For years, I’ve watched Tesla defy the traditional gravity of the automotive industry. They’ve operated more like a software company than a car manufacturer, enjoying valuation multiples that would make any legacy CEO weep. But the January registration data coming out of Europe isn’t just a "blip" or a seasonal adjustment; it’s a systemic collapse in the very markets that once served as Tesla's most loyal strongholds.

In Norway, a country where EVs represent over 94% of new car sales, Tesla registrations plummeted by 88% in January. The Netherlands followed suit with a 67% drop. When you lose the "Land of EVs," you aren't just having a bad month; you're facing a fundamental rejection of your brand. While some analysts point to the end of incentives, the reality is that competitors are now outperforming the Model Y.

Is the Decline Isolated or a Global Contagion?

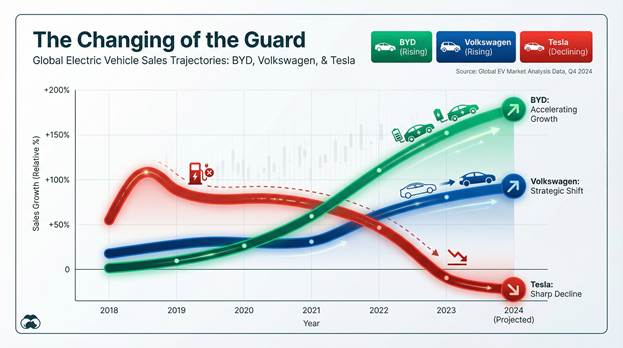

The initial instinct for the Tesla faithful is to claim these numbers are isolated. They aren't. We are seeing a "Brand Fatigue" contagion across the continent. According to recent European registration data, Tesla’s market share in the EU has begun to plateau while the overall EV market continues to grow. Tesla is beginning to look like the BlackBerry of the 2020s: a pioneer that forgot to keep pioneering the hardware.

The Three-Headed Monster: Brand Toxicity, Aging Tech, and Real Competition

Why is this happening now? It’s a combination of three distinct failures:

- The Musk Effect: In Europe, social consciousness is a primary driver of EV adoption. Elon Musk’s pivot into polarizing political spheres has turned the "Tesla Statement" into something many European buyers no longer want to make.

- Reliability Woes: The 2024-2025 TÜV Report recently ranked the Model 3 as the least reliable vehicle in its age category. With high failure rates in suspension and brakes, the "it’s just a software problem" excuse is no longer flying.

- The Chinese Wave: Companies like BYD and Xiaomi are delivering cars that feel like 2026. BYD has already overtaken Tesla in total EV volume, offering a broader portfolio that captures the budget-conscious buyer.

The Robotics Pivot: Visionary or Distraction?

Tesla’s recent announcement that they are pivoting toward "Physical AI" and robotics (Optimus and the Cybercab) is a classic Musk move: when the current house is on fire, point at the shiny new skyscraper you plan to build next door.

While the Cybercab and Optimus represent a massive potential market, they don’t solve the "idle factory" problem. You cannot fund a robotics revolution with a collapsing automotive revenue stream. This pivot signals to the market that Tesla has given up on winning the "Car War" and is betting the farm on a "Robot War" that is still years away from meaningful revenue.

The Winners: Who Inherits the Kingdom?

As Tesla recedes, the vacuum is being filled by two groups:

- The Legacy Giants: Volkswagen (with the ID series) and Audi with the e-tron GT have finally figured out their software stacks.

- The Chinese Disruptors: BYD's vertical integration and aggressive pricing make them the new "value" king of the EV world.

Canary in a Coal Mine or Just a Sick Bird?

Is Tesla’s decline a sign that the EV market is dying? Hardly. EV adoption in Norway is at record highs. The market is healthy; the brand is not. Tesla is the "canary," but it’s not warning us about the air in the mine—it’s warning us about what happens when a market leader stops listening to its customers.

The Risk of Failure: The 2028 Horizon

Tesla isn't going bankrupt tomorrow. However, if they cannot refresh their lineup and fix their reliability issues by 2027, they risk becoming a niche player—a "boutique" robotics firm that makes a few cars on the side. I suspect that if the current 40%+ quarterly declines continue, we could see a major structural "reset" by 2028.

Wrapping Up

Tesla’s 88% collapse in Norway is a wake-up call that the "first-mover advantage" has officially expired. To survive, Tesla needs to stop treating cars as secondary to robots, refresh their entire lineup, and depoliticize the brand. Without these changes, the "Autonomous Summer" they’ve promised may arrive just in time for a cold "Automotive Winter."

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.

Comments

The Tesla fad is deep into…

Permalink

The Tesla fad is deep into fade mode. It sounds like Leon finally gets that, too.