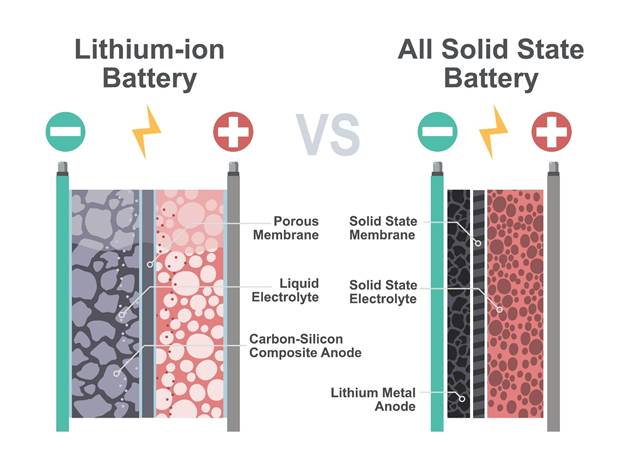

For years, Toyota, the titan of the automotive world, has been viewed as a reluctant participant in the all-electric vehicle revolution. While competitors raced to launch new battery electric vehicles (BEVs), the Japanese giant seemed to be dragging its feet, earning criticism from environmental groups and EV enthusiasts alike. But a recent announcement signals a potential paradigm shift in its strategy, a high-stakes bet that could either redefine the market or cement its status as a laggard. In early October, Toyota announced a joint venture with Sumitomo Metal Mining to mass-produce cathode materials for solid-state batteries, with plans to launch cars featuring this breakthrough technology by 2027 or 2028. This isn't just an incremental update; it's a potential game-changer. Solid-state batteries promise to be a holy grail for EVs, replacing the flammable liquid electrolyte in current lithium-ion batteries with a solid material, offering higher energy density for longer range, significantly faster charging times, and enhanced safety.

Toyota's Calculated Hesitation

To understand the gravity of this move, one must first understand Toyota's long-standing skepticism towards a BEV-only future. The company that pioneered hybridization with the Prius has consistently advocated for a "multi-pathway approach" to decarbonization. For years, Toyota executives argued that a premature rush to all-electric vehicles was misguided. They pointed to several valid concerns: the high cost and environmental impact of battery production, the strain on global mineral supply chains, the lack of robust charging infrastructure in many parts of the world, and the fact that hybrids still offered a more immediate and accessible way for the masses to reduce emissions.

Instead of going all-in on BEVs, Toyota diversified its bets, continuing to refine its world-leading hybrid systems, developing plug-in hybrids (PHEVs), and investing heavily in hydrogen fuel cell technology, as seen with its Mirai sedan. This cautious strategy was often interpreted as stubbornness or a failure to innovate. In reality, it was a pragmatic, if conservative, calculation. Toyota was unwilling to commit its vast manufacturing empire to a technology it viewed as immature and fraught with logistical hurdles. They were waiting for a breakthrough that aligned with their core principles of reliability and mass-market viability. Solid-state batteries appear to be the breakthrough they were waiting for.

A Silver Bullet Against China's Dominance?

Toyota's timing is critical. While it has been cautious, Chinese automakers, led by giants like BYD, have stormed the global EV market. China now dominates the EV space, not just in sales but in the most critical component: the battery supply chain. Chinese companies control a huge portion of the mining and refining of essential minerals and are leaders in producing cost-effective and increasingly popular LFP (lithium iron phosphate) batteries. For Western and Japanese automakers, competing with China on the current lithium-ion playing field is a daunting uphill battle.

This is where Toyota’s solid-state strategy could be a stroke of genius. Instead of trying to catch up in a race they are already losing, they are attempting to change the race entirely. By successfully mass-producing solid-state batteries, Toyota could effectively "leapfrog" the current generation of EV technology. A Toyota EV in 2028 with a 600-plus-mile range that can recharge in minutes would represent a monumental advantage over any vehicle on the market today. It would shift the competitive benchmark from battery cost—where China excels—to technological superiority in performance, safety, and convenience. This move is a direct challenge not to match China’s current strengths, but to render them obsolete with a next-generation standard.

Is It Too Little, Too Late?

The multi-billion-dollar question is whether Toyota can pull it off in time. A 2027-2028 launch window feels both tantalizingly close and perilously far away. By then, competitors will have nearly a decade of experience in building and marketing EVs. They will have refined their software, built out their charging networks, and secured their own supply chains for current-generation batteries. Furthermore, lithium-ion technology is not standing still. Advances in battery chemistry and cell design are continuously improving energy density and charging speeds, potentially narrowing the performance gap that solid-state batteries promise to create.

Toyota is in a high-stakes race not just against other legacy automakers like VW and Honda, who also have solid-state ambitions, but against the relentless pace of incremental innovation. If production delays push the launch to 2030 or beyond, or if the cost of the technology remains too high for the mainstream market, Toyota's gamble could backfire spectacularly. In that scenario, they would have squandered precious years while their rivals solidified their positions in the defining automotive transition of our time. The company is betting the house that its technological leap will be significant enough to erase its late start.

Wrapping Up

Toyota's pivot to mass-producing solid-state batteries is the culmination of its long and deliberate EV strategy. Born from a deep-seated caution about the limitations of current battery technology, this move is a bold attempt to redefine the electric vehicle landscape. It serves as a direct counter-offensive to the market dominance established by Chinese manufacturers, aiming to shift the battleground from cost to next-generation performance. Whether this proves to be a visionary masterstroke or a desperate, delayed entry will depend entirely on execution. If Toyota can deliver a reliable, affordable solid-state EV by 2028, it will not only have caught up but will have positioned itself to lead the next phase of the electric era.

Summary: Toyota's plan to mass-produce solid-state batteries by 2028 is a high-stakes gamble to leapfrog current EV technology and challenge China's market dominance, but its success hinges on delivering the breakthrough on time and at a competitive cost.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.