The automotive industry is nothing if not a game of timing, and Nissan has just played a card that feels both overdue and surprisingly familiar. With the unveiling of the 2026 Nissan Rogue PHEV, the automaker finally enters the plug-in hybrid battleground in the United States, a segment that has been dominated by Toyota and, ironically, Nissan’s own alliance partner, Mitsubishi. As we stare down the barrel of 2026, a year pivotal for electric mandates and consumer adoption, the question isn't just whether the Rogue PHEV is a good car—it’s whether it’s enough to save Nissan from its current financial and identity crisis.

The 2026 Rogue PHEV: What We Know

Let’s get the specifications on the table. The 2026 Rogue PHEV is not a ground-up Nissan engineering marvel. It is, by nearly every mechanical metric, a Mitsubishi Outlander PHEV wearing a Nissan mask. It features a 20-kWh lithium-ion battery paired with a 2.4-liter gasoline engine and dual electric motors, producing a combined 248 horsepower and 332 lb-ft of torque.

Nissan claims an all-electric range of 38 miles and a total range of roughly 420 miles. While these numbers are respectable, they come with caveats. Unlike its Mitsubishi twin, the Rogue PHEV reportedly drops the CHAdeMO DC fast-charging port, limiting owners to Level 1 or Level 2 AC charging—a full recharge on Level 2 will take about 7.5 hours. It’s a vehicle designed for the suburban driveway, not the interstate fast-charger.

Stiff Competition: Rogue vs. The Pack

How does this stack up? If you look at the 2026 Toyota RAV4 Prime, the Rogue is fighting an uphill battle. The RAV4 Prime has long been the segment king, boasting 302 horsepower and an electric range that consistently tops 40 miles in real-world testing. Toyota’s offering is faster, tows more (2,500+ lbs vs. the Rogue’s expected 1,500 lbs), and carries the bulletproof reliability reputation of the Toyota hybrid synergy drive.

Then there is the internal fratricide. The Mitsubishi Outlander PHEV offers the exact same powertrain but sweetened with a significantly better warranty (10-year/100,000-mile powertrain vs. Nissan’s standard 5-year/60,000-mile) and the aforementioned DC fast-charging capability. Unless Nissan aggressively undercuts Mitsubishi on price—which is difficult given the thin margins on PHEVs—the Rogue exists in a strange limbo where the "best version" of the car is sold at a different dealership.

PHEVs vs. BEVs: The Battle for the Driveway

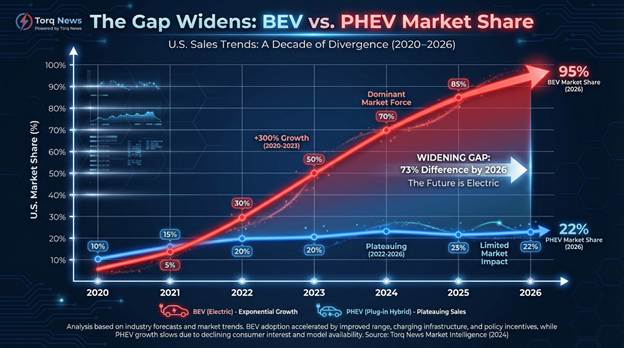

The arrival of this vehicle in 2026 highlights a fascinating friction in the market. How are PHEVs actually doing? Despite the loud narrative that "EV demand is cooling," pure Battery Electric Vehicles (BEVs) continue to outsell PHEVs by a significant margin in the U.S., capturing roughly 10% of the market compared to the PHEV’s <2% share as of late 2025.

However, the PHEV has proven resilient. It appeals to the "one-car solution" demographic—buyers who want to commute on electrons but refuse to plan their road trips around charging nodes. Yet, recent data from the International Council on Clean Transportation (ICCT) suggests that real-world PHEV efficiency is often overstated because owners simply don't plug them in enough, burning gas to haul heavy, empty batteries.

The “Bridge” Theory: When Will PHEVs Die?

For years, executives called PHEVs a "bridge technology." The 2026 Rogue is a plank in that bridge. But how long is the bridge? The consensus among analysts is that the window is closing faster than anticipated.

The obsolescence of the PHEV will likely arrive between 2028 and 2030. Why? Cost and Complexity. A PHEV is mechanically the most complex vehicle you can buy; it needs a complete internal combustion cooling, fueling, and exhaust system plus a high-voltage battery, motor, and inverter system. As battery pack prices continue to plummet—dropping below $100/kWh—it becomes cheaper for manufacturers to build a 300-mile pure EV than a 40-mile PHEV. Once a BEV like the Chevrolet Equinox EV or Tesla Model Y reaches price parity with a gas Rogue, the value proposition of the "bridge" collapses. The Rogue PHEV is likely the last generation of this technology we will see before it becomes a niche product for rural applications.

Nissan’s State of Affairs: A Strategic Pivot or a Stopgap?

We must address the elephant in the room: Nissan’s financial health. The company reported a net loss of over 220 billion yen in the first half of FY2025, driven by slumping sales in China and the U.S. The "Re:Nissan" recovery plan is in full swing, but the company is bleeding.

In this light, the Rogue PHEV is a survival tactic, not an innovation. By rebadging the Mitsubishi Outlander, Nissan saved billions in R&D and years of development time. They needed a plug-in product on dealer lots yesterday to meet emissions compliance and stem the exodus of customers to Toyota and Hyundai.

Will it help? In the short term, yes. The Rogue is Nissan’s best-selling product. Giving loyal customers a plug-in option keeps them in the family. Will it hurt? In the long term, potentially. It dilutes the brand’s engineering reputation. Nissan was once a pioneer with the LEAF; now, they are borrowing homework from Mitsubishi to pass the test. If the Rogue PHEV suffers from the same complexity demons that haunt other PHEVs, it could damage the trust Nissan is desperately trying to rebuild.

Comparison to 2026 Pure EVs

If you are walking into a dealership in 2026 with $45,000 to spend, you have choices. You could buy the Rogue PHEV, or you could drive home in a refreshed 2026 Tesla Model Y or the 2026 Hyundai Ioniq 5.

The 2026 EVs offer:

- Lower Maintenance: No oil changes, spark plugs, or transmission fluid.

- Better Tech: Native EV platforms offer flat floors and more interior volume (frunks!) than the compromised layout of a PHEV conversion.

- Performance: The instant torque of a dual-motor EV generally smokes the complex handoff of a PHEV powertrain.

The Rogue PHEV’s only trump card against these 2026 EVs is the gas tank. For the apartment dweller with street parking or the rural driver 50 miles from a DC fast charger, the Rogue wins. For everyone else, the pure EVs offer a superior ownership experience and better residual value retention as the market pivots fully electric.

Wrapping Up

The 2026 Nissan Rogue PHEV is a competent, comfortable, and crucial vehicle for Nissan. It is a necessary bandage to stop the bleeding of market share. However, it is not the future. It is a borrowed solution for a transitional moment that is rapidly ending. If you are a die-hard Nissan fan who isn't ready to cut the cord, this is the car you’ve been waiting for. For the rest of the market, it might just be a nice Mitsubishi with a different grille.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.

Set Torque News as Preferred Source on Google