- Towing capacities near traditional pickup capability

- Up to ~450 miles of range on certain configurations

This is a truck that’s trying to cover all the bases - performance, range, towing, and payload.

Tesla Cybertruck

Tesla has historically touted very high performance figures for top trims (sub-4.0-second acceleration in some specs), robust electric range, and competitive towing. But real-world output and timeline are still emerging as deliveries build.

Bottom Line:

- Ford = balanced performance for $30K segment

- GM = high capability and range in premium trims

- Tesla = strong performance narrative with cutting-edge powertrain

4. Use-Case and Buyer Appeal

Ford - Everyday Practical Buyer

Ford’s strategy seems directed at mainstream truck buyers who want:

- Affordable ownership

- Reliable EV technology

- A vehicle that fits everyday life without overpaying

This matters because electric adoption for mass market pickup buyers will hinge on price and utility, not just specs.

GM - Capability and Familiar Truck Feel

GM is leaning into its truck heritage. The Silverado EV lineup offers:

- Trim levels ranging from Work Truck to off-road Trail Boss

- Midgate flexibility (borrowed from its gas siblings)

- Advanced tech like Super Cruise with towing integration

This appeals to buyers who want traditional truck capability and features in an EV.

Tesla - Tech & Brand Loyalists

Cybertruck’s buyer profile skews toward people who value:

- Cutting-edge tech ecosystem (software features, Autopilot)

- Bold styling and differentiation

- Tesla’s Supercharger and software experience

5. Production & Market Timing

- Ford aims for 2027 with its ~$30K truck, giving it time to refine cost efficiencies but also entering a more crowded EV landscape.

- GM is already producing Silverado EV in limited quantities, though additional production scale-up has seen delays, and some EV production hub plans have been reworked.

- Tesla is already delivering Cybertrucks in limited numbers but is still ramping and resolving early production kinks.

Timing matters: Ford is later to market but cheaper; GM is now in market but expensive; Tesla is early but still evolving production.

Ford’s entry shakes up expectations by aiming squarely at the affordability problem that’s kept many buyers on the sidelines. GM, by contrast, has doubled down on capability and truck heritage with the Silverado EV: a vehicle that’s already in the real world and showing what electric pickups can do if price isn’t the first constraint. Tesla’s Cybertruck occupies the third path: technology-first and unconventional, but its pricing and production challenges put it in a different niche from Ford’s value play.

All three approaches matter. The market isn’t just one buyer, and at this stage of EV adoption, price, performance, and practicality all have different audiences. If Ford hits its ~$30K goal with a capable enough truck, it could accelerate EV pickup adoption in a way the others haven’t yet managed. But if you want proven range and utility today, GM’s Ultium-based trucks already offer that - at a premium price.

If Ford really delivers a $30,000 electric pickup by 2027, would that be enough to pull you away from a higher-priced Silverado EV or Cybertruck?

And when choosing an electric truck, what matters most to you - price, range, towing capability, charging access, or long-term reliability? Share your thoughts and let us know which approach you think will win the EV pickup race.

Armen Hareyan is the founder and Editor-in-Chief of Torque News. He founded TorqueNews.com in 2010, which since then has been publishing expert news and analysis about the automotive industry. He can be reached at Torque News Twitter, Linkedin, and Youtube. He has more than a decade of expertise in the automotive industry with a special interest in Tesla and electric vehicles.

Set as google preferred source