Elon Musk has threatened to resign from his CEO role at Tesla if shareholders do not approve his trillion-dollar pay package at the November 6 meeting.

Musk states he has outperformed all other automotive CEOs and suggests Tesla consider hiring one of those leaders because he will not stay at Tesla without his compensation package.

Musk made this threat after Romain Hedoui, a former Tesla employee and investor, posted on X claiming that Tesla is paying Elon Musk too much and proposed hiring a different CEO without the $1 trillion compensation.

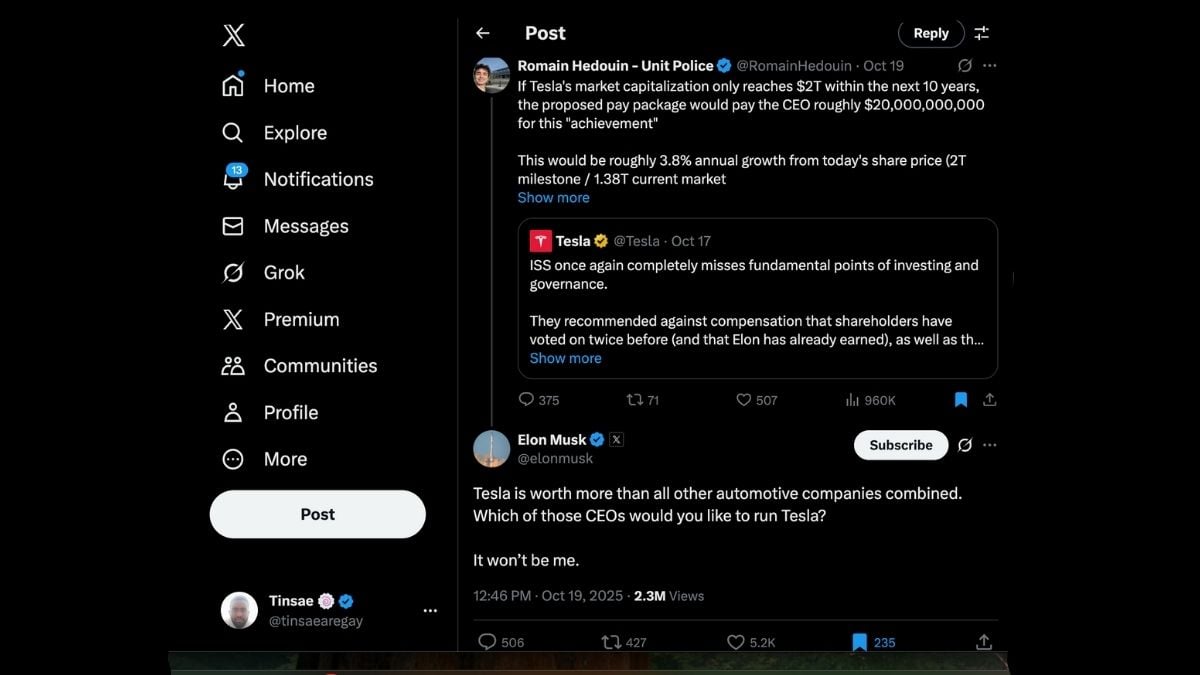

Romain started the conversation writing…

“If Tesla's market capitalization only reaches $2 trillion within the next 10 years, the proposed pay package would pay the CEO roughly $20,000,000,000 for this 'achievement’

This would be roughly 3.8% annual growth from today's share price ($2 trillion milestone / $1.38 trillion current market capitalization)

That would barely beat inflation, and it would underperform the S&P 500 considerably.

Sorry, Tesla, some of us (and supposedly, Institutional Shareholder Services too) don't think that underperforming the S&P 500 this much is worth paying somebody 20 billion dollars' worth of company value.

As a fan, I love Tesla. I want it to succeed.

As a shareholder, I don't want Tesla to overpay for its CEO

I strongly believe that the 2025 pay package proposal would over-pay for its CEO, and that other competent CEOs could grow Tesla just as much with way less political drama and cost investors much less than this proposal.”

Romain believes that another competent CEO will be able to do as good a job as Elon Musk without having to get paid 10 percent of the company.

However, Elon Musk doesn’t seem too happy with this suggestion and directly addressed Romain's comment.

Musk asks which other CEO Romain wants to run Tesla, because without the compensation package, it wouldn’t be him.

Musk responded, writing…

“Tesla is worth more than all other automotive companies combined. Which of those CEOs would you like to run Tesla?

It won’t be me.”

This isn't the first time Elon Musk has made threats related to his compensation package. In the past, Musk warned he would stop working on AI and robotics at Tesla if he didn't get a compensation plan that increased his ownership stake to 25% of the EV maker.

He expressed that his main worry was the lack of control, which could allow other entities to oust him from Tesla and steer the company’s technology toward harmful uses.

However, this time Musk is directly threatening to leave Tesla and is emphasizing financial factors such as shareholder returns rather than AI safety.

What’s notable is that Musk already owns 16 percent of Tesla, with his shares valued at nearly $200 billion. One would assume that this would be enough motivation to keep him running the company.

Should Tesla investors approve the pay package?

Given that Musk’s compensation package would dilute Tesla shareholders by 12% and the CEO appears less focused on the EV maker, it’s fair to question whether he deserves such a massive compensation package.

However, one argument in favor of Tesla shareholders paying this hefty price for Musk is the company’s stock performance.

As Musk stated, Tesla's value at $1.4 trillion is larger than that of all other automotive companies combined.

Yet, Tesla’s massive market cap isn’t due to its dominance in the automotive sector, vehicle delivery numbers, or profits.

For instance, Toyota and Volkswagen each sell about 10 million vehicles annually, while Hyundai sells more than 7 million a year.

In comparison, Tesla has never delivered even 2 million vehicles in a year.

And even when considering profits, last year Tesla earned around $7 billion; in contrast, Toyota made $32 billion and Volkswagen earned $13.5 billion.

When considering growth, Tesla is also not the fastest-growing automotive company, with deliveries and profits declining for two consecutive years.

So why is Tesla valued so much higher than other automakers? The answer is Elon Musk.

Musk has convinced investors that Tesla will become the biggest company in the world with self-driving cars, a highly profitable Robotaxi business, and humanoid robots that will revolutionize the labor market.

Musk’s extraordinary promises explain why Tesla’s stock is currently valued at 200 times its annual profit. In other words, if you invested in Tesla and only planned to recover your money through profits, it would take 200 years to break even based on current profits and valuation.

Tesla’s remarkable stock performance is largely due to Elon Musk, and it appears shareholders must continue paying him if they want to keep the stock price going up.

However, please let me know what you think in the comments. Share your ideas by clicking the red “Add new comment” button below. Also, be sure to visit our site, torquenews.com/Tesla, regularly for the latest updates.

For more information, check out: A Cybertruck Owner Says Tesla Is Asking Him to Pay $423 For Wheel Alignment on a 3-Month-Old Vehicle – Adds, “The Cybertruck Came Off The Line With Alignment Issues, It’s Tesla’s Responsibility To Fix It For Free”

Tinsae Aregay has been following Tesla and the evolution of the EV space daily for several years. He covers everything about Tesla, from the cars to Elon Musk, the energy business, and autonomy. Follow Tinsae on Twitter at @TinsaeAregay for daily Tesla news.

Comments

I would sell my 750 shares…

Permalink

I would sell my 750 shares if Elon leaves.