Lucid's stock price jumped on Monday hot on the heels of LCID receiving another 'Buy' rating from Citi analyst Itay Michaeli.

Michaeli gave the stock a 'Buy' rating along with a price target of $12. At the time of writing LCID was well on its way towards this with a 13% gain on the day raising it to around $8.80 per share.

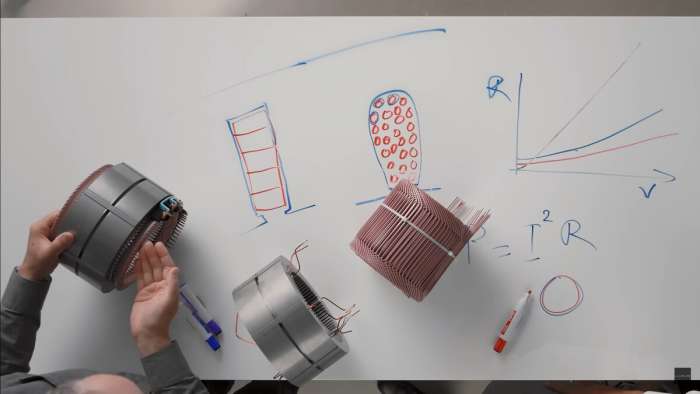

Lucid's proprietary technology, which underpins its range record-setting vehicles, is partially to thank for its latest 'Buy' rating.

Profitability Predictions

As Barron's reports, Michaeli sees Lucid's slide over the past year as an opportunity to secure a stake in a promising company for rock-bottom prices.

“We continue to like the company’s technology and product positioning in the EV race. Key focus areas now include the continued production ramp of the Air, upcoming reservation/demand updates, the company’s go-forward pricing strategy, 2023 gross margin outlook and Gravity launch milestones.”

Lucid delivered 4,369 cars in 2022 and the article goes on to say that Wall Street analysts expect Lucid to deliver around 24,000 vehicles in 2023. Despite representing a major uptick in production, that number of vehicles would still see Lucid operating at a 14% loss, or about $2 billion. Lucid has cash on hand to weather these early days and should achieve profitability some time in 2024.

Citi's 'Buy' rating comes not long after LCID received another from Cantor.

Related Story: Lucid Motors Are Powering Formula E Race Cars

Images by Lucid Motors licensed by CC BY 4.0.

James Walker is an Automotive Journalist at Torque News focusing on Lucid Motors. If it's got wheels he's interested, and he's looking forward to seeing what kind of cars the EV revolution brings us. Whether it's fast, slow, new, or old, James wants to have a look around it and share it in print and on video, ideally with some twisty roads involved. You can connect with James on Twitter, Instagram, and LinkedIn.

Set Torque News as Preferred Source on Google