There comes a moment, quiet, sobering, and often too late, when a person realizes that some systems aren’t broken at all. They’re working exactly as intended. Designed not for service or satisfaction, but for efficiency measured strictly in balance sheets. In the world of insurance, this design shows itself most clearly when you need the help you’ve been paying for.

Tesla Rear-End Collision Claim Nightmare, Total Loss, No Settlement from Tesla Insurance

And for some Tesla owners, particularly those enrolled in Tesla’s in-house insurance program, that realization can arrive the hard way, right around the time your car is declared a total loss, and no one seems to be answering the phone.

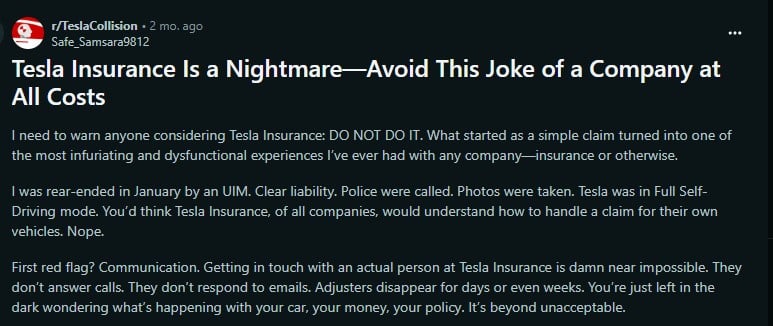

Such was the experience of Reddit user Safe_Samsara9812, who laid out their ordeal in a detailed post on r/TeslaCollision, a subreddit fast becoming a repository for cautionary tales.

“I need to warn anyone considering Tesla Insurance: DO NOT DO IT. What started as a simple claim turned into one of the most infuriating and dysfunctional experiences I’ve ever had with any company, insurance or otherwise.

I was rear-ended in January by an UIM. Clear liability. Police were called. Photos were taken. Tesla was in Full Self-Driving mode. You’d think Tesla Insurance, of all companies, would understand how to handle a claim for their own vehicles. Nope.

First red flag? Communication. Getting in touch with an actual person at Tesla Insurance is near impossible. They don’t answer calls. They don’t respond to emails. Adjusters disappear for days or even weeks. You’re just left in the dark wondering what’s happening with your car, your money, your policy. It’s beyond unacceptable.

Second red flag? Incompetence. Tesla Insurance contacted me with a first adjuster who clearly didn’t understand how to handle a claim involving modern Teslas. They wrote a weak estimate, and then dropped off the face of the earth. A second adjuster took over without ever introducing herself or explaining the change. No continuity, no accountability. I literally had to manage my own claim, hunt for answers, and re-explain everything multiple times to different people who couldn’t even be bothered to read the claim file.

Third red flag? Delays and mismanagement. Tesla took forever to authorize basic steps in the process. They issued a check, then never followed up. No explanation. No next steps. Meanwhile, my car sat at the Tesla-certified collision center for weeks, untouched. Eventually, without so much as a conversation, they decided my vehicle was a total loss and had it picked up for salvage. Still no formal notice. Still no settlement offer. It’s April now. This claim started in January.

Fourth red flag? Lack of professionalism. The adjuster I finally got assigned to is easily the most unresponsive and unprofessional rep I’ve ever dealt with. No follow-through. No documentation. No effort to actually help or explain anything. It’s like they were trained to avoid doing their job. You’re left completely on your own.

Tesla Insurance markets itself as being tailor-made for Tesla vehicles. In reality, it's a disaster. It’s run by inexperienced agents, poor systems, and a company culture that simply does not care once they have your money.

Save yourself the stress. Go with an actual insurance company that knows what they’re doing. I regret ever switching and will never recommend Tesla Insurance to anyone. Ever.”

The post highlights familiar pain points for anyone who's dealt with a claim: poor communication, unresponsive adjusters, unexplained delays. Except in this case, the issues weren’t with a third-party insurer unfamiliar with Tesla's vehicles, they were with Tesla's own insurance program, built specifically for the cars it designs and manufactures.

Why Insurance Payouts Take a Long Time

- By dragging out the investigation or delaying payments, insurers keep money on hand longer. This gives them time to accrue investment income and often wears claimants down, some may even miss their window to sue

- Insurers often present quick, artificially low settlement offers, hoping claimants will accept them out of frustration or need. Once accepted, most can't negotiate for a higher amount

- Adjusters may interpret policy details in the insurer's favor, misrepresenting coverage limits, disputing what's legally owed, or using confusing jargon to justify underpayment or denial

- By shifting blame to the claimant or contesting the extent and origin of injuries/damages, insurers create uncertainty. That can justify partial or denied payouts and reduce their liabilities

Importantly, this isn’t an isolated case. Another user, vandamnitman, described a seven-month ordeal involving three separate adjusters, culminating in a complaint to the state’s Division of Insurance.

“This is apparently what an ‘optimized organization’ looks like.”

They wrote, alluding to the cold logic of process automation. When multiple adjusters cycle in and out of a case with minimal continuity, it's easy to feel like the system isn't designed to resolve issues, but to absorb and delay them.

And while every insurance provider has its critics, several users were quick to point out that the issues aren’t universal. nyc2pit shared a far smoother experience with NJM, noting timely communication, reasonable settlement offers, and even responsiveness when additional vehicle options weren’t included in the initial valuation.

“They instantly sent back a better offer... Got my check about two days later,” they said.

The major delay? Not the insurer, but Tesla, which took time to deliver repair parts. This detail helps illustrate the broader reality: not all problems fall squarely on Tesla Insurance, but the end-to-end ownership of both vehicle and insurance product adds complexity when either side stalls.

Insurance Delay Tactics

Tesla Insurance entered the market with a bold pitch, offer competitive rates based on real-time driving data and tailor coverage to Tesla vehicles with an internal knowledge of parts, systems, and repair protocols. In theory, this vertical integration should streamline claims. In practice, users like Robert_who and CorgiNumerous4156 report missing rental cars, dropped communication, and service center confusion when adjusters fail to authorize repairs or respond to escalation requests.

Even service center employees reportedly struggled to get in contact with Tesla Insurance staff. It's not so much a lack of concern as it is a lack of capacity, a growing program learning, perhaps too slowly, how to scale.

To be fair, not every experience has been negative. Some Reddit users, like timotheusthegreat, shared stories of smooth claims, free rentals, and positive outcomes. This variability suggests the foundation may not be fundamentally flawed, but its consistency, and execution, leave room for improvement. Tesla Insurance is still relatively new in the insurance space, and unlike legacy providers with decades of claims infrastructure, it’s building the plane while flying it. That doesn’t excuse the delays, but it adds context.

Tesla Insurance Features

- Tesla collects data on your driving, like hard braking, aggressive turning, following distance, and collision warnings, and uses that Safety Score to adjust your monthly rate. Drive more safely, and your premiums can go down; unsafe driving may cause them to rise

- Insurance is baked into the Tesla ecosystem. You can get a quote, purchase coverage, and manage your policy directly through the Tesla app, no need to call agents or deal with third-party brokers

- Tesla’s insurance is only available for its own cars and is often priced lower than traditional competitors because the company has deep insight into repair costs and technology. That first‑party knowledge helps eliminate middlemen fees

- In some regions (like Texas and Arizona), Tesla offers extra discounts, up to about 10%, for drivers enabling Full Self‑Driving (FSD) features for a set percentage of miles. The idea: incentivize behaviors that Tesla believes improve safety while gathering more performance data

The takeaway here isn’t that Tesla Insurance is uniquely negligent; it’s that, like many tech-driven solutions, it still struggles with the human element.

Software can calculate premiums and flag risky behavior, but customer service, especially when things go wrong, isn’t easily automated. Algorithms can’t replace empathy, nor should they try. And when your vehicle is in a body shop, your rental hasn’t arrived, and your emails go unanswered, what you need isn’t optimization, you need support.

Some customers are finding what was promised: a streamlined experience, modern data use, and a company that knows its cars. Others, like Safe_Samsara9812, are left navigating a maze of silence and ambiguity at a time when clarity matters most. As Tesla continues to expand its services beyond automotive manufacturing, it would do well to remember that in industries like insurance, reputation isn’t built on innovation alone, but on reliability, responsiveness, and trust.

What would you do in this situation? Let us know in the comments below.

Image Sources: Tesla Newsroom

Noah Washington is an automotive journalist based in Atlanta, Georgia. He enjoys covering the latest news in the automotive industry and conducting reviews on the latest cars. He has been in the automotive industry since 15 years old and has been featured in prominent automotive news sites. You can reach him on X and LinkedIn for tips and to follow his automotive coverage.

Set Torque News as Preferred Source on Google

Comments

drunk driving regulations…

Permalink

drunk driving regulations about Ohio can be complicated then again its crucial to provide a solid understanding of all of them if anyone are facing accusations. Driving below really influence of alcohol DUI will be a severe criminal offense which can own significant ramifications on your own life. In Ohio will lawful threshold for body alcohol concentration BAC is 8 percentfor most motorists then 0.04 business truckers. If you can be pulled by police police and suspected of DUI they might undertake field soberness exams or chemical challenges that given that breathalyser or blood exams to determine ones level of disability. Declining involving tests can lead to programmed sanctions including license suspension. drunk driving crimes in Ohio have multiple penalties depending on variables like past convictions BAC levels furthermore when here had been an crash or hurt required. Problems can come with penalties license pause mandatary alcohol cures workouts test period and uniform penitentiary time. Residual offensive activity and annoyed instances can result in more dreadful penalties. Acquiring a skilled DUI barrier attorney is crucial to manage the complexnesses of Ohio driving while intoxicated statutes. They may analyze the indicators question the legality of the halt matter the accurate of trials and examine new defense to help extenuate the costs. On top of that an lawyer can lead you with the appropriate process producing their rights are insulated and promoting for the ultimate imaginable results. Keep in mind being knowledgeable approximately Ohios DUI laws and trying the support of an suffered attorney are critical steps in thoroughly taking care of a DUI price and/or defending on your upcoming. embezzlement lawyer

Thanks for the detailed info…

Permalink

In reply to drunk driving regulations… by Jeffreycoism (not verified)

Thanks for the detailed info! definitely important for folks in Ohio to understand their rights and the laws. My article focused on the Tesla insurance process, but I appreciate you contributing to the conversation!