Tesla Insurance arrived to upend an industry as bloated and cynical as a DMV line at closing time. No more judging drivers by zip codes or age brackets. Instead, Tesla would peer directly into your driving behavior, every brake tap, every corner, every instance of following a little too close, and calculate your premium accordingly. It was supposed to be the future: fair, accountable, merit-based. But now, we’re seeing the limitations. Because in the real world, you don’t always control who’s behind the wheel. And that’s where the system fails.

"Any way to stop the valet guy from tanking my safety score by driving with no seat belt?"

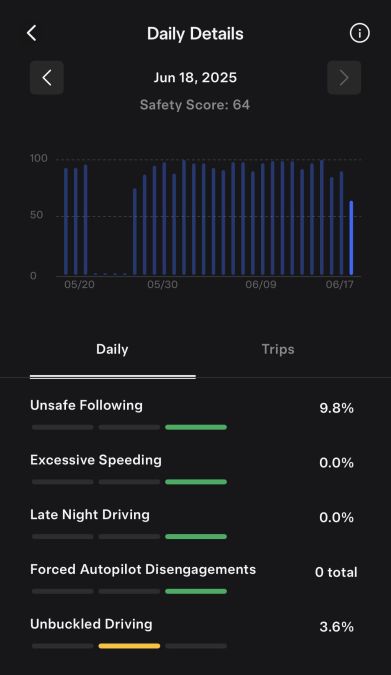

That was the plea of Reddit user insaneburrito8, posted in r/TeslaLounge alongside a Safety Score of 64 and a glaring 3.6% “Unbuckled Driving” rate. No high-speed antics. No late-night sprints down Mulholland. Just the simple act of trusting a valet, likely for less than five minutes, with the keys to a $50,000+ car.

The irony? Tesla has a Valet Mode designed to limit speed and lock down personal data. But it didn’t stop the system from recording this unbelted episode and slashing the score. One act of negligence by someone who probably didn’t even know what Safety Score was, and the owner gets hit.

Tesla Safety Score Plummets When Valet Drivers Skip Seatbelts, Is Your FSD Beta at Risk?

- Tesla monitors key behaviors like hard braking, aggressive turning, late‑night driving, speeding, and seatbelt usage to compute a “Predicted Collision Frequency” and map it to a Safety Score from 0–100

- Your monthly insurance cost is directly linked to the average of your daily scores over the past 30 days multiplied by miles driven: safer drivers pay less

- Newer versions give extra weight to excessive speeding and minimize the impact of forward‑collision warnings, reflecting improved real-world risk modeling

- Rather than simple checklists, Tesla continuously refines its algorithms, translating real-time driving data into an evolving risk model that predicts likely crashes per million miles

The comments on the post ricochet between hilarity and helplessness. “Like the butler is causing enough problems already,” joked Elegant_Inevitable45, and while the line earns a laugh, the problem is dead serious.

That Safety Score doesn’t just affect your ego, it can influence your insurance premiums and even your eligibility for Full Self-Driving Beta. The valet doesn’t know, doesn’t care, and certainly isn’t the one footing the bill. But the system isn’t built to distinguish between you and a hotel attendant, just whether or not a seatbelt was buckled when the car moved.

This brings us to a larger truth that remains unchanged, whether we're talking about legacy insurers or data-hungry tech startups: companies have always sought innovative ways to pinch pennies at the expense of policyholders. Tesla might package its insurance in clean typography and talk of AI, but it's still a profit-seeking enterprise. And when it comes to assigning blame or calculating risk, the default setting, just like in old-school insurance, still puts the burden on you. You are the account holder. Your score, your problem.

Tesla Safety Score Breakdown: Hard Braking, Speeding, Seatbelts & Risk Prediction

Let’s assume the best-case scenario: the owner remembered to engage Valet Mode. Even then, Tesla’s system should automatically recognize that behavior outside of your control should be weighted differently, or disregarded entirely. Odd_Manufacturer_328 pointed out,

“The safety score beta formula specifically ignores events that occur while Autopilot is engaged… Valet Mode restricts speed and acceleration…”

According to Tesla, those protections should apply. But the presence of that 3.6% "Unbuckled Driving" proves the system either wasn't engaged, or it simply doesn’t work the way it should.

The system, even if it’s sensitive and consequential, must account for edge cases, valet sessions, service center test drives, family members, and even errors. Because, as Fidget808 rightly noted, “This assumes OP put it in valet mode though.” One forgotten toggle, one distracted moment, and weeks of cautious driving evaporate. And thanks to Tesla's 30-day, mileage-weighted rolling average, this isn’t just a bad score on one day, it’s a penalty that lingers. The system demands perfection in an imperfect world. A setup like that only serves the insurer, not the insured.

Why Tesla’s Valet Mode Fails to Filter Out Unbuckled-Seatbelt Events

- Despite ongoing "Full Self‑Driving" branding, Tesla FSD remains a supervised assistance system; regulators like NHTSA still classify it as Level 2, not true autonomy

- Since October 2024, NHTSA has tracked four crashes involving FSD in conditions like fog or glare, including one pedestrian fatality

- FSD's toll smaller but significant – Aggregated data shows 51 deaths tied to Autopilot, while FSD itself accounts for at least two confirmed fatal crashes

- Ongoing reviews include NHTSA investigations into FSD in 2.4 million vehicles, a Texas robotaxi pilot, and multiple inquiries focused on crash data and performance in challenging conditions

Worse, we’ve seen this scenario before. Last year, Tesla owners reported their Safety Scores dropped after service technicians took their vehicles for test drives. According to Tesla Motors Club forums, one owner’s score fell from 98 to 83 due to a 20-mile service run. These aren't theoretical oversights; they're real-world bugs in a system that affects real money. If Tesla won’t separate owner behavior from third-party actions, then the system is punitive, not progressive.

Tesla FSD Beta Safety Report: Level 2 Status, Crash Data & NHTSA Reviews

Until this changes, the promise of Tesla Insurance remains half-baked. Fairness requires nuance, and algorithms don’t do nuance well without better logic gates. If you’re going to tether your insurance cost, or your access to flagship tech like FSD Beta, to a rolling behavioral score, then the score needs to reflect your behavior. Not your valet’s. Not your technician’s. Not your teenage nephew’s. Just yours. Until then, owners aren’t being rewarded for good driving, they’re being punished for trusting others. And that’s not innovation. That’s just a new way to lose.

Image Sources: Tesla Media Center

Noah Washington is an automotive journalist based in Atlanta, Georgia. He enjoys covering the latest news in the automotive industry and conducting reviews on the latest cars. He has been in the automotive industry since 15 years old and has been featured in prominent automotive news sites. You can reach him on X and LinkedIn for tips and to follow his automotive coverage.

Set Torque News as Preferred Source on Google

Comments

Everything is always someone…

Permalink

Everything is always someone else’s fault, eh.

This is about who YOU hire to handle your car.

The fact that a behavior…

Permalink

The fact that a behavior like this can be quickly detected and affect your rates means that an improvement on your part can also be quickly detected and rewarded with a rate reduction. I’m sure you’ll post here enthusiastically when that happens.

a really good point! It's…

Permalink

In reply to The fact that a behavior… by Chuck Gollnick (not verified)

a really good point! It's true that if negative impacts are quickly reflected, then positive improvements should also be recognized and rewarded just as swiftly. I'm definitely hopeful for that, and I appreciate you highlighting the potential for improvement!

I totally disagree with this…

Permalink

I totally disagree with this statement "Tesla’s system needs smarter solutions to keep owners protected." The valet can get in an accident just as easy and the owner. Like telling your kid you ride with a helmet but I don't need to use one because I'm an adult. The same applies to service advisors or technicians that take your car out for test drive and don't use safety equipment. Plenty of lawsuits over crashed cars in for service. Just look at the legal documents you sign for insurance for monitoring systems that help lower your insurance premium. I know, I just signed my two teenage drivers up for monitoring while driving and the disclaimer and rules are pages of legal ease.

a very strong and valid…

Permalink

In reply to I totally disagree with this… by Brian Morton (not verified)

a very strong and valid point about safety and accountability for everyone behind the wheel, regardless of who they are! You're absolutely right that the same safety standards should apply to all drivers, and the potential for accidents is universal. Thanks for sharing your perspective on that crucial aspect!

It's the same insurance…

Permalink

It's the same insurance whether its you, a friend, or a valet driving. So the metric is valid.

My ICE SUV has the option to not allow shifting into forward or reverse unless the seatbelt is engaged. That sounds like the simplest fix for this issue.

really insightful point…

Permalink

In reply to It's the same insurance… by Steve Berkholz (not verified)

really insightful point about the insurance metric remaining consistent regardless of the driver! And your suggestion for a seatbelt interlock for shifting is a fantastic idea it sounds like a very straightforward and effective solution to this kind of issue. Thanks for sharing that!

I have a similar issue in so…

Permalink

I have a similar issue in so far as my current assessment on my Lexus shows me at 17% for potential insurance discount , where my cars EV percentage rating can be logically no better than 50% due to geographic considerations.

I live in a hilly environment where long and short slopes are in every direction I choose to drive (3 Possible) and the climb or drop to the local destinations are in the order of 600 to 1500 feet. Bearing in mind there are several 'humps' along the way.

Now considering I manage against the odds round tripping on most journeys to be 51% (figure that one out). I think the whole scheme is discriminatory. It does not take into consideration what CAN be achieved, by any driver of any skill or care.

Both your and my issues are beyond our reasonable control.

It has raised the issue of data spying by our cars. I am trying to figure out how to firewall it so I control it. Not easy.

Once my current car is beyond end of life I am selling it to revert to using my Defender 90 TDI 300, which I will make more comfortable in the interim. Its a dumb grunt and I love it.

really compelling and…

Permalink

In reply to I have a similar issue in so… by Ian Stevenson (not verified)

really compelling and frustrating situation you've described with your Lexus and the insurance discount! You've hit on a critical point about how these systems often fail to account for real-world environmental factors and individual driving conditions. It truly feels like a form of data spying when it impacts your rates without full context. It's understandable why you'd consider going back to a dumb grunt like your Defender 90 TDI 300 sometimes simplicity and control are exactly what's needed. Thanks for sharing your experience!