The opaque world of automotive lease returns, particularly for electric vehicles, has once again been cast into sharp relief by a recent social media post detailing a Hyundai Ioniq 5 owner's frustrating experience. What began as a routine lease-end process quickly devolved into a baffling quest for transparency, exposing a system where residual values bear little resemblance to market reality and the fate of returned vehicles remains shrouded in secrecy.

This disconnect between manufacturer projections and real-world depreciation is not merely an inconvenience for the lessee; it signals a deeper, systemic issue within the EV market that manufacturers like Hyundai are struggling to manage.

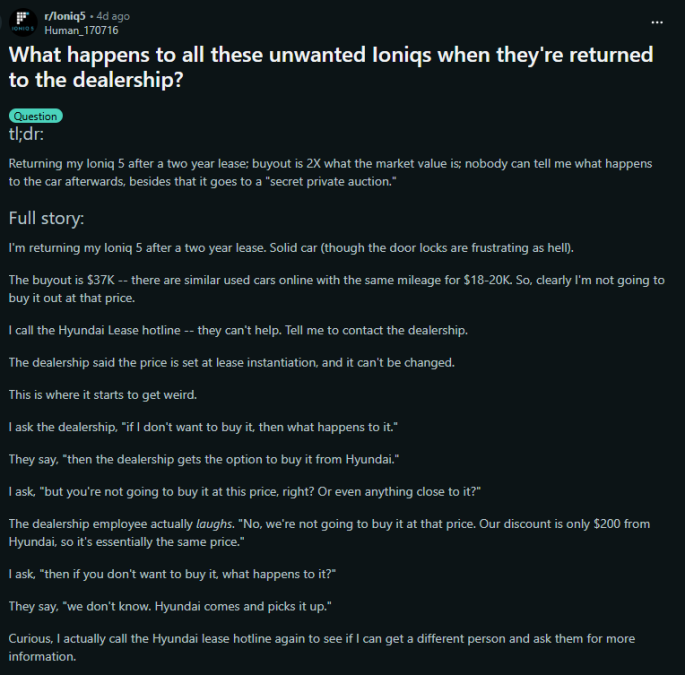

The original post, shared by Reddit user Human_170716 on the r/Ioniq5 subreddit, laid bare the bewildering situation:

"tl;dr:

Returning my Ioniq 5 after a two-year lease; buyout is 2X what the market value is; nobody can tell me what happens to the car afterwards, besides that it goes to a "secret private auction."

Full story:

I'm returning my Ioniq 5 after a two-year lease. Solid car (though the door locks are frustrating as hell).

The buyout is $37K -- there are similar used cars online with the same mileage for $18-20K. So, clearly, I'm not going to buy it out at that price.

I call the Hyundai Lease hotline -- they can't help. Tell me to contact the dealership.

The dealership said the price is set at lease instantiation, and it can't be changed.

This is where it starts to get weird.

I ask the dealership, "If I don't want to buy it, then what happens to it?"

They say, "Then the dealership gets the option to buy it from Hyundai."

I ask, "But you're not going to buy it at this price, right? Or even anything close to it?"

The dealership employee actually laughs. "No, we're not going to buy it at that price. Our discount is only $200 from Hyundai, so it's essentially the same price."

I ask, "Then if you don't want to buy it, what happens to it?"

They say, "We don't know. Hyundai comes and picks it up."

Curious, I actually called the Hyundai lease hotline again to see if I could get a different person and ask them for more information.

After a quick discussion, they actually tell me what happens if the dealership also passes on the option to buy: "It goes to an auction."

I respond, "Oh, can you please tell me where? I'd love the chance to bid."

The response, "Oh -- it's not available to the public."

...what? Like, is this like an Eyes Wide Shut party, but with my poor unwanted Ioniq 5?"

The owner's frustration is palpable, and for good reason. The idea that a vehicle's residual value, set two years prior, could be double its current market worth is a stark indictment of the industry's forecasting capabilities, particularly for rapidly evolving EV technology. This isn't just an inconvenience; it's a financial trap for consumers who might have been led to believe their lease buyout was a viable option.

Hyundai Ioniq 5: Lease End Value Challenges

- The Hyundai Ioniq 5, launched in 2021, quickly became a popular EV due to its distinctive styling and competitive range. However, its rapid depreciation in the used market has presented significant challenges for lease residual value forecasting. Early lease agreements often set residual values that are now double the actual market price for similar used models.

- The vehicle's original MSRP ranged from approximately $41,800 for the SE Standard Range to over $56,000 for the Limited AWD trim. Despite its strong initial appeal, the competitive EV landscape and evolving technology have contributed to a faster-than-anticipated decline in its resale value.

- The Ioniq 5 offers an EPA-estimated range of up to 303 miles for the RWD Long Range model, powered by a 77.4 kWh battery pack. Its 800V architecture allows for ultra-fast charging, capable of going from 10% to 80% in just 18 minutes under optimal conditions.

- While the Ioniq 5 has garnered numerous awards for its design and performance, the financial realities of its depreciation show a critical area for improvement in EV market valuation. This rapid value loss is not unique to Hyundai but is a widespread issue impacting many early EV models as the market matures.

One commenter, zpoon, offered a pragmatic explanation for the "secret private auction" phenomenon: "The auctions these cars go to are packaged in big lots with many other cars, which are then purchased by other dealerships or businesses that turn them around to be sold as certified pre-owned. They are rarely sold or auctioned individually, as that takes too much time and effort. This is why these auctions are not geared toward the general public, but towards businesses that sell lots of cars."

This explanation, while technically accurate, does little to alleviate the underlying problem. It paints a picture of a system designed for institutional efficiency rather than consumer transparency or market fairness. The notion that individual vehicles are too much "time and effort" to sell directly to the public reveals a fundamental disconnect between the financial institutions and the very customers who drive their business. It's a classic example of the automotive industry prioritizing its internal logistics over the consumer experience, treating a depreciating asset like a commodity to be moved in bulk, not a vehicle with individual market value.

This situation reveals a critical flaw in the current EV leasing model for the Ioniq 5. Manufacturers, eager to push new technology, often inflate residual values to keep monthly payments attractive. However, the rapid pace of EV development, coupled with price adjustments and evolving incentives, means that these initial projections can quickly become wildly inaccurate. The consumer is left holding the bag, or rather, returning the car at a significant loss to the finance company, which then offloads it at a discount through these private channels. This practice, while standard, is economically irresponsible for the finance arms and ultimately harms consumer trust in the long run.

Another commenter, Own_Inspector_285, identifying as a "Shooting Star-Hyundai Salesperson," corroborated the auction process and offered a blunt assessment of the financial implications for the manufacturer: "It goes to a Hyundai finance auction where it gets bid on by other dealers. Dealers won’t pay more than market value for it. Hyundai Motor Finance is going to be writing down a bunch of losses this year. That’s what is gonna happen."

This candid admission from an insider is telling. It confirms that Hyundai Motor Finance is indeed facing substantial losses on these vehicles. This isn't merely a minor accounting adjustment; it's a direct consequence of setting unrealistic residual values at the outset of the lease. The industry, particularly in the emerging EV market, has consistently struggled with accurate depreciation forecasting, leading to a glut of off-lease vehicles that must be sold at a significant markdown. This practice is unsustainable and indicates a lack of foresight that would be unacceptable in any other mature financial product.

The original poster, Human_170716, also added a crucial insight, suggesting that Hyundai's experts should have anticipated this market shift: "You know what's weird, but... I knew the car wasn't going to be worth much at lease-end. EVs have been like that for 15 years now. It's why I didn't want to buy it outright (purchase price was something like $52K). I'm sure the experts at Hyundai knew this, too. Something isn't adding up."

This observation cuts to the core of the issue. If the average consumer can predict the rapid depreciation of EVs, why can't the financial experts at Hyundai? The only logical conclusion is that the initial residual values were artificially inflated to stimulate sales, effectively kicking the can down the road for the finance arm to deal with later. This strategy, while moving units in the short term, erodes consumer confidence and creates a volatile used EV market. It's a shell game where the finance company ultimately absorbs the loss, but the reputational damage falls on the brand.

The opaque nature of these lease returns and subsequent auctions is a disservice to both the consumer and the broader automotive market. It prevents potential buyers from accessing these vehicles at competitive prices and leaves lessees feeling exploited by a system that offers no transparency. This isn't just about a single Ioniq 5; it's about the integrity of the entire EV leasing ecosystem.

Image Sources: Hyundai Media Center

Noah Washington is an automotive journalist based in Atlanta, Georgia. He enjoys covering the latest news in the automotive industry and conducting reviews on the latest cars. He has been in the automotive industry since 15 years old and has been featured in prominent automotive news sites. You can reach him on X and LinkedIn for tips and to follow his automotive coverage.

Set Torque News as Preferred Source on Google