As EVs like the Tesla Model Y and Rivian R1 series continue their ascent into the mainstream automotive market, state and local governments across the United States find themselves grappling with a new challenge. The erosion of their tax revenue streams. For nearly a century, fuel taxes have served as the cornerstone of transportation infrastructure funding, generating billions of dollars annually for road maintenance, bridge repairs, and highway construction.

However, the accelerating adoption of a new class of heavy-weight vehicles has begun to create significant holes in these municipal budgets, as electric vehicles like the 9,000lb Escalade IQ and Hummer EV utilize the same roads and bridges while completely bypassing the traditional per-gallon fuel tax collection system.

The Hidden Cost of Going Electric

This disconnect between infrastructure usage and funding mechanisms has forced state legislatures to innovate new revenue collection methods, often leading to controversial solutions like dedicated EV registration fees.

For many EV owners, these policy changes are showing up as unexpected costs at DMV offices nationwide. What was once a routine vehicle registration renewal now comes with surprising new fees. The impact of these changes is becoming increasingly apparent, as more EV owners encounter these additional charges during their annual registration process.

One Tesla Owner's Frustration

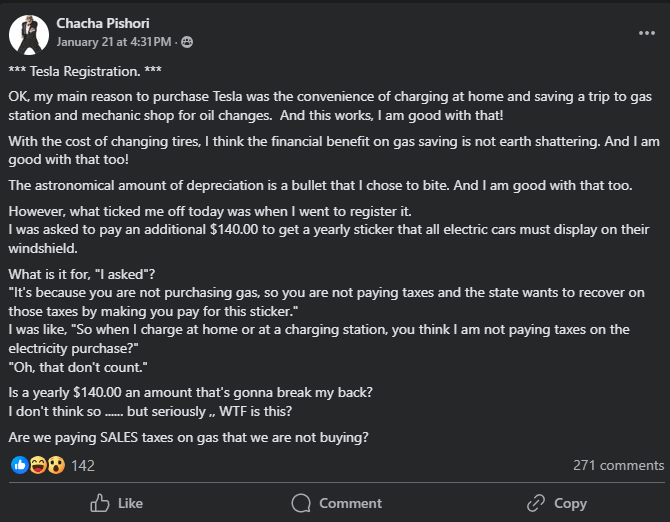

This growing tension between EV adoption and infrastructure funding recently came to life when one owner took to the Facebook Group to share their concerns when hit with a surprise ‘$140 fee’.

Pishori shared his first-hand account of this new tax in a lengthy quote,

OK, my main reason to purchase Tesla was the convenience of charging at home and saving a trip to gas station and mechanic shop for oil changes. And this works, I am good with that!

With the cost of changing tires, I think the financial benefit on gas saving is not earth shattering. And I am good with that too!

The astronomical amount of depreciation is a bullet that I chose to bite. And I am good with that too.

However, what ticked me off today was when I went to register it.

I was asked to pay an additional $140.00 to get a yearly sticker that all electric cars must display on their windshield.

What is it for, "I asked"?

"It's because you are not purchasing gas, so you are not paying taxes and the state wants to recover on those taxes by making you pay for this sticker."

I was like, "So when I charge at home or at a charging station, you think I am not paying taxes on the electricity purchase?"

"Oh, that don't count."

Is a yearly $140.00 an amount that's gonna break my back?

I don't think so ...... but seriously ,, WTF is this?

Are we paying SALES taxes on gas that we are not buying?

3 Hidden Economic Impacts You Need to Know

- Gas prices and inflation maintain a complex relationship in the American economy, with fuel costs acting as both a driver and indicator of broader price pressures. When gas prices surge, as seen in recent years, the ripple effects extend far beyond the pump - transportation costs rise across supply chains, leading to price increases in everything from groceries to consumer goods. This inflationary pressure is particularly acute in the US due to the nation's heavy reliance on road transportation.

- The mass adoption of electric vehicles, while promising environmental benefits, raises significant concerns about grid capacity and infrastructure readiness. Studies suggest that if EV adoption reaches 30% of vehicles, peak electricity demand could increase by 25-40% in some regions. This additional strain comes at a time when the US electrical grid is already dealing with aging infrastructure and increasing stress from extreme weather events.

- While EVs offer protection from gas price volatility, their increasing numbers strain electrical infrastructure, potentially driving up electricity rates. Utilities are already implementing demand-based pricing and special EV charging rates to manage grid load, suggesting that as more Americans switch to electric vehicles to escape gas prices, they may face a different kind of energy cost challenge through higher electricity bills and infrastructure fees.

How Tesla Rewrote America's Electric Car Narrative

Tesla played a pivotal role in bringing long-range affordable EVs to market starting in the early 2010s, but other major brands were not far behind. This has allowed EV sales to steadily increase over the past decade. However, while a boon for reducing emissions, each EV sale represents lost tax revenue compared to a gasoline-powered vehicle of similar weight and miles driven. Analysts estimate the average EV annually avoids $135 in state gas taxes, creating a multi-billion dollar funding gap as adoption grows.

The evolution of modern electric vehicles tells a tale of missed opportunities and eventual redemption in American automotive history. In the 1990s, GM led the charge with its revolutionary EV1, the first mass-produced electric vehicle of the modern era.

This sleek, aerodynamic car showcased what was possible with electric propulsion, building a devoted following among its lease-only customers. However, in a decision that would later prove short-sighted, GM chose to terminate the EV1 program and literally crush its fleet, pivoting instead to profitable but fuel-hungry vehicles like the Hummer. This strategic pivot came just years before a major oil crisis would reshape the automotive landscape. While American manufacturers retreated from electrification, Toyota seized the moment by doubling down on its hybrid technology.

EV Sales, Lost Gas Taxes, and Infrastructure Gaps

The Prius, initially dismissed as a niche vehicle, became a global success story as gas prices soared. Its innovative combination of gasoline and electric power demonstrated that alternative powertrains could appeal to mainstream consumers, setting the stage for future electric vehicles.

America's absence from the electric vehicle market persisted until Tesla arrived with a novel approach. Rather than immediately attempting to build an affordable mass-market vehicle, Tesla began with the Roadster – essentially a modified Lotus Elise fitted with lithium-ion batteries and an electric powertrain.

This strategic choice allowed Tesla to prove that electric cars could be exciting and desirable, while the high price point of the sports car helped fund the development of their true goal, the Model S.

The Pioneer Accelerating Electric Performance

- The Tesla Roadster is an all‐electric sports car that made its debut in 2008, pioneering the use of lithium‑ion batteries in production vehicles and setting new benchmarks for range and performance.

- Built on a modified Lotus Elise chassis, early Roadsters could accelerate from 0 to 60 mph in under 4 seconds, showcasing Tesla’s innovative electric powertrain and rapid acceleration capabilities.

- The next generation of the Tesla Roadster was famously launched into space aboard a Falcon Heavy rocket in 2018, complete with a mannequin dubbed “Starman” to symbolize humanity’s reach into the cosmos.

The Roadster served as both a proof of concept and an investment vehicle, with early adopters essentially funding the development of what would become America's first successful new car company in generations. The key to this success lies in Tesla's innovative approach to battery technology.

By using thousands of small lithium-ion cells, similar to those found in laptop computers, Tesla created battery packs with unprecedented energy density and performance. This system, combined with sophisticated thermal management and charging capabilities, finally made long-range electric vehicles viable. The resulting charging network and battery management systems would help Tesla establish a significant lead in the electric vehicle race, one that traditional automakers are still trying to close.

Automaker Commitments and Infrastructure Overhauls

Automakers have increasingly united around a vision of an all-electric future over the next few decades. Ford, GM, Toyota, and others have set specific targets to phase out production of new gasoline-powered vehicles entirely between 2030-2040 in key markets like the US and Europe. At the same time, infrastructure bills are allocating billions for updating the electrical grid and building out a nationwide charging network.

This debate over updating road funding models is not a new phenomenon. Gas taxes themselves were an innovation in the 1920s and took decades to become widely adopted as gasoline-powered vehicles replaced horses, bicycles, and public transit as the transportation norms. Prior to that, roads were largely locally funded through property taxes, tolls, and other general taxes not tied to transportation methods.

Earlier this century, debates raged over aviation taxes and fees as commercial air travel disrupted intercity rail's established funding streams. In the late 1800s, disputes erupted between railroads and traditional roads over which entities should bear infrastructure costs - with distances, weights, and other metrics battled over.

Evolving Road Funding in a Post-Gas Tax Era

EVs represent the latest major transportation shift to spur the evolution of these funding paradigms. Just as past transitions played out over many years, the gas tax's long reign as road funding's backbone may only slowly diminish.

While yearly registration fees for electric vehicles may frustrate individual owners seeking gasoline savings, the broader shift to EVs is inevitably phasing out gas taxes that have filled government coffers for a century. This collision between innovative technologies and antiquated funding models is nothing new, mirroring conflicts sparked by previous transportation revolutions. As tailpipe emissions fade, the public and private sectors must collaborate on fair and sustainable infrastructure funding solutions.

Do you think electric vehicle tax is necessary or is it just another way to drain our wallets?

Noah Washington is an automotive journalist based in Atlanta, Georgia. He enjoys covering the latest news in the automotive industry and conducting reviews on the latest cars. He has been in the automotive industry since 15 years old and has been featured in prominent automotive news sites. You can reach him on X and LinkedIn for tips and to follow his automotive coverage.

Set Torque News as Preferred Source on Google

Comments

You don’t pay gasoline tax. …

Permalink

You don’t pay gasoline tax. Actually, you should Pay more than that cause your vehicle is heavier and it causes more wear and tear on the road. Yes, I’m gonna purchase an EV, but I do understand the cost of maintaining the infrastructure

Weight damaging the road is…

Permalink

In reply to You don’t pay gasoline tax. … by John Baker (not verified)

Weight damaging the road is a joke compared to the damage the government does to their own roads with snow plows. I see so many new potholes after snow gets cleared. But we have to pay on taxes for the damage the government causes because they get a free ride on everything. I think roads are a huge waste of resources though, if we want to look towards the future we should get rid of roads entirely and move to transport via the air and build our transport systems around that. I suppose drone taxis probably aren't that far off so we may have a disruption to our transportation sector again within the next decade or so.

I have never seen a snow…

Permalink

In reply to Weight damaging the road is… by Jack (not verified)

I have never seen a snow plow on my roads, but I have seen many EVs, and they gotta pay somehow. Electric taxes dont cover roads...

I have no problem paying…

Permalink

In reply to You don’t pay gasoline tax. … by John Baker (not verified)

I have no problem paying extra tax for my EV. In fact, I pay quite a bit more than I would have paid in gasoline tax for a similar size vehicle, but I save more than that every month by not buying gas. The best and most fair would be a tax for all vehicles regardless of the fuel and based on miles × weight, and drop the gas tax.

We all live in the same…

Permalink

We all live in the same place and we all pay for infrastructure upkeep. Stop whining.

This just proves how out of…

Permalink

This just proves how out of touch liberals are with the real world. Just because you virtue signal doesn't mean you get a pass on paying taxes. Afterall your EV uses the same roads, bridges and tunnels as ICE cars do.