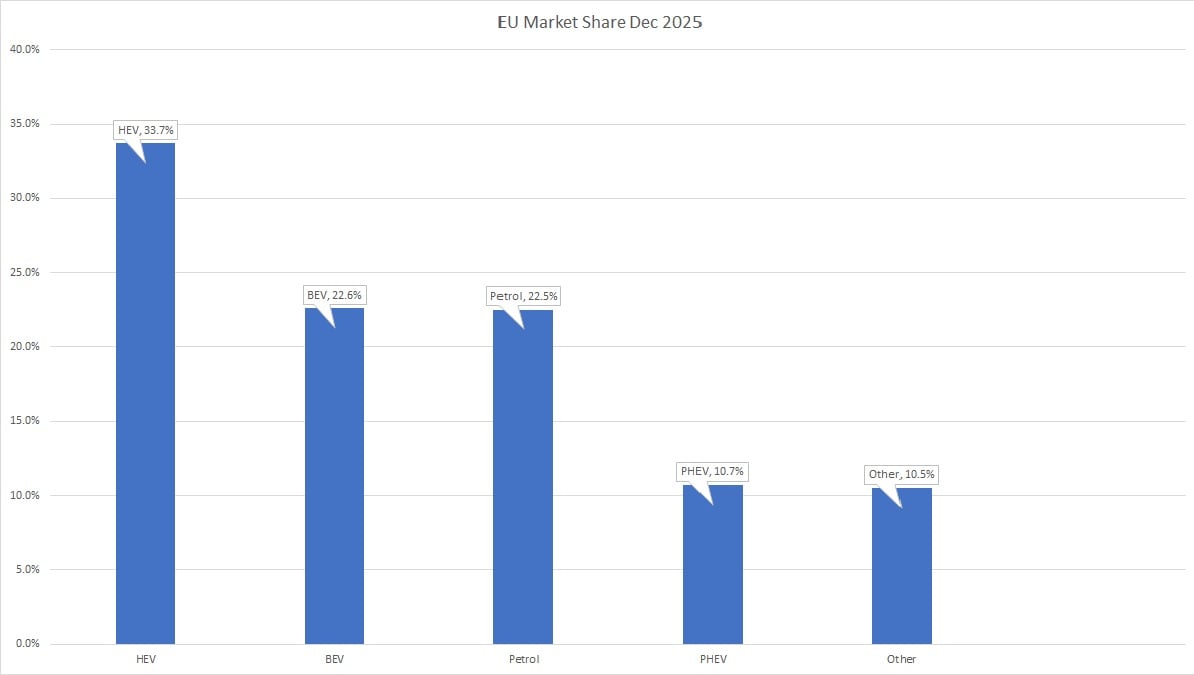

It is clear that consumer demand for electric vehicles is growing worldwide. Data from the European Automobile Manufacturers' Association (ACEA) shows that EV sales exceeded that of gas-only vehicles for the first time in December 2025. Although, it has a bit to do with how vehicles are categorized, the trend is undeniable. ACEA segments vehicles into five categories: plug-in hybrids (PHEV), hybrid electric (HEV), battery electric (BEV), gas-powered, and other. Their data shows, that for the first time, BEV sales exceeded gas-powered. This surprise result lit up social media with posts like this on the r/electricvehicles subreddit where Tesla Model 3 owner AMLRoss posted:

“Really nice to see. The ICE age is over.”

Original_Sedawk posted a word of caution regarding how the vehicles are counted:

“Hybrids. They are petrol cars and it really skews this assessment.

If you are going to say ‘Fully Electric,’ then you must say ‘Gas Only’.”

Luckysed gave an update from France and a prediction:

“Once prices go down, many people will switch. Here in France when they offered great incentives for low-income families, they basically sold out in 24 hours. Petrol is just a pain for so many reasons, and word of mouth is doing a great job at converting. Good for climate, lower noise all around, reliability and cleaner air. I can’t wait to switch.”

EVs Pass a Major Milestone in Europe

Consumer demand for electric vehicles continues to build across Europe. New data from the European Automobile Manufacturers’ Association shows that, for the first time, battery electric vehicles outsold gas only cars in December 2025. How vehicles are categorized plays a role in the headline, but the underlying trend is clear. Fully electric cars are gaining ground quickly, and gas-powered cars are losing relevance faster than many expected.

ACEA breaks the market into battery electric vehicles, plug in hybrids, regular hybrids, gas powered cars, and other categories. In December 2025, registrations of battery electric vehicles reached 217,898, up 51% year over year. Gas only car registrations fell to 216,492, down 19% from the previous December. Hybrids remain the single largest segment, which has led to debate online about how the results should be framed, but few dispute the direction of travel.

This milestone sparked lively social media chatter. Some EV owners celebrated the moment as symbolic of the end of the internal combustion era. Others urged caution, pointing out that hybrids still rely on petrol and can blur comparisons. Drivers from countries like France shared firsthand experiences, noting that incentives, rising fuel costs, and word of mouth are pushing more buyers toward electric options.

Looking at the full year, battery electric vehicles captured 17.4% of the EU market in 2025, up from 13.6% the year before. Nearly 1.88 million new battery electric cars were registered, with Germany, the Netherlands, Belgium, and France accounting for 62% of that total. ACEA described the result as encouraging, while noting there is still room for growth to stay aligned with long term transition goals.

Petrol (European for gas) car registrations fell 18.7% across 2025, with sharp drops in every major market. France saw a 32% decline, followed by Germany, Italy, and Spain. Diesel performed even worse, falling 24.2% and shrinking to just 8.9% of the market. These trends help explain why some gas stations in Europe and the UK are already planning to phase out diesel sales by the end of the decade.

Hybrids remain the most popular choice overall, accounting for 34.5% of European sales in 2025. At the same time, vehicles that can be charged from the grid are growing faster than any other segment. Battery electric vehicle sales jumped 51% in December, while plug in hybrids rose 36.7%, showing where future momentum is building.

The EU recently adjusted its clean car strategy, moving from a full ban on new combustion engine sales to a requirement for a 90% reduction in carbon dioxide emissions by 2035. The remaining emissions could be offset through low carbon materials or alternative fuels. Automakers have pushed back repeatedly, arguing that competition from Chinese brands and global trade pressures make aggressive targets harder to meet.

Volkswagen continued to hold the largest EU market share, followed by Stellantis, Renault, Hyundai, Toyota, and BMW. Tesla saw its share fall sharply in 2025, while Chinese manufacturer BYD tripled its EU market share and reported sales growth of 228% for the year. Lower prices and aggressive expansion from Chinese brands are reshaping the competitive landscape.

Europe offers one of the widest selections of electric vehicles outside Asia, ranging from compact city cars to large family SUVs. Legacy automakers now sell electric versions of nearly every model line, while prices have come down as smaller and more affordable EVs enter the market. Combined with fuel costs, cleaner air, lower noise, and improving charging infrastructure, the value proposition is becoming harder to ignore.

Bottom Line

December 2025 marked a symbolic turning point for Europe’s car market, even if hybrids still dominate overall sales. Gas and diesel cars are clearly in retreat, while fully electric vehicles continue to gain share at a rapid pace. Policy shifts may soften timelines, but consumer behavior tells a clearer story. Electrification in Europe is no longer a future scenario, it is already well underway.

The Tesla Model Y

The Tesla Model Y is a compact electric SUV that was launched in 2020 and has quickly become one of the most popular cars in the world thanks to its mix of range, performance, and everyday practicality. It offers very top-notch acceleration, competitive real-world efficiency, a spacious interior with a large cargo area. It also has access to Tesla’s well developed Supercharger network, which remains a major advantage for long distance driving in Europe. What sets it apart from many other EVs is how well it balances price, space, software, and charging convenience in a single package, rather than excelling in just one area. In most European markets, the Model Y costs roughly the equivalent of $45,000 to $60,000 depending on configuration and incentives, placing it squarely in the heart of the family car market. It is sold as a five-seat crossover SUV, with a higher seating position and flexible cargo layout that appeals to families and company car buyers alike. Those traits, combined with strong brand recognition, frequent updates, and wide availability across Europe, help explain why the Model Y has consistently ranked as a best-selling vehicle in the region.

What Do You Think?

Are hybrids a sensible long term solution or just delaying the inevitable?

How soon do you expect gas and diesel sales to fall below ten percent?

Chris Johnston is the author of SAE’s comprehensive book on electric vehicles, "The Arrival of The Electric Car." His coverage on Torque News focuses on electric vehicles. Chris has decades of product management experience in telematics, mobile computing, and wireless communications. Chris has a B.S. in electrical engineering from Purdue University and an MBA. He lives in Seattle. When not working, Chris enjoys restoring classic wooden boats, open water swimming, cycling and flying (as a private pilot). You can connect with Chris on LinkedIn and follow his work on X at ChrisJohnstonEV.

Photo credit: Provided by author