The last year and a half has been a tumultuous time period for Tesla investors. In 2022, Tesla’s stock price fell by as much as 70%. This was equivalent to more than $700 billion being wiped out from the EV maker’s market cap.

In 2022 a couple of main reasons contributed to Tesla’s decline. The first is a higher interest rate environment which has shifted money from stocks to bonds. This has caused a lull in the entire stock market, with tech stocks fetching higher multiples being the worst affected by the current macroeconomic environment – There isn’t much Tesla can do about this.

The second reason for the massive fall in Tesla’s stock price was Elon Musk’s deal to buy Twitter. Arguably, this might even be a bigger contributor to the fall in the EV maker’s stock price than higher interest rates.

Elon Musk has recently admitted that his Twitter deal was particularly painful as it forced him to sell billion of dollars worth of Tesla stock. And Musk says that contributed to the massive fall in Tesla’s stock price in 2022.

Related News: Tesla Wants To Drill For Its Own Water at Giga Berlin Using a Loophole

In addition to directly contributing to the fall in Tesla’s stock price by selling billions of dollars in TSLA shares, Musk’s involvement in the social media platform has also negatively affected Tesla due to the polarizing political nature of Twitter and sentiment that Musk is distracted by his obligations at the social media platform.

This year, Tesla's stock price performance has also been a mixed bag, with the stock rising leading up to Tesla's Investor Day presentation on March 1st, 2023. The event was themed around Musk's "Master Plan 3," which is a long-term roadmap toward sustainability that involves electric cars and other clean energy products.

The most “concrete” announcement from the event was Tesla's plan to build a new Gigafactory in Nuevo Leon, Mexico to produce its next-generation, cheaper electric vehicles. It will be Tesla's fifth car manufacturing facility in the world. Musk also introduced his leadership team to the public and most of them for the first time.

Tesla, at the event, also unveiled its third-generation vehicle platform. The Gen-3 platform is a radical rethink of the final assembly of vehicles, and along with Tesla's advancements in battery cells, structural battery pack, and drive train efficiency, will enable the company to reduce the cost of building its next vehicle by 50%.

Personally, I found Tesla’s step-by-step walkthrough of how they plan to cut down the cost of building a vehicle extremely fascinating. However, Wall Street was more disappointed by the lack of new product announcements and Tesla’s stock price started to fall back once again.

This decline was further exacerbated by Tesla’s less-than-stellar Q1 2023 financial results announced on April 19. Although Tesla’s business has grown in so many ways, the EV maker also reported a substantial decline in automotive gross margin, operating gross margin, and free cash flow.

This coupled with earlier concerns about waning demand for Tesla vehicles and substantial price cuts for the company’s products, caused Tesla’s stock price to fall sharply following the earnings report.

Since then, Tesla’s investor base has been in a bit of a raucous, with arguments breaking out on whether Tesla should start advertising in order to drum up demand, whether Tesla should cut the price of FSD to improve uptake, and whether the overall direction the EV maker is heading in is correct.

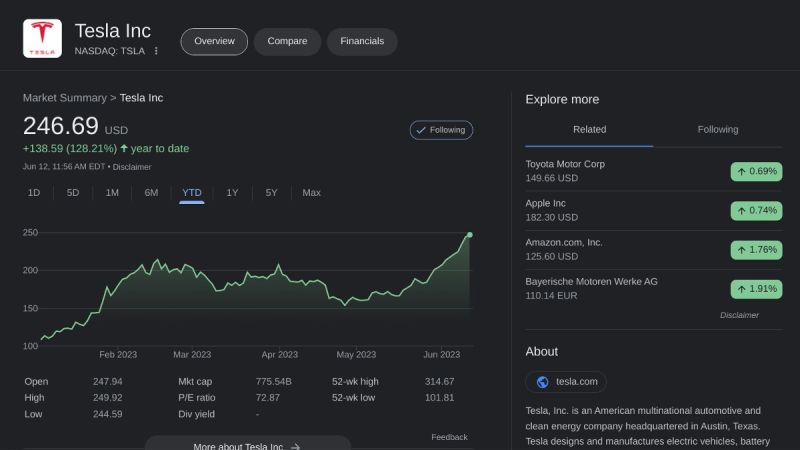

However, that was a month and a half ago, and now Tesla stock is yet again in positive territory. After closing green for 12 days in a row, Tesla has beat its previous consecutive gain record and the EV maker is now trading at $247 per share.

Tesla started the year trading at $108, meaning after its recent rise, the EV maker’s stock is up 128% just this year. This is a stellar performance for Tesla stock, however, the EV maker has yet to reclaim the stock price it had the day Elon Musk announced his bid to buy Twitter.

Musk made his Twitter announcement on April 14, 2022, at the time, Tesla’s stock was trading at around $330 per share and at today's opening price of $247 per share, Tesla will need to go up another 40% in its already incredible 2023 performance to reach the pre-Twitter price.

Even more challengingly, Tesla stock will need to go up another 65% to reclaim the stock’s all-time high record of $407 per share achieved back in November 2021.

Putting it in other words, Tesla’s market cap today stands at around $770 billion which means, the stock, in order to be back to its previous highs, will need to add another $450 billion in market cap to reach the $1.22 trillion record.

The EV maker certainly has a daunting task ahead, however, knock on wood 2023 appears to be going splendidly for Tesla and if the company can maintain this momentum, 2023 might end up being another breakout year for Tesla’s stock price.

Currently, Tesla is working on numerous projects targeted at growing the company's output. And, we will be sure to keep you posted as the EV maker hits more milestones along its progress path. Until then make sure to follow our site torquenews.com/Tesla regularly for the latest updates.

So what do you think? Are you happy with Tesla’s stock performance this year? Also, do you think the EV maker will be back to the pre-Twitter deal stock price in 2023? Let me know your thoughts in the comments below.

Image: Screenshot from Google search of Tesla stock price

For more information check out: Tesla Semi Amazes Intersection Onlookers With Acceleration and Sound in a New Viral Video

Tinsae Aregay has been following Tesla and The evolution of the EV space on a daily basis for several years. He covers everything about Tesla from the cars to Elon Musk, the energy business, and autonomy. Follow Tinsae on Twitter at @TinsaeAregay for daily Tesla news.

Set as google preferred source

Comments

Are you seeking the best

Permalink

Are you seeking the best bitcoin recovery company to assist you in recovering your stolen bitcoins? I must mention this so that you don't lose money to shady brokers on the cheap. I made an initial investment of roughly 125,000,00 USD on a binary option platform, and after a few weeks I decided to withdraw, but the withdrawal was unsuccessful. I attempted to contact the platform by phone and email, but I never heard back. It began to feel strange. A few days later, I received a message from the platform requesting that I increase my investment in order to be able to withdraw my bitcoins. I rejected the message, and after that, I didn't hear from them again. At that point, I realized I had been duped. I owe a debt of gratitude to Wizard Web Recovery, a cryptocurrency recovery-assisting hacking team of experienced hackers. My missing bitcoin was recovered with their help. I truly appreciate you, in fact. One way to interface with a wizard web recovery is: wizardwebrecovery(@)programmer.net & WhatsApp: +1 (917) 725-3296

Thanks,

Roderick.