At Tesla's recent annual shareholder meeting, investors made a monumental decision, approving a new, mind-boggling compensation package for CEO Elon Musk. This isn't just a generous bonus; it's a plan potentially valued at $1 trillion (or $878 billion after required payments). This figure, the largest in human history, is designed to incentivize Musk to achieve astronomical goals, like growing Tesla to an $8.5 trillion valuation and producing 20 million vehicles.

But as shareholders cheered, a critical question went largely unasked: What is the opportunity cost of this $1 trillion bet on one man? What could Tesla, the company, actually do with that kind of capital?

What a Trillion Dollars Could Buy

Let's put $1 trillion into perspective. It's a number so large it borders on the abstract. So, what could Tesla buy with the potential value of this single compensation package?

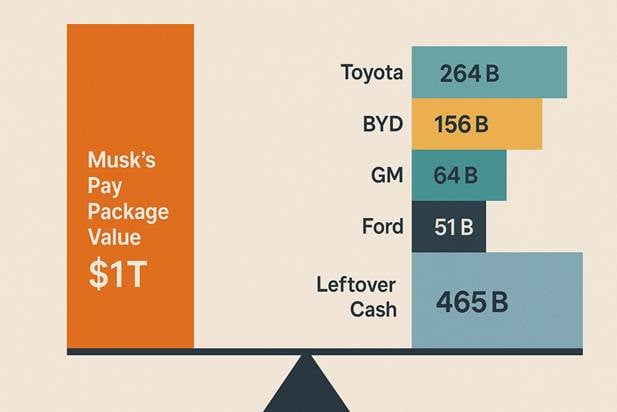

- The Entire Legacy Auto Industry (With Change to Spare): For $1 trillion, Tesla could acquire its top competitors. All of them. As of November 2025, the market capitalization of Toyota is roughly $264 billion. BYD, its chief EV rival, is valued at around $156 billion. General Motors sits at $64 billion, and Ford at $51 billion. Tesla could buy Toyota, BYD, GM, and Ford outright, and still have over $465 billion left over.

- A Massive Slice of Big Tech: Not interested in cars? For $1 trillion, Tesla could decide to buy IBM, AMD, Uber, and Qualcomm combined, and still have hundreds of billions in cash.

- A Quarter of the World's Cars: Let's think in terms of Tesla's own products. The 2025 Model 3 starts at $44,130. For $1 trillion, Tesla could buy 22.6 million brand-new Model 3s. The total number of cars sold globally in 2025 is forecast to be around 89.6 million units. This single pay package is equivalent in value to buying 25% of the entire planet's annual car sales.

Comparing $1 Trillion to... Tesla

The "opportunity cost" argument becomes even more stark when you compare the value of this package to Tesla's own financial fundamentals.

- Revenue: Tesla's total annual revenue for 2024 was $97.69 billion (TSLA Revenue 2011-2025 - Macrotrends). This $1 trillion package is worth more than 10 years of the company's entire global revenue.

- Profit: Tesla's annual net income (profit) for 2024 was $7.13 billion (TSLA Net Income 2011-2025 - Macrotrends). This pay package is worth 140 times the company's 2024 profit.

- Assets: Tesla's total "Property, Plant, and Equipment"—its Gigafactories, machinery, and physical assets—was valued at $35.8 billion at the end of 2024 (TSLA Property, Plant, and Equipment 2011-2025 - Macrotrends). The $1 trillion package is valued at nearly 28 times more than every factory, robot, and building Tesla owns.

What Could $1 Trillion Actually Build?

Perhaps the most compelling argument isn't what Tesla could buy, but what it could discover. What if that $1 trillion in potential stock value was instead dedicated to R&D or capital expenditure?

For $1 trillion, Tesla could:

- Fund its own "Terafab": Musk himself mentioned at the meeting that Tesla would need a "gigantic chip fab" and might partner with Intel (Tesla CEO secures record USD 1 trillion pay package - Indian Express). For $1 trillion, Tesla wouldn't need Intel; it could build the most advanced semiconductor foundry on Earth.

- Solve Autonomous Driving (for real): Instead of incentivizing the goal of 1 million robotaxis, $1 trillion could fund the R&D, engineering, and global testing infrastructure to solve Level 5 autonomy outright.

- Build a Mars Colony: Forget SpaceX; $1 trillion is well within the estimated range needed to fund a self-sustaining city on Mars, Musk's other great ambition.

- Buy the Robot Revolution: The goal of 1 million humanoid robots is ambitious. A $1 trillion investment could acquire every major robotics and AI startup on the planet, consolidating their R&D to build Optimus faster than anyone thought possible.

Instead, that $1 trillion in potential value is earmarked to incentivize one person.

The Awkward Optics: Trillions for One, Layoffs for Thousands

This historic vote doesn't happen in a vacuum. The entire tech industry, including Tesla, is in the midst of a painful contraction. The year 2025 has been defined by widespread tech layoffs, affecting giants like Google, Intel, Rivian, and HP.

This workforce reduction is explicitly linked to automation and AI advancements—the very technologies Musk is being paid to pioneer. Amazon's CEO, Andy Jassy, stated bluntly, "We will need fewer people doing some of the jobs." Tesla itself has faced overproduction dilemmas, leading to its own workforce anxieties.

The optics are, to put it mildly, challenging. Approving the largest compensation package in human history for one executive, while the broader workforce is being asked to accept layoffs and economic uncertainty driven by that same executive's technology, is a level of tonal deafness that is hard to ignore.

The "Unmissable" Benchmarks (That He Might Miss Anyway)

The package is justified by its "pay-for-performance" structure, tied to seemingly impossible goals: an $8.5T market cap, 20 million vehicles, 1 million robotaxis, and 1 million humanoid robots. These goals are so audacious they border on science fiction. But will he be paid if he misses?

This is the most critical question. Buried in the analysis of the plan is a concerning detail. Corporate governance experts like Nell Minow of ValueEdge Advisors have pointed out that the plan gives the board discretion to award him the amount of shares whether he meets those goals or not. This transforms the "performance" benchmarks from a rigid contract into a set of very expensive suggestions. Given Musk's singular role and the board's repeated warnings that Tesla could lose Musk if the deal isn't approved, it's highly probable he will receive massive tranches of this package regardless of whether a million Optimus robots are walking the earth.

Wrapping Up

Tesla's $1 trillion compensation package is far more than a simple payday; it is a staggering bet on a single individual. When compared to the value of Tesla's entire physical infrastructure (28x smaller), its annual profits (140x smaller), or its legacy auto rivals (all of whom could be bought with the money), the opportunity cost is astronomical. Worse, the optics of this package are jarring, approved amid a wave of tech layoffs driven by the very AI Musk is pioneering. The most telling part may be that the "impossible" benchmarks set to justify this sum might just be corporate theater, with the board seemingly empowered to grant the payday anyway. Shareholders have approved the deal, but the real cost—in capital, focus, and employee morale—is yet to be calculated.

Disclosure: Images rendered by ChatGPT 5.0

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.