Cox Automotive has just reported its monthly average transaction prices by vehicle type and brand. The best news in the report is that the cost of the vehicle type that the most shoppers buy declined for the month. Compact Crossover average prices dropped slightly, despite tariffs and inflation. The average transaction cost to consumers of vehicles like the Toyota RAV4, Honda CR-V, Subaru Forester, Mazda CX-5, and Nissan Rogue was $36,414 in January. Included in the Cox Automotive monthly summary was this statement:

“The popular compact SUV segment is a reminder that many excellent vehicles are available at more than 25% below the industry average.”

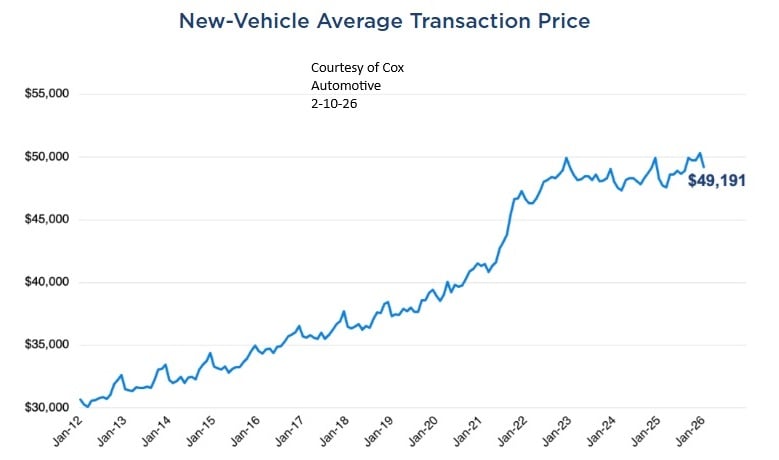

A glance at the average transaction price by year graph in the report also shows that ATPs are presently lower than in 2023.

Overall, the average transaction price of all vehicle types combined is continuing to remain at levels seen three years ago. There is no evidence that any changes in the average consumer cost are due to tariffs or even inflation. You can clearly see on the ATP chart that ATPs were higher years before the current round of tariffs was introduced. The reason ATP isn't declining rapidly is that large pickup trucks remain popular, and their prices continue to rise. The report points out that “...full-size pickup trucks…had among the lowest incentive levels.” In other words, the heavy discounting to move full-size trucks has been more moderate as of late. Still, pickups are rising in cost by only about a third of the U.S. inflation rate. They rose about 1.3% year over year to $66,102.

Looking over the list of manufacturers’ ATPs, it’s clear that many brands are experiencing overall declines in average prices. We counted 11 brands with lower ATPs this January than in 2025. Acura stands out, with a big drop of 5%. Cadillac and Tesla reported 3% and 2% year-over-year declines in average prices, respectively. It’s not just luxury brands with dropping average prices. Kia, GMC, and Dodge all saw price declines. It should be noted that product line changes can account for manufacturer price changes. It’s not only individual price cuts that cause this. For example, if an inexpensive model like Acura’s ADX is added to the lineup, it lowers the brand's average price. Tesla also added a new trim with a lower cost recently. And its pricey Cybertruck is a complete flop and barely sells.

Most other "news" outlets will try to torture the data until it tells you that prices are rising, and those suffering from TDS may even pretend that tariffs played a role. Now you know the truth. Tell us in the comments below if you were surprised that the most popular type of vehicle purchased in America dropped in price.

You can read the (outstanding) report by Cox Automotive at this link. We find this report to be invaluable in our reporting.

John Goreham is the Vice President of the New England Motor Press Association and an expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. He is a member of the Society of Automotive Engineers (SAE int). In addition to his fourteen years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can connect with John on LinkedIn and follow his work on his personal X channel or on our X channel. John employs grammar and punctuation software when proofreading, and he sometimes uses image generation tools.

Set as google preferred source