Yes, the market by every definition is uncertain by its very nature. That’s the most basic message here. That is the risk. However, not every investor handles the uncertainty arena in the same manner.

First, things first, though. You must accept the fact that the market, regardless of sector, is an arena for uncertainty. If it wasn’t, there would be no need for markets to make constant reassignments of value.

It is the uncertainty aspect, though, that drives many in the industry to avoid or work at seeking certainty in other forms. Some strive for insider information. Others glean reports and research from various gurus in an attempt to get that edge over uncertainty.

If it wasn’t for the uncertain aspects of the market, though, there would be no opportunity for speculative profit in markets. In other words, there would be no reason to buy and hold an asset based on your expectation that it will increase in value.

Market Risk

I hate the statement that you must learn to manage risk. How, pray tell, do you do that? In my book, “Awaken Your Speculator Mind” I spent a considerable amount of pages addressing that very issue.

Fact is, I have found that it is arrogant to assume you can manage risk. It gives you this false sense of control, as if you can control almost anything. Market risk never changes despite your best efforts. This is no different than driving. Think about it: The risks on the road are uncontrollable. That is why you wear seat belts, buy cars with ABS brakes and drive defensively.

And despite what some may say this is a play on words, truth is, words make a difference once you come to terms with them. So, here it goes.

You cannot manage risk. There, I wrote it for all to see and ponder. Read it again - You cannot manage risk! You can, however, manage yourself and your money relative to all that is risky. That is the best you can do, believe it or not.

Wait, you might think. How is that different? As a trader for many years, I dare say it is different. And only those who come to terms with markets in that manner have a wake of a chance.

Don’t just take my words for it, read the books, “Market Wizards I & II" by Jack Schwager. They are a collection of interviews with famous and many unknown but wealthy traders. In just about every interview, the trader blew up in the beginning, and did not succeed until he or she came to terms with the true nature of the market; then learned to manage themselves, their emotions, relative to that market. Each, by the way, has a healthy and deep respect for the power of the markets.

Uncertainty and Price Dynamics

The existence of the continuous movement of price literally defines the existence of market uncertainty, as it is an expression of best guesses about an extremely uncertain future compared to other investors’ measure of value.

In case you hadn’t realized it, that is how you profit in markets. You either guess or evaluate better than the next guy about future events, or you get lucky and your position soars in value based on an event that wasn't even within the realm of your best set of guesses. As the saying goes, better to be lucky than wrong. Unfortunately, many lose in the market arena,

That is why this trader uses technical analysis. It helps me define direction, momentum and conviction of price moves. In this sense, I do not care what the stock is; I only care that I can define its trend bias; and, even there, I have no way of knowing for certain how long a price move in a given direction might last.

Sure, I can project. I can look at the chart and see where buyers came in before and where they last sold off. That defines price support and resistance; and that defines the analysis of price dynamics.

Furthermore, I can use Fibonacci projections of a band defines by a swing high and swing low to define potential targets for the next high or low. Is there ever a guarantee? No. There is only a measure of probability, which takes me to the next point

Always Think in Terms of Probability

I often like to look at scenarios. For example, the auto sector has been down for most of 2011. Read my previous article, Auto Sector Stocks: a look forward into 2012 and Auto Sector Stocks: investor resolution ideas for 2012. Of course, it could continue lower in 2012.

However, in terms of probability, all market moves get old. So applying an actuary mentality to the situation, time becomes what legendary trader, W.D. Gann, once wrote as, “more important than price.” In that case, a bear trend can indeed get old; likewise for a bullish trend. When no more sellers come in, that’s when the buyers have the opportunity to buy and drive up prices.

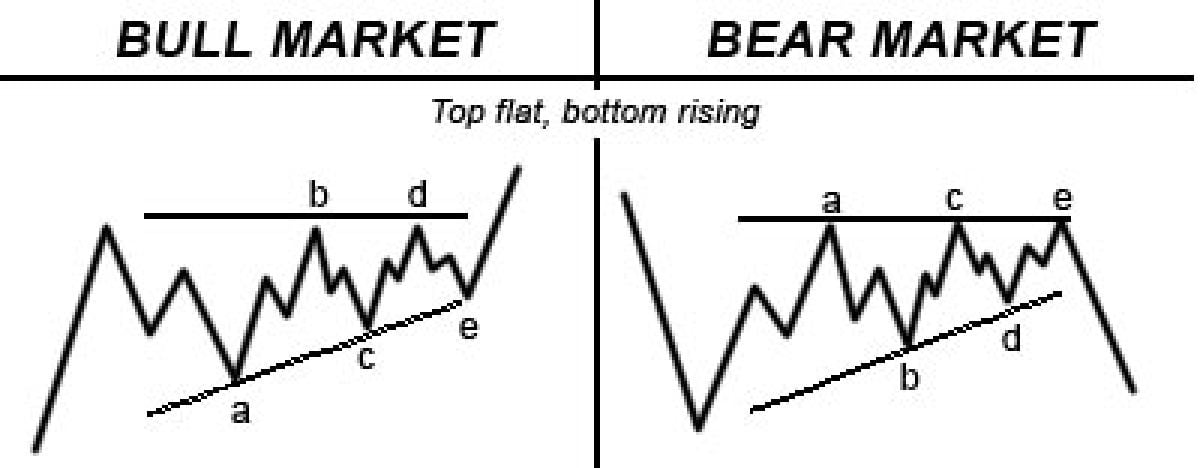

That is why pattern recognition is so important to techncial traders. Price patterns do indeed repeat themselves; albeit, there is never any guarantee that the next move wil be exactly the same. Some, however, have repeatable rates of 70%, 80% and 90%. How's that for thinking in terms of probability?

Then there is that ultimate form of uncertainty, the black swan event. Named after the book, "Black Swan” by Nassim Taleb, it relates how the scientific community in all their pontificating wisdom and arrogance firmly believed that all swans were white. Then came a visit to Australia. Need I say more? Yes, Virginia, black swans do exist!

Point is, there are events that just cannot be seen or even projected. At best you can accept their existence and perhaps look for telltale signs, if there are any.

In the case of markets, that is why the industry created options; those derivatives that most brokers and advisors say are evil. They are there for a reason: to manage your investment positions relative to all risks, both seen and unseen.

So, what does that tell you? If you want to manage yourself to all that is risky, do not simply depend on diversification. That didn’t work so well in 2008, did it? Those who hedged their positions with put options, though, protected themselves and their financial condition.

If you want to learn more, then educate yourself about options. Visit the options exchange website for free education webinars and articles. CBOE Learn Center I have used this resource in the past; and it is the one thing that has helped me most in these uncertain market environments.

Best wishes for success in 2012!

-----------------------

Full Disclosure: At time of publication, Sherosky, creator of the auto sector charts for TN, is neither long or short with the mentioned stocks or futures, except a call option on Ford, though positions can change at any time. None of the information in this article constitutes a recommendation, but an assessment or opinion.

-----------------------

About the Reporter: After 39 years in the auto industry as a design engineer, Frank Sherosky now trades stocks, futures and writes articles, books and ebooks like, "Perfecting Corporate Character," "Awaken Your Speculator Mind", and "Millennial World Order" via authorfrank.com. He may be contacted here by email: FrankS@TorqueNews.com and followed in Twitter under @Authorfranks

________________________________________________

Additional Reading:

More intrigue behind scenes of Chinese quotas of rare earths

Chevy Volt vs Cruze cost comparison not appreciated by some Volt owners

Toyota stock shows blah reaction to Moody's downgrade of TMMC

GM and J.D. Power attempt to understand the why behind Chevy Cruze sales

GM CEO Akerson dismisses price factor with building 60,000 Chevy Volts in 2012

Auto Sector Stocks: investor resolution ideas for 2012

G-Oil sponsors TriStar Motorsports Toyota Camry team for 2012 NASCAR Nationwide Series

Corporate culture as important as innovation per Booz & Company