Battery-electric vehicles will finish calendar year 2025 at approximately 7.9% market share in the United States, within a fraction of a percentage point of the same level that they were at in 2023. The data for quarters one through three and the month of October are in now, and here’s how it breaks down:

Q1 = 7.55

Q2 = 7.4

Q3 = 10.5

Running average at the end of Q3 = 8.5%

October = 5.8%

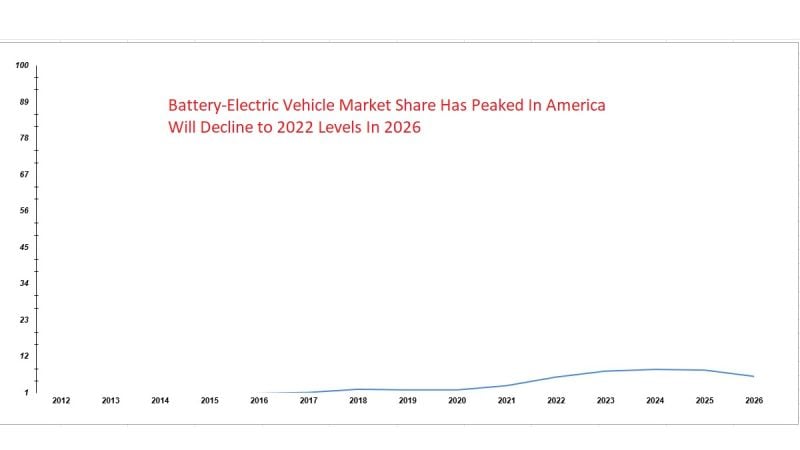

We extrapolated the likely year-end total market share for 2025 by using 6% market share for both November and December. Doing so, the year-end U.S. BEV market share percentage looks to be 7.9%. That’s about the same market share that EVs had in calendar 2023. It is a drop from the 2024 yearly average of 8.1%.

Why EV Market Share Is Declining

Battery-electric vehicle market share is declining primarily due to waning interest in EVs by consumers. Price reductions and promotional interest rates piled on top of the now-expired federal tax incentive in Q3 pushed up the market share to its all-time high. That was nice to see, but it clearly pulled sales forward, as the 5.8% market share in October has now proven. Basically, EVs have borrowed some deliveries that would have happened in October, November, and December.

Another objective way to prove that EV deliveries will be lower for some models is that they have now been either outright canceled, such as the Nissan Ariya and Ram Rev, or the models have had their production shuttered, like the Ford F-150 Lightning. The Wall Street Journal has reported that its sources say the Lightning may end up being sunsetted for good, though we have not confirmed that.

Another sign that EV market share won’t be able to keep pace with its past highs in America is the many factory slowdowns, shift eliminations, and temporary pauses. GM is pausing its Cadillac production due to weakening demand for EVs. Reuters quoted a GM executive as saying:

As we (General Motors) adjust to the new EV market realities, the strength of our ICE portfolio will continue to separate our brands from the pack and give us flexibility and profitability that EV-only companies lack.

Other manufacturers have delayed the launches of models that EV advocates looked forward to. These include Kia’s EV4 and EV9 GT.

EV News Is Not All Bad - Ford’s Example

Although Ford’s F-150 Lightning is in limbo, the Mustang Mach-E had a typical October, which is to say Ford delivered about 3,000 of them in the month. The fact that the Mach-E wasn’t down dramatically in sales is interesting, as is the fact that for the past five years, Ford has sold almost exactly the same number in the month of October. Is the Mustang Mach-E more resilient than its peers?

Ford is also pushing forward with a new generation of affordable EVs, this time in the form of a midsized truck. The media are repeating Ford’s claim that the truck will have a starting price of $30K. I don’t believe that will prove true, but a truck priced lower than the Lightning, Cybertruck, and Rivian R1T seems logical. Hopefully, Ford will hit its target price, and dealers won’t mark it up over MSRP by $10K to $20K, like they did the Maverick Hybrid pickup.

2026 EV Market Share U.S.

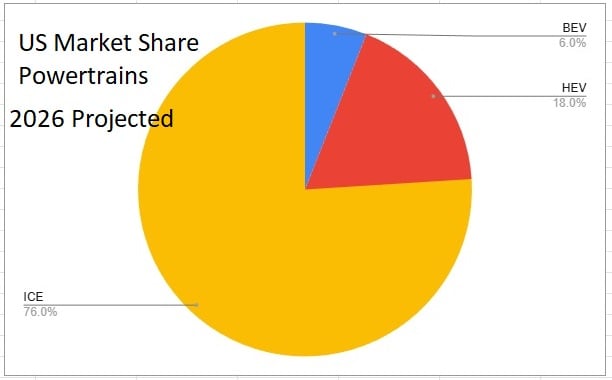

My prediction, based on the delivery trends, factory capacities, and the general vibe in America around EVs, is that the market share will drop back to 2022 levels in the coming year. Expect market share to hover around 6% with bumps up and down, depending on seasonality and new model entries. 2026 will be the thirtieth year of the modern battery-electric vehicle in America, and all the evidence available indicates that about 94% of Americans won't buy one when they shop for a new car or crossover. With EV trucks, it looks much worse. We expect that roughly 99% of shoppers will not buy an EV pickup truck in 2026. EVs are loved by a vocal minority of shoppers, owners, and policy wonks. However, mainstream buyers in America opt for hybrids in greater numbers, and the gap is growing. About 75% of new vehicles sold in 2026 will have conventional powertrains.

What do you think of the U.S. EV market share situation? Tell us in the comments below.

Market share data courtesy of Cox Automotive. Projections by the author. Images by the author.

John Goreham is the Vice President of the New England Motor Press Association and an expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. He is a member of the Society of Automotive Engineers (SAE int). In addition to his fourteen years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can connect with John on LinkedIn and follow his work on his personal X channel or on our X channel. John employs grammar and punctuation software when proofreading, and he sometimes uses image generation tools.

Comments

The EV fad was fun while it…

Permalink

The EV fad was fun while it lasted, wasn't it?