Tesla’s financial report this week felt like watching a champion sprinter realize they’ve been running the wrong race. The Q4 2025 results were a sobering reminder that the "first-mover advantage" has a shelf life. With net profits cratering 61% and an annual revenue decline that would make any CFO sweat, the message is clear: the automotive side of Tesla is under siege.

The problems aren't just market saturation; they are structural. Tesla is facing a brutal pincer movement between aggressive price-cutting from Chinese rivals like BYD and a product lineup that is starting to look more "legacy" than "cutting edge." When you see a company sunsetting the Model S and X to make room for robots, you aren't just seeing a strategy shift—you’re seeing a desperate pivot away from a segment where the margins are disappearing.

The Brand Width Dilemma

Does Tesla have the brand width to be both a car company and a robotics firm? In my experience, the answer is rarely "yes" without a massive internal divorce. Brands are like rubber bands; you can stretch them, but eventually, they snap.

Tesla’s brand is currently synonymous with EVs and Elon Musk’s personal brand. By trying to house Optimus—a product that requires entirely different sales channels, safety certifications, and service infrastructures—under the same roof as a family SUV, Tesla risks confusing its mission and its investors.

If Tesla wants to win in robotics, it should seriously consider a spin-out. A dedicated robotics brand could operate with the agility of a startup while Tesla Motors focuses on the grueling reality of manufacturing cars in a world where China is scaling manufacturing at a "next level" pace.

The Musk Vision: Trust or Trajectory?

Elon Musk has a history of making predictions that are notoriously decoupled from the calendar. We’ve heard "Full Self-Driving next year" since 2016. Now, we’re being told that Optimus will be mass-produced by the end of 2026 and that doctors will be obsolete by 2030.

The question for investors isn't whether Musk is a visionary—he clearly is—but whether his vision is actionable within the financial constraints of a company seeing its core revenue shrink. Betting on Musk’s timeline has historically been a losing game, yet the market continues to price Tesla like a software company rather than a metal-bender.

Learning from the Ghost of Corporate Past

Tesla isn’t the first to try a radical pivot. History is littered with companies that thought they could jump to a new category on brand name alone:

- Kodak: Invented the digital camera but was too wedded to film to execute.

- Nokia: Owned the mobile world but ignored the software shift until it was too late.

- IBM: Successfully pivoted from hardware to services, proving it can be done, but it took a decade of pain and a complete cultural overhaul.

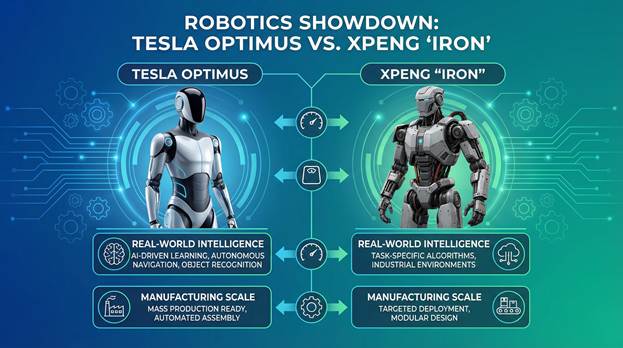

Tesla’s pivot is more like IBM’s than Kodak’s, but the competition is moving much faster. Chinese companies like Xpeng are already mass-producing humanoid robots like the "Iron," which is specifically designed to compete with Optimus.

The Execution Gap

To survive this, Tesla needs to stop acting like a car company and start acting like a robotics lab. This means moving beyond the "Musk-as-the-sole-visionary" model and building a robust, independent leadership team for the robotics division.

Furthermore, they must address the "China Problem." Musk himself admitted that China will be their toughest competitor because they can scale manufacturing faster than anyone else. If Tesla can't secure a manufacturing advantage for Optimus, they will simply be the Research & Development department for their Chinese competitors.

Wrapping Up

Tesla is at a crossroads. The transition from an EV leader to a robotics and AI entity is a bold move, likely necessitated by the collapsing margins of the car business. However, without a dedicated brand strategy and a realistic timeline that accounts for the massive manufacturing scale of China, Tesla risks becoming a "what if" in the history books of innovation.

Musk is betting the company on a future where robots do the work and cars drive themselves. It’s a compelling vision, but as the Q4 numbers show, the path there is paved with red ink.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.