The automotive world has officially witnessed the passing of the torch. As we settle into 2026, the data from the past year confirms what many analysts predicted but few die-hard fans wanted to believe: BYD has comprehensively dethroned Tesla as the world’s leading manufacturer of battery-electric vehicles (BEVs).

For the second consecutive year, Tesla’s sales have declined, a stark contrast to the meteoric rise the company enjoyed in the early 2020s. Meanwhile, China’s BYD has surged ahead, capitalizing on a vertically integrated supply chain and a hunger for global expansion that Tesla has struggled to match.

Why Tesla Continues to Decline

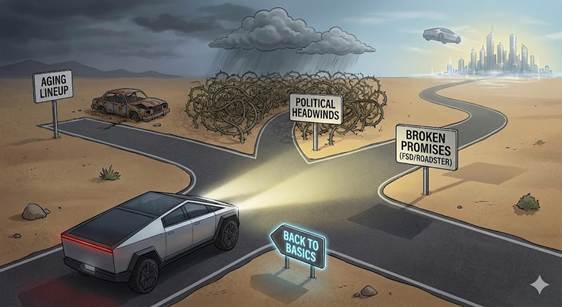

The reasons for Tesla’s slump are multifaceted, creating a "perfect storm" that battered the Texas-based automaker throughout 2025.

First and foremost is the aging product lineup. The Model 3 and Model Y have been the workhorses of the EV revolution, but they are no longer the fresh faces they once were. In an industry that thrives on novelty, Tesla’s reluctance to refresh its core lineup significantly or introduce a true mass-market "Model 2" left the door open for competitors.

Second, political headwinds have played a undeniable role. Elon Musk’s increasingly polarizing political activities and his advisory role in the Trump administration alienated a significant portion of Tesla’s core liberal demographic. This "reputational damage" was compounded by the administration’s removal of the $7,500 federal EV tax credit in late 2025, which decimated domestic demand in Q4.

The BYD Eclipse: How They Did It

While Tesla stumbled, BYD sprinted. The Chinese giant didn't just win on volume; they won on strategy. BYD’s vertical integration—owning everything from the lithium mines to the battery manufacturing (Blade Battery) to the chip production—allowed them to slash costs aggressively.

In 2025, BYD exported over 1 million vehicles, a staggering 150% increase year-over-year. They successfully penetrated markets in Europe, Southeast Asia, and South America with affordable, high-tech EVs like the Dolphin, Atto 3, and Seal. Unlike Tesla, which relies heavily on two models, BYD offers a vehicle for every price point, flooding the market with options that Western rivals simply couldn't compete with on price.

Sales Breakdown: Winners and Losers

The Survivors: Model 3 and Model Y Despite the slump, the Model 3 and Model Y remain Tesla’s lifeline, accounting for the vast majority of their ~1.64 million deliveries in 2025. However, even these stalwarts saw declining numbers as buyers defected to fresher alternatives from BYD, Hyundai, and even legacy automakers like BMW.

The Flop: Cybertruck The Cybertruck was supposed to be Tesla’s halo product, a brutalist statement of intent. Instead, it has become a niche curiosity. Sales data from 2025 reveals a grim picture: the polarizing truck sold only ~16,000 units in the first nine months of the year, averaging just 59 sales a day. With a price tag that remains high and a design that limits its mass appeal, the Cybertruck has failed to arrest Tesla’s slide.

Is Tesla at Risk of Going Under?

Despite the gloomy sales figures, is Tesla at risk of bankruptcy? Unlikely in the near term.

Tesla remains a financially robust company, largely due to its pivot toward energy storage and the continued—albeit baffling—strength of its stock, which rose ~11% in 2025. Investors seem willing to overlook poor car sales, betting instead on Musk’s promises of AI, Optimus robots, and the Cybercab.

However, the risk lies in identity. Tesla is transitioning from a dominant mass-market automaker into a niche tech holding company. If the "Robotaxi" gamble fails to pay off by 2027, the valuation bubble could burst, forcing a painful restructuring.

Broken Promises: Autonomous Driving and The Ghost of the Roadster

Tesla’s decline is also a story of missed deadlines and regulatory battles.

FSD Struggles The "Full Self-Driving" (FSD) dream faced a harsh reality check in 2025. NHTSA launched fresh investigations into the system after reports of vehicles running red lights and crashing in low-visibility conditions. Furthermore, the European rollout of FSD remains stalled by strict UNECE regulations, locking Tesla out of lucrative software revenue in a key market.

The Roadster Delay Perhaps nothing symbolizes Tesla’s distraction better than the next-gen Roadster. Originally unveiled in 2017 for a 2020 release, the "flying" sports car has been delayed yet again. Musk now claims a demo will happen on April 1, 2026, with production pushed to 2027 or 2028. For many deposit holders, the Roadster has become a vaporware myth.

What Tesla Needs to Do to Reverse the Decline

To regain its footing, Tesla must return to basics:

- Launch the $25k Car: The "Model 2" cannot be a Robotaxi; it needs to be a steering-wheel-equipped car that people can buy now.

- Decouple from Politics: The brand needs to depoliticize to win back the center-left buyers who drove its initial success.

- Refresh the Lineup: A true redesign of the Model Y and Model 3 is overdue, not just minor "Highland" or "Juniper" facelifts.

Wrapping Up

As we look at the automotive landscape of 2026, the era of unquestioned Tesla dominance is over. BYD has proven that a diversified, affordable lineup backed by manufacturing might is the winning formula for the global EV market. While Tesla pivots to a future of robots and AI, they are losing the war for the driveway today. Unless they can refocus on building cars that people want and can afford, the gap between the two giants will only widen.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.

Set Torque News as Preferred Source on Google