The electric revolution has hit a speed bump, and it isn't related to range anxiety or charging infrastructure. For the better part of a decade, Tesla has been the undisputed king of the EV hill, praised for its blistering acceleration, over-the-air updates, and a Supercharger network that remains the envy of the automotive world. But a new shadow has been cast over the brand, one that concerns something far more traditional than neural networks or gigacasting: the simple ability of a car to stay in one piece as it ages.

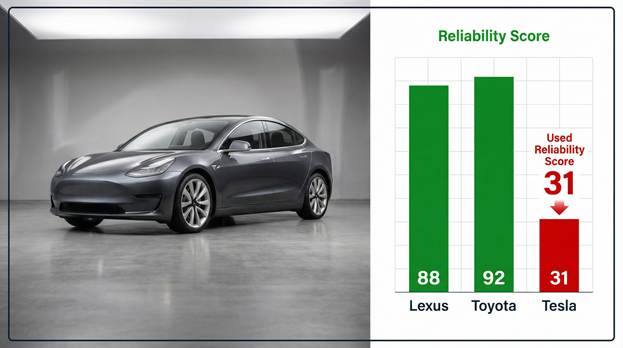

According to a bombshell study released by Consumer Reports late in 2024, Tesla ranked dead last in used car reliability among 26 automotive brands. With a reliability verdict of just 31 out of 100, the brand didn’t just slip; it plummeted, falling behind brands traditionally plagued by quality gremlins like Jeep, Ram, and Chrysler. For a company that prides itself on being the future of transportation, this ranking is a stark reminder that the past—specifically the manufacturing shortcuts of the past—is catching up.

This isn't just a bad headline; it’s a warning shot for the company’s long-term value proposition. In this column, we dig into the causes of this ranking, whether Elon Musk’s focus on robotics is leaving drivers behind, and if the "Cult of Tesla" can survive the service center waiting room.

The Data: A Hard Look at Last Place

The ranking comes from Consumer Reports’ extensive survey of vehicles aged five to ten years old, specifically focusing on models from 2016 to 2021. While Lexus and Toyota sat comfortably at the top with scores in the 70s, Tesla languished at the absolute bottom. The disparity is jarring: a used Lexus is statistically more than twice as likely to be trouble-free as a used Tesla from the same era.

This finding was corroborated across the Atlantic, silencing any critics who might claim this is purely an American bias. The German TÜV Report 2025 also delivered a scathing verdict, ranking the Tesla Model 3 and Model Y at the very bottom of the list for reliability in cars aged 2 to 3 years. The German inspection data pointed to a startling defect rate of over 17% for the Model Y—the worst performance for a car of that age in a decade.

When the two most rigorous testing bodies in the world—one relying on owner surveys and the other on mandatory government safety inspections—both place your brand in the cellar, it is no longer a statistical anomaly. It is a pattern that potential buyers can no longer ignore.

Under the Hood: Why is Tesla Struggling?

To understand the ranking, we have to look at what is actually breaking. Contrary to the myths spread by anti-EV skeptics, the core electric powertrain—the battery and electric motors—is rarely the primary culprit. The motors are generally bulletproof compared to internal combustion engines.

The problem is everything else.

Consumer Reports and TÜV identified specific failure points that are dragging Tesla down. Foremost among them is the suspension. The Model 3 and Y are significantly heavier than their gas-powered counterparts due to the battery packs. Early iterations of these vehicles used suspension components, particularly control arms and bushings, that simply couldn't handle the load over time. Owners frequently report squeaking, rattling, and eventual failure of these parts, often just outside the warranty window.

Then there is the issue of brakes. In a cruel twist of irony, the Model Y’s efficiency is its undoing in safety inspections. Because EVs rely heavily on regenerative braking to slow the car and recapture energy, the physical friction brakes are rarely used. In wetter climates like Germany, this causes the brake discs to rust and corrode from disuse, leading to mandatory inspection failures.

Finally, we cannot ignore the "Production Hell" legacy. The cars surveyed (2016-2021) come from the era where Tesla was scaling from a niche luxury maker to a mass-market manufacturer. These vehicles were notoriously built in tents during rushed assembly pushes. Owners from this era continue to plague forums with reports of loose trim, rattling interiors, water leaks in the trunk, and door handles that refuse to present themselves. This isn't just "panel gap" vanity; it's a degradation of the ownership experience.

The Robot in the Room: Is Optimus a Distraction?

While early adopters are wrestling with out-of-warranty suspension repairs, Tesla corporate seems to have its eyes elsewhere. Elon Musk has increasingly pivoted the company's narrative away from being a "car manufacturer" to being an AI and Robotics company.

The recent unveiling of the Optimus Gen 2 robot and the heavy emphasis on the "Cybercab" Robotaxi suggest a shift in resources. Critics argue that this split focus is detrimental to the "nuts and bolts" of automotive quality control. Tesla is still a relatively new car company, and it lacks the century of institutional knowledge that helps Ford or Toyota refine a door latch until it is perfect.

When the CEO is focused on teaching a humanoid robot to fold laundry or promising a Mars colony, who is focusing on the tolerance gaps of a Model Y door hinge? If Tesla treats its cars merely as a platform for software and AI, the hardware—the actual steel and rubber that customers rely on—suffers. The "move fast and break things" ethos works for coding apps, but it is disastrous for suspension geometry.

The Loyalty Test: Will Drivers Finally Bail?

For years, Tesla has enjoyed brand loyalty that borders on religious fervor. Owners would happily overlook glitches because they were participating in a movement. But the used car market is different.

Used car buyers are not generally early adopters looking to save the planet; they are pragmatic buyers looking for value. If a used Model 3 costs the same as a used Toyota Camry but is statistically likely to spend twice as much time in the shop, the value proposition collapses.

This ranking hurts Tesla’s resale value, which has already been volatile due to Tesla's aggressive new-car price cuts. If the perception cements that a five-year-old Tesla is a "money pit," the residual values will crater. This creates a vicious cycle: low resale value increases the cost of ownership (depreciation), which eventually hurts new car sales as lease prices skyrocket and trade-in values vanish.

However, the "Cult of Tesla" is resilient. Many owners in the Consumer Reports survey, despite reporting issues, still rated their satisfaction highly. They love the instant torque and the Supercharger network enough to forgive the mechanical flaws. But relying on forgiveness is not a sustainable business strategy for a company aiming to sell 20 million cars a year.

The Fix: Is Tesla Righting the Ship?

It is important to add a layer of nuance here: Old Tesla is not New Tesla.

While the 2016-2021 models are ranking last, data on the newest iterations of the Model 3 (the "Highland" refresh) and the Model Y suggests improvements. Tesla has moved to "Gigacasting"—casting huge sections of the car as single pieces of aluminum. This reduces the number of parts that can rattle or fail and ensures consistent geometry.

In fact, Consumer Reports noted that Tesla's new car reliability has jumped into the top 10, creating a massive disparity between the cars rolling off the line today and the ones currently sitting on used car lots. They have learned from their mistakes.

The question is whether they can fix the millions of older "beta" cars already on the road. Currently, service appointments can take weeks to book in major metros. If Tesla wants to shed the "unreliable" label, they don't just need better robots; they need more service bays and mechanics to support the aging fleet.

Wrapping Up

Tesla ranking last in used car reliability is a sobering wake-up call. It highlights the growing pains of a company that revolutionized an industry but cut corners to get there. The legacy of "Production Hell" is now sitting in used car lots, and it is rusting.

For the consumer, this means that buying a used Tesla requires homework. A 2018 Model 3 is a very different machine than a 2024 Model 3. For Tesla, it is a signal that while AI and robots are the future, they cannot neglect the boring, unsexy reality of bushings, control arms, and paint quality. If they do, they might find that the only thing autonomous about their future is the customers driving away to buy a Lexus.

What do you think? Does this study change your mind about buying a used EV, or is the tech worth the risk? Let me know in the comments below.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.