There are few rites of passage in modern American life more bittersweet than buying your first dream car. It’s not just a purchase, it’s a declaration of arrival, a rolling embodiment of years spent clawing your way through the grind. So when Zah Naderi bought a C8 Corvette in full, no lease, no finance, just keys and cash, it was a milestone.

When Your Brand-New C8 Corvette Is Ruined Overnight

Five days later, that dream lay twisted and broken thanks to a hit-and-run, parked on a street that might as well have been a battlefield. But the greater wound came not from the impact, but from what followed: a lesson in how auto insurance companies work, not with compassion or logic, but with spreadsheets and soulless algorithms.

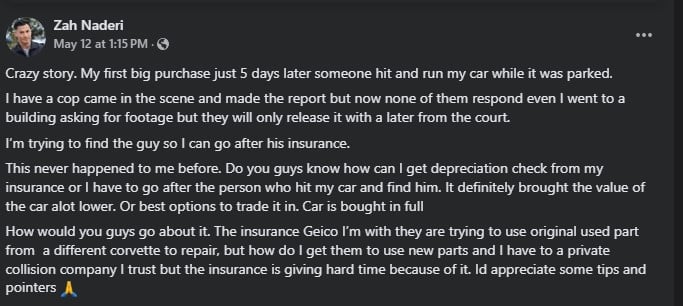

“Crazy story. My first big purchase, just 5 days later, someone hit and ran my car while it was parked.

I have a cop who came to the scene and made the report, but now none of them responded, even though I went to a building asking for footage, but they will only release it with a letter from the court.

I’m trying to find the guy so I can go after his insurance.

This never happened to me before. Do you guys know how I can get a depreciation check from my insurance, or do I have to go after the person who hit my car and find him? It definitely brought the value of the car a lot lower. Or the best options to trade it in. The car is bought in full.

How would you guys go about it? The insurance I’m with they are trying to use an original used part from a different Corvette to repair, but how do I get them to use new parts? I have to use a private collision company I trust, but the insurance is having difficulty because of it. I'd appreciate some tips and pointers 🙏”

The Facebook group C8 Corvette Owners (And Friends) quickly rallied to Naderi’s side, and in doing so, peeled back the curtain on an industry few fully understand until it’s too late. Zah wasn’t just dealing with the loss of an unsullied sports car, he was fighting a faceless economic machine programmed to calculate risk, minimize payout, and move on.

How Insurers Profit: Premiums, Investments & the Quest to Minimize Claims Costs

- Insurers collect premiums from policyholders, aiming to set rates that exceed the expected cost of claims and operating expenses. Effective underwriting, assessing, and pricing risk accurately is crucial to ensure that the premiums collected lead to profitability.

- The premiums collected are invested in various financial instruments, such as bonds and stocks. The returns from these investments, known as investment income, provide a significant source of profit for insurance companies, supplementing their underwriting income.

- Insurance companies strive to minimize their expenses by efficiently managing operational costs and carefully handling claims. This includes efforts to reduce fraudulent claims and negotiate settlements effectively, which helps in maintaining profitability.

Insurance companies today operate on actuarial science and profit-driven algorithms, not human sympathy. Your car’s condition, value, and uniqueness don’t mean a thing to the code running the claim.

As several commenters pointed out, “pre-crash condition” is one of the great lies told by the modern insurer. Gregory Khanjian, a fellow enthusiast, summed it up,

“Most insurance companies claim to ‘repair your car to pre-crash condition.’ Tell them the pre-crash condition did not involve used or aftermarket parts.”

But as Luke Short quickly replied, there’s a catch,

“GEICO doesn’t offer an endorsement for new OEM parts… OP agreed to use aftermarket parts when he bought the policy.”

Why OEM Parts Matter for Your C8 Corvette

The true absurdity is that the C8 Corvette isn’t a Honda Civic or a base Malibu; it’s a bespoke, performance-focused American supercar. Every panel, sensor, and structural component is part of a carefully tuned system, and even minor deviations can compromise its performance or safety.

“Most parts will only be OEM, even the headlight.”

Noted, Mike Meglino, in the comments, and he’s right. Yet Geico’s solution was to slap in salvaged bits from another totaled C8, as if your car's soul could be reassembled like a Lego kit on clearance.

This kind of treatment also undermines long-term value. Diminished value, the real, lasting financial hit your car takes even after repairs, isn’t just a nuisance; it’s the central concern in enthusiast ownership. Zah was right to ask about it.

Protecting Your C8’s Resale After an Accident

A C8 with an accident history is permanently marked, and unless you force your insurer’s hand, you’ll eat that loss at trade-in. Many companies will fight these claims with the vigor of a courtroom drama, hoping you don’t know what you’re entitled to. As Insurance Journal noted in a 2022 report,

“Less than 10% of insured drivers pursue diminished value claims.”

Mostly due to ignorance or fear of confrontation.

Adding insult to literal injury, some users even questioned Zah’s integrity. Alex Edwards commented,

“I don’t think this was parked,”

Implying that insurance companies were investigating for fraud. Zah’s reply:

“The car was parked and pushed forward and above the curb. The insurance company has tools that show the car was in motion, and it wasn’t. lol.”

That’s the reality. Not only are you fighting for repairs, you’re fighting for your credibility in a system built to distrust you by default.

From Clay Models to Fighter-Jet-Inspired Aerodynamics

- The shift from a front-engine to a mid-engine configuration was a significant departure from previous Corvette designs. This change aimed to enhance performance by improving weight distribution and handling dynamics, aligning the Corvette with other high-performance sports cars.

- The design team employed a combination of traditional sketching, clay modeling, and advanced digital tools to develop the C8's aesthetics. Multiple full-scale clay models were created, each exploring different styling directions, allowing designers to refine the vehicle's appearance meticulously.

- Drawing inspiration from modern fighter jets, the C8's design features sharp lines, large air intakes, and a low, aggressive stance. These elements not only contribute to the car's striking appearance but also serve functional purposes, such as improved aerodynamics and cooling efficiency.

There’s also the galling reality that while Zah was scrambling for courthouse letters to get security footage, his insurer, who technically has more legal standing and resources, refused to help. Glenn Murphy rightly noted,

“Your insurance company should be able to obtain any surveillance video… Demand new OEM parts.”

But unless it saves them money, most won’t lift a finger. These companies aren't in the business of finding justice. They're in the business of risk management, at your expense.

The lesson here isn’t just for C8 owners, it’s for anyone who still believes that buying a dream car means you’ve crossed some invisible finish line.

The modern insurance landscape doesn’t care whether you’re driving a Bugatti or a beat-up Buick. If it costs more to fix than an algorithm finds palatable, you’re just a number waiting to be reconciled.

Until the industry adapts to recognize the unique status of enthusiast vehicles, where function, form, and emotion are inseparable, owners like Zah will continue to face a world where passion is irrelevant, and a junkyard part is considered "good enough."

Image Sources: Chevrolet Media Center

Noah Washington is an automotive journalist based in Atlanta, Georgia. He enjoys covering the latest news in the automotive industry and conducting reviews on the latest cars. He has been in the automotive industry since 15 years old and has been featured in prominent automotive news sites. You can reach him on X and LinkedIn for tips and to follow his automotive coverage.

Set Torque News as Preferred Source on Google

Comments

Was it parked at the…

Permalink

In reply to The insurance industry is… by Benjamin Boozer (not verified)

Was it parked at the entrance of a lot on the corner...like the photos show it was? If it was, it's all on you, your bad.

Sad article. The author…

Permalink

Sad article. The author really hasn't made any suggestions as to how we can protect ourselves from these marketing practices. A new car or a specialty car usually isn't eligible for "Collector Car" insurance. What's the answer?

The C8 could have qualified…

Permalink

In reply to Sad article. The author… by Tinman (not verified)

The C8 could have qualified for a collector car 'agreed value' policy if owner meets the requirements. Usually they are:

1. Another daily driver car.

2. C8 kept in fully enclosed and secure garage.

3. C8 driven less than 5000 miles/year.

4. Helps to belong to Corvette Club.

Companies that underwrite collector or special interest cars do not advertise on TV.

You would be surprised how inexpensive this type of insurance is. The C8 premium would most likely be a lot lower than Geico or any of the companies that advertise on TV. And the premium on a second collector car is even lower: they only charge liability for one car 'cause you can only drive one at a time.

If you replace or get your C8 back, contact an independent insurance agent or some of the insurers recommended by the Corvette Club.

That's useful information I…

Permalink

In reply to The C8 could have qualified… by Phil (not verified)

That's useful information I wish I'd known that sooner. I'll look into those options if I get it back. Thanks!

Fair point and thanks for…

Permalink

In reply to Sad article. The author… by Tinman (not verified)

Fair point and thanks for the reminder. I'll definitely share more tips soon to help others avoid what I went through.

Oh boohoo they are not doing…

Permalink

Oh boohoo they are not doing what I want them to do. Did you ever read your policy before you start crying.

If it was you and your car…

Permalink

In reply to Oh boohoo they are not doing… by Johan (not verified)

If it was you and your car you'd be missing your pants keyboard warrior lmfao

What insurance company do…

Permalink

In reply to Oh boohoo they are not doing… by Johan (not verified)

What insurance company do you, or did you, work for, David? Your repeated comments about this individual tragedy are pretty transparent. With a nation full of victims suffering from the same utterly inhumane treatment from some of the same said companies (I am not one, thankfully) after soul and financially crushing natural disasters that left them bereft and ruined — and then denied, mark my words, people will mobilize and revolt against this gathering monster. From someone who used to work in group health insurance years ago, and parroted the company line, “read your policy…your fault,” too many times, as someone who owned a family-built multi-million dollar company for decades and understands it from all angles, and someone who was a victim of a drunk driver, only to be denied, myself — I found my humanity for these people. I hope you find your humanity sooner, rather than later. Insurance has morphed into grand scale legalized fraud, and its time will come.

Thank you for sharing your…

Permalink

In reply to What insurance company do… by T (not verified)

Thank you for sharing your perspective it really resonates. This experience opened my eyes in ways I didn’t expect.

Hard lesson learned but I’m…

Permalink

In reply to Oh boohoo they are not doing… by Johan (not verified)

Hard lesson learned but I’m better informed now.

Haha fair enough! it…

Permalink

In reply to Oh boohoo they are not doing… by Johan (not verified)

Haha fair enough! it definitely hits different when it’s your own car. Hoping no one else has to deal with it!

Go after your insurance…

Permalink

Go after your insurance company and file under "uninsured motorist". When they say "oh, "he" has insurance", say "who? I want my car fixed. This is why I carry "uninsured motorist"."

Looks like he got hit…

Permalink

In reply to Go after your insurance… by David Myers (not verified)

Looks like he got hit pulling into the driveway. Look how far he is from the curb and wheels turned.

Good eye but nope it was…

Permalink

In reply to Looks like he got hit… by Ray Luca (not verified)

Good eye but nope it was fully parked when it happened. Just awful timing.

Yeah I’ll definitely be…

Permalink

In reply to Go after your insurance… by David Myers (not verified)

Yeah I’ll definitely be asking more pointed questions about that option.

When most consumers buy…

Permalink

When most consumers buy insurance based on price they shouldn't be surprised when the companies do what they can to keep costs low. If people bought insurance based on coverage and quality we wouldn't be in this situation in general. Consumer habits dictate markets, and American consumerism is about being cheap.

True, We kinda get what we…

Permalink

In reply to When most consumers buy… by DA (not verified)

True, We kinda get what we choose.

In 2010, My 04 Impala got…

Permalink

In 2010, My 04 Impala got hit in the driver's rear quarter panel by someone who was on the Phone! A nameless,well known insurance company ( the guy who hit Me) wanted to use junkyard parts. I don't know what state you're in, but you need to call the state insurance commission and report them! It's your brand new vehicle, you didn't ask to be hit! Make a stink, that is a beautiful car and it deserves factory parts put on a a GREAT shop! Jump up and down, it's worth it!!

Oh, my God. Yes, it's called…

Permalink

Oh, my God. Yes, it's called a business. And in this case the business isn't fulfilling the customers needs. It's not as if he couldn't have done some research. He's not owed brand new parts from this company. There are plenty of others to choose from. But yeah, just demonize the insurance company, as if they're supposed to be a charity. You people really s***.

Junkyard parts are not a big…

Permalink

Junkyard parts are not a big deal. They are still OEM. I got a junkyard headlight after my car was wrecked and it was in far better condition compared to what I had. The knock off parts are a bigger concern.

This vehicle should be with…

Permalink

This vehicle should be with a specialist like Hagerty. The claim process would be much easier. The downside of a direct writer like Geico is you have to negotiate the claim and most people don't have the knowledge or experience.

GEICO is notorious for…

Permalink

GEICO is notorious for minimizing their outlay for claims and excluding responsibility in the contract fine print. Too many people purchase insurance based upon low premiums, but if you've ever had a claim you come to understand that customer service is what really counts in choosing an insurance company.

GEICO is notorious for…

Permalink

GEICO is notorious for minimizing their outlay for claims and excluding responsibility in the contract fine print. Too many people purchase insurance based upon low premiums, but if you've ever had a claim you come to understand that customer service is what really counts in choosing an insurance company.

Take the junkyard parts you…

Permalink

Take the junkyard parts you pansy ass pussy

Theres nothing wrong with…

Permalink

Theres nothing wrong with salvage yard parts so long as they are OEM and are carefully inspected for damage. In my experience chance of damage to a new part in transit is about the same as getting a damaged salvage yard body part. Probably more so when talking high dollar parts because salvage yard employees are going to be extra carefull pulling those.

As long as the parts are in…

Permalink

As long as the parts are in the same excellent condition it doesn't really matter

Sounds like he had a…

Permalink

In reply to As long as the parts are in… by Justin (not verified)

Sounds like he had a standard insurance policy.. these cars are not driven...everyday... specialty coverage is usually gotten not your statefarn geico progresive etc.. shame on the.C8 owner u should of done yur homework

yup, that's true

Permalink

In reply to As long as the parts are in… by Justin (not verified)

yup, that's true

My daughter was a body shop…

Permalink

In reply to As long as the parts are in… by Justin (not verified)

My daughter was a body shop manager. When a current model is still in production, the auto makers use every part to build new cars. If a body shop is an insurance pro shop, they are given a certain amount of time to make repairs, if cars aren't fixed they are penalized and don't get as many cars assigned to them. My daughter had a roll over Suburban in her shop, less then 5000 miles. Vehicle was still in production, she needed a new roof. She shopped the entire US and no parts were available. Had to wait until Chevrolet finished production of new vehicles to get the new roof panel. Suburban was at the body shop for nearly 5 months before a new roof panel could be secured. That is why body shops use used parts, they are OEM, and often on brand new vehicles, especially on a new body style, the only source of parts for a new vehicle, while production is ongoing.

Newer trust any insurance…

Permalink

Never trust any insurance company, agency, or insurance sales person.I

They are all liars and crooks.

This issue happened to every person with every claim in America, regardless as to car, house, business,etc.

"OH, I'm sorry, your not covered for that"

Well, what am I covered for?

"Well, Mr. Smith, you automotive policy covers you for only flat tires, in a collision, in Alaska, at night, SORRY"

WTF.

YOUR NEVER COVERED FOR ANYTHING, UNLESS YOU ADD $10,000.00 WORTH OF RYDERS.

INSURANCE IS BASICALLY WORTHLESS.

ASK SOMEONE FROM WESTERN NORTH CAROLINA.

Pagination