Just when prospective EV buyers thought they had until the New Year to lock in the deal of the year, Tesla pulled the rug out. On December 18, days earlier than anticipated, the automaker abruptly ended its highly publicized $299/month lease offer for the Model 3 Rear-Wheel Drive.

This wasn't just a minor website update; it was a significant signal during the critical holiday shopping window. The attractive lease had served as a massive demand lever, moving inventory aggressively throughout Q4. By yanking it early, Tesla is sending a clear message to the market: the era of rock-bottom pricing to fuel endless volume growth is ending, and sticker shock for the incoming 2026 models is likely just around the corner.

This surprise move forces us to look deeper at the current state of the EV market, Tesla’s recent performance, and what this strategic pivot means for the company’s future.

Caption: Tesla surprised many by ending its attractive $299/month Model 3 lease deal just days before Christmas.

The Broader EV Price Rollercoaster

To understand Tesla's move, we must contextualize it within general electric vehicle price trends. For the past two years, the narrative has been dominated by a brutal price war, largely instigated by Tesla itself. In an effort to protect market share and suffocate emerging competition, Tesla slashed prices repeatedly throughout 2023 and early 2024. The rest of the industry—from Ford to startup Rivian—was forced to follow suit, often at the expense of profitability.

However, the music is slowing down. While average EV transaction prices are lower than they were at their 2022 peak, experts note they have begun to stabilize. The industry is realizing that price cuts alone cannot sustain demand indefinitely, especially as early adopter pools dry up and high interest rates make financing more expensive for mainstream buyers.

We are now seeing a correction. Manufacturers are trying to recoup margins. The vanishing of the $299 lease is the canary in the coal mine indicating that the industry, led again by Tesla, is attempting to reset pricing expectations upward before the 2026 model year vehicles arrive. Some analysts are already predicting that lease prices for the Model 3 could jump by nearly 67% to around $499 per month.

Tesla’s Recent Sales Performance Report Card

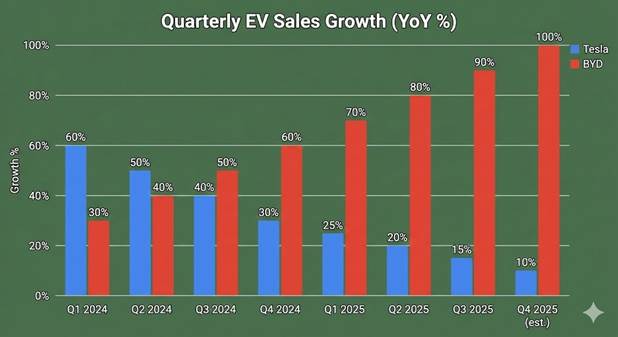

Why pull a demand lever if sales are booming? The reality of Tesla's recent performance is nuanced. They are no longer seeing the exponential, 50% year-over-year growth that investors once took for granted.

In recent quarters, Tesla’s growth has matured and slowed. While the refreshed "Highland" Model 3 brought renewed interest to the sedan, the Model Y remains the undisputed heavyweight champion, carrying the bulk of the company's volume globally. However, projections for late 2025 suggest a bleak sales picture, with Q4 numbers potentially down significantly compared to the previous quarter.

Tesla is facing unprecedented competition, particularly in China from juggernauts like BYD, which offer compelling alternatives often at lower price points with better interior appointments. In the US and Europe, legacy automakers are finally producing competent, desirable EVs. Tesla is still the market leader, but their slice of the pie is naturally shrinking as the pie itself gets larger. The abrupt end of the lease deal suggests Tesla may have hit its internal delivery targets for Q4 early and is now shifting focus toward margin preservation rather than pushing every last unit out the door at a discount.

Caption: While still dominant, Tesla's explosive growth has moderated in the face of intense global competition.

Short-Term Pain vs. Long-Term Gain: The Lease Gamble

Will discontinuing such an attractive leasing plan hurt or help Tesla long term? It’s a high-stakes gamble with arguments on both sides.

In the short term, it definitely hurts. It alienates fence-sitters who were planning on pulling the trigger during the final holiday week. It also reinforces a narrative of chaotic management, where prices and deals fluctuate wildly without warning.

However, long term, this might be necessary medicine. The relentless price cuts over the last two years decimated the resale value of existing Teslas, angering a loyal customer base. By raising the floor on the entry price, Tesla helps stabilize used car values.

Furthermore, relying too heavily on cheap leases to move metal can tarnish a "premium" brand image. Ending the deal signals confidence in the product’s inherent value. It’s a pivot from a "growth at all costs" mentality to a more mature strategy focused on sustainable margins. If they can maintain decent volume without fire-sale tactics, their financials will look much healthier in 2026.

Fixing the Image Problem and Wooing Buyers Back

If prices are indeed heading up for the 2026 models, Tesla cannot rely solely on its charging network and acceleration stats to win buyers. The company faces a significant image problem that needs addressing.

First, the polarization surrounding CEO Elon Musk’s public persona is a tangible headwind. Surveys and studies have shown that his increasingly political and controversial stance is deterring a segment of the traditional liberal/environmentalist EV buyer demographic. Research indicates that this "brand damage" is real, with some liberal buyers turning away from the brand entirely.

Second, Tesla must close the gap on perceived quality and service. While drivetrain reliability is generally excellent, complaints about fit and finish, squeaks, and rattles persist. Furthermore, the service center experience is often described as impersonal and overwhelmed compared to traditional luxury dealerships like Lexus or Mercedes.

Finally, Tesla needs to manage expectations regarding "Full Self-Driving" (FSD). Years of undelivered promises about imminent robotaxis have created skepticism. Focusing marketing on the currently excellent assisted driving features, rather than future autonomy dreams, would rebuild trust. To justify higher prices in 2026, Tesla needs to offer an undeniable premium ownership experience, not just a fast car with a great app.

Wrapping Up

The abrupt end of the $299 Model 3 lease is more than just a Grinch-like holiday maneuver; it's a strategic inflection point. It signals the end of the aggressive price-war phase of the EV transition and the beginning of a more mature, margin-focused era. While it may cause short-term sales friction, it is a necessary step to protect brand value. However, if Tesla intends to command higher prices in 2026, they must address their lingering brand reputation and service issues to convince increasingly savvy buyers that the premium is worth it.