When Toyota and Mazda were planning a pair of new crossovers for the U.S. market, they could have simply leveraged their existing factory locations in Japan, Canada, and other locations to build them. However, Toyota and other companies like Honda and Subaru were having record-breaking sales from crossovers they build inside the U.S. market. The vehicles are high volume, affordable, highly rated for quality, and most important of all, profitable.

Related Story (2019) - Toyota Pours Resources and Jobs Into Expanding U.S. Manufacturing - Is Your State On The List?

Because Toyota has partnered with Subaru and BMW in recent years to leverage the strengths of both companies, Toyota looked to partner with Mazda for this new plant to build new models specifically for the U.S. market. Toyota has taken an ownership position with Mazda, just as it has with Subaru, and the joint venture manufacturing plant would be an excellent opportunity to bring the two companies even closer together. For Toyota, manufacturing inside the U.S. was not new, but this would be Mazda’s first-ever plant inside the United States since its five-year joint venture plant with Ford from 198-1992 (Thank you TN reader, MiataMan, for this tidbit).

The partnership, along with some basic details and forecasts, was announced in 2018, during President Trump’s first term (Trump 45). Torque News covers all things Mazda and Toyota VERY closely, so we provided multiple updates and focus stories at that time. In 2022, the very first Mazda CX-50 rolled off the Alabama production line headed for U.S. customers.

Now that America has again elected President Trump (Trump 47), the plant that Mazda and Toyota teamed up to build in Alabama is more valuable than ever. New tariffs, be they a negotiating tool or serious long-term import duties, have been launched by the new administration to augment the 100% tariffs on all Chinese EVs by President Biden, and the long-standing 25% tariffs instituted by President Johnson in the 1960s on light-duty trucks. With auto tariffs levied by a long list of American Presidents now piling up, manufacturing inside of the market one sells into is becoming the smart strategy.

While strategic manufacturing decisions like establishing domestic plants can shield automakers from tariff-related price hikes, individual vehicle owners still face unexpected challenges that test the resilience of these strategies. Consider the case of a Tesla Model 3 owner who, after an unusual hailstorm, found his vehicle suddenly deemed a total loss by his insurance company. Despite the car's operability, she was offered the option to retain it for $10,000—a decision fraught with financial and emotional considerations. This scenario underscores how unforeseen events can impact vehicle value and ownership decisions, even when broader industry strategies aim to stabilize the market.

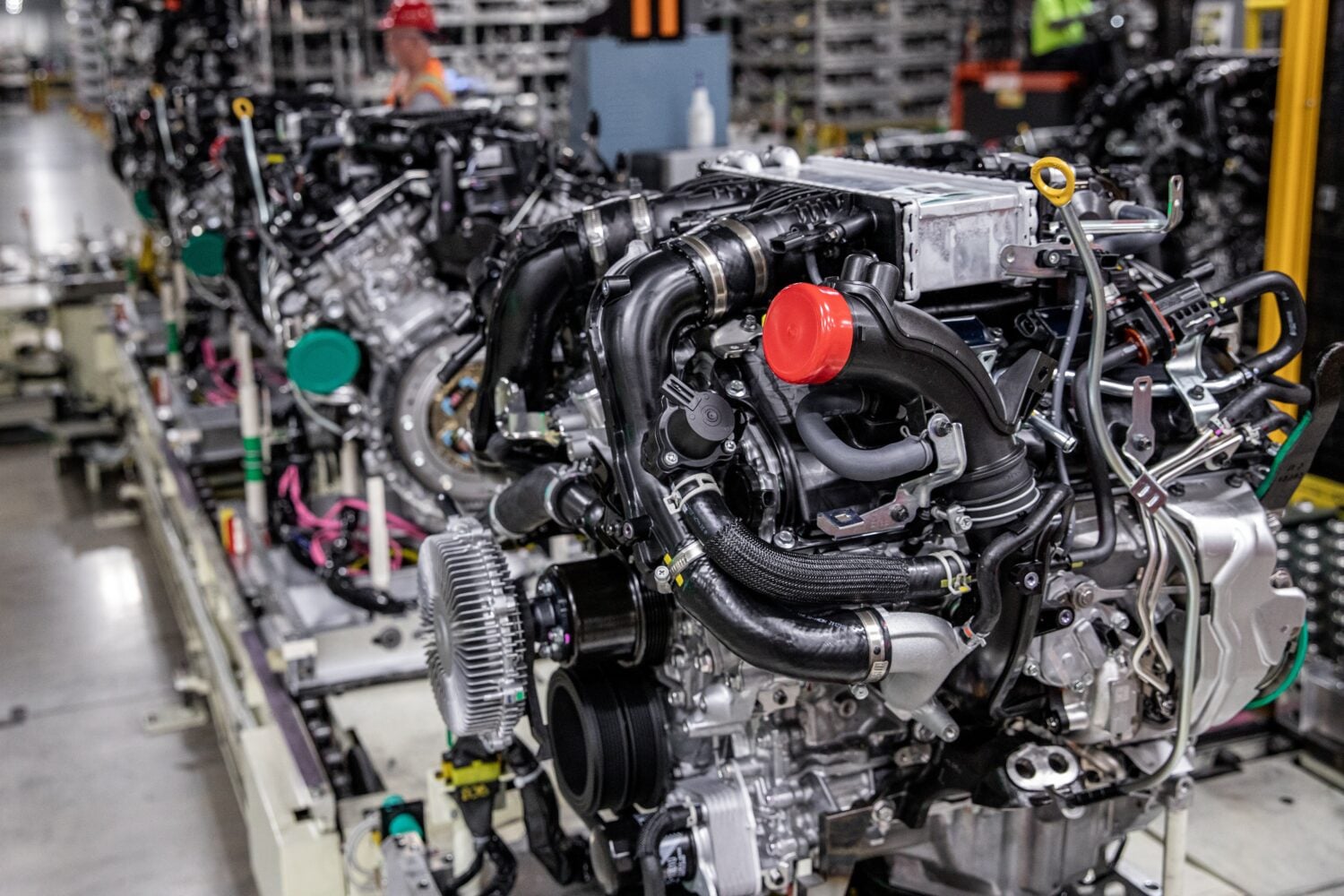

The Alabama plant employs 4,000 U.S. workers. It is called “Mazda Toyota Manufacturing, U.S.A., Inc.” It is often shortened to MTMUS or MTM by insiders. It has a production line volume of 300,000 units per year, split about evenly between Mazda and Toyota. The plant doesn't just assemble vehicles. Rather, it also makes the most important parts of a long list of vehicles in-house. In 2024, the plant produced 895,000 engines.

Sales of both of the vehicles being produced on the MTM's lines are production-limited, meaning they are very successful, sell with almost no incentives, and U.S. consumers can take every one produced. The Corolla Cross and CX-50 are big hits for both brands. Both are among the top crossover models in terms of sales for each brand.

After the latest round of U.S. tariffs from the Trump administration, Canada responded with reciprocal tariffs. This move impacted MTMUS directly. The reporting is varied on this, but our take is that Mazda opted to discontinue producing the Canada-specific version of its CX-50, and hold off on making more. Mazda has plenty of CX-50 inventory in its dealer pipeline for the short term. If the Canadian tariffs remain in place, the U.S. version can easily be substituted, and the volume will be sold in the United States.

MTMUS was just one example of Toyota pouring massive amounts of resources, jobs and production capacity into the United States during Trump 45. In March of 2019, Torque News produced a spotlight article on Toyota’s expansion into the United States. Here is what the CEO of Toyota North America said about the automaker’s expansion into America at that time:

“These latest investments represent even more examples of our long-term commitment to build where we sell. By boosting our U.S. manufacturing footprint, we can better serve our customers and dealers and position our manufacturing plants for future success with more domestic capacity.”

While there is certainly a lot of fear, uncertainty, and doubt being reported (much of it justified) about auto tariffs today, the fact is that the United States and other countries have had tariffs on autos for the better part of the last 100 years. Smart automakers like Toyota and Mazda recognized the coming sea change over a decade ago and began to shift their capacity into the United States ahead of the expected changes we see today.

Do you think the new round of auto tariffs will last indefinitely like the Johnson tariffs did, or will they be used as leverage by President Trump to benefit U.S. manufacturing and to better balance trade imbalances? Tell us your thoughts in the comments below.

Image Notes: Top of page image courtesy of MTMUS public page. Second image showing MTM worker and third image showing engines produced at MTMUS courtesy of Toyota U.S. media image page.

John Goreham is a credentialed New England Motor Press Association member and expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. He is a member of the Society of Automotive Engineers (SAE int). In addition to his eleven years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can connect with John on Linkedin and follow his work on his personal X channel or on our X channel. Please note that stories carrying John's by-line are never AI-generated, but he does employ grammar and punctuation software when proofreading and he also uses image generation tools.

Set as google preferred source

Comments

G, thank you for adding this…

Permalink

In reply to You claim to follow Toyota… by G Harada (not verified)

G, thank you for adding this post. It opens up a very important part of this topic for further discussion. To answer your question, no, "the majority" of the components are likely not sourced from vendors outside of North America, like Hitachi, which I think is what you are implying, and a lot of the parts are likely made in the United States. We don't know because the Monroney stickers list U.S./Canada together. The 2023 CX-50 Monroney we saw had that at 50%. Auto manufacturing will always be a global effort. No realist who has ever set foot inside any manufacturing plant denies that. However, the build of the vehicles employs a lot of highly-paid people, who are supported locally by vendors large and small. My own small town of 25,000 people in Metro Boston's wealthy suburbs has an employer named Haartz Corp. who is the town's largest private employer. The company makes textiles for vehicles right here in one of America's wealthiest and oldest towns. Their employment, income, payroll, and property taxes are vital to the town's success. I say it was a genius move because automakers are now scrambling to ramp up production inside the U.S. Toyota and Mazda saw this trend happening, and took action years ago. This puts them in a much better position to serve the planet's most profitable auto marketplace.

The wingnuts will mimic back…

Permalink

In reply to G, thank you for adding this… by John Goreham

The wingnuts will mimic back everything the cult feeds them. If you hear Tяump speak and don't spend the entire time thinking, "Wow, this guy sounds like a complete and total babbling idiot" it's because you are a complete and total babbling idiot, too.

This plant wasn't built…

Permalink

This plant wasn't built because of Trump's tariffs. It was planned and built before Trump was elected. And since most of the parts for these cars still come from overseas, tariffs will still significantly increase their costs. Please try to think before you write biased nonsense.

Thank you for your opinion,…

Permalink

In reply to This plant wasn't built… by Bobm (not verified)

Thank you for your opinion, Bobm. We'll stick to the factual statement we wrote on this part of the topic, which is "The partnership, along with some basic details and forecasts, was announced in 2018, during President Trump’s first term (Trump 45)." The title is also factual. The move was made before new 2025 tariffs, which you confirm, and, as proven by the models' success, they are, in fact, competitive.

It’s interesting how…

Permalink

It’s interesting how everyone wants to tout bringing relatively low paying manufacturing jobs back to the states when the latest generation of kids don’t want those jobs. How is it beneficial to bring low paying jobs back to the US with only make things more expensive instead of investing new technology jobs that the newer workforce actually wants. Trump is stuck in his old head mentality and everyone that believes his propaganda is just delusional to think for themselves about what actually is right for Americans.

How’s it going for everyone with “reduced prices” for everyone? how’s the economy? Getting rich yet off tariffs?

Nope! Everyone that voted for Trump just set the entire nation back years in the global economy, technology development, energy transition, and we all will suffer as a result of it.

Low-paying jobs? Automobile…

Permalink

In reply to It’s interesting how… by Sam (not verified)

Low-paying jobs? Automobile manufacturing employs huge numbers of STEM-educated high-earners directly in manufacturing. Many more work in the tier two automation and electronics suppliers that serve tier one operations. Semiconductor, specialty chemical, pharma, and biopharma are just a few other areas in which America still leads in highly skilled manufacturing. I live in a Boston-area town known for having the best schools in the nation. Our largest employer is an automotive supplier. Sam, it's not the 1800s anymore. Visit a few factories if any have tours in your area. Ask about the engineering staff and what they earn.

Pagination