General Motors, a titan of American industry, recently made a strategic decision that has sent ripples through the automotive world: reportedly halting its $300 million investment in electric motor production while simultaneously pouring $888 million into developing a new generation of V8 gasoline engines. This pivot, if true, marks a significant re-evaluation of GM's future trajectory, raising critical questions about its commitment to electrification and its competitive standing in a rapidly evolving global market.

The Apparent U-Turn: From EV Ambition to ICE Reinforcement

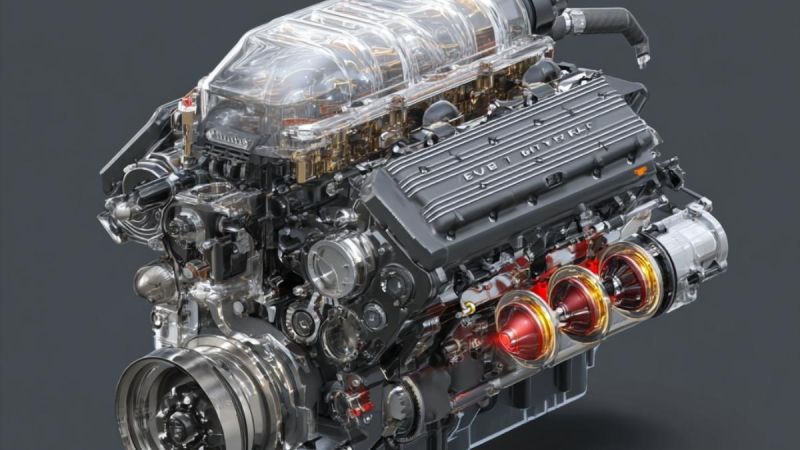

For years, GM had been vocal about its "all-electric future," with CEO Mary Barra frequently touting ambitious EV production targets and significant investments in battery technology and electric vehicle platforms like Ultium. The reported $300 million allocated for electric motor production was a tangible sign of this commitment, aimed at bringing key EV component manufacturing in-house. The sudden shift away from this, coupled with a nearly billion-dollar bet on internal combustion engine (ICE) technology, suggests a pragmatic, perhaps even defensive, response to current market realities. The $888 million investment in V8 engines is likely aimed at bolstering its highly profitable truck and SUV segments, which remain overwhelmingly powered by gasoline engines and are crucial for GM's immediate financial health. [Source: AutoNews.com/GM-Strategy-Shift]

See the video explanation of GM's Pivot on Torque News' Youtube Channel.

Context: GM's Recent Financial Performance

GM's financial performance has been a mixed bag. While the company has posted strong profits, largely driven by robust sales of high-margin trucks and SUVs in North America, its EV division has faced headwinds. Production ramp-ups for models like the Hummer EV and Cadillac Lyriq have been slower than anticipated, and the market for EVs, while growing, has shown signs of cooling in some segments, particularly with higher interest rates impacting affordability. Traditional ICE vehicles, especially large trucks and SUVs, continue to be cash cows, subsidizing the costly transition to EVs. This reliance on ICE profits likely influenced the decision to double down on a proven revenue stream.

Short-Term Gains vs. Long-Term Vision

In the short term, this strategic pivot could certainly benefit GM. By focusing on V8 engines, GM can capitalize on strong current demand for its gasoline-powered trucks and SUVs, which command higher transaction prices and profit margins. This could provide a much-needed boost to immediate revenues and profitability, pleasing shareholders who prioritize current returns. It also allows GM to defer some of the massive capital expenditures associated with a full-scale EV transition, giving it more breathing room.

However, the long-term implications are far more precarious. The global automotive industry is undeniably moving towards electrification, driven by increasingly stringent emissions regulations, evolving consumer preferences, and the urgent need to address climate change. Major markets like Europe and China are aggressively pushing EV adoption, and even in the U.S., while the pace might vary, the direction is clear. By de-emphasizing in-house EV motor production and heavily investing in V8s, GM risks falling further behind competitors who are fully committed to the EV race. This could lead to a loss of market share in future, high-growth segments and potentially alienate environmentally conscious consumers.

Competitive Positioning: US and Global

This move undeniably impacts GM's competitive positioning. In the U.S., Ford, while also navigating the ICE-to-EV transition, has maintained a strong public commitment to its EV plans, investing heavily in new battery plants and EV production lines. Tesla, of course, remains the dominant force in the pure-EV space, constantly innovating and expanding. Internationally, Chinese automakers are rapidly advancing their EV technology and market penetration, while European manufacturers are also making significant strides.

GM's V8 investment could be seen as a concession to its legacy business, potentially signaling a lack of confidence in its own EV ramp-up. This could make it harder for GM to compete effectively in markets where EV adoption is accelerating, and could damage its brand image as a forward-thinking innovator. While its truck and SUV dominance might hold for a few more years, relying too heavily on a declining technology could leave GM vulnerable as the global automotive landscape shifts dramatically.

The "Better Path" Debate

Could GM have chosen a different, more beneficial path? A more balanced approach, perhaps. Instead of seemingly abandoning its in-house EV motor plans, GM could have maintained that investment while strategically deploying the V8 funds. This would have allowed it to continue capitalizing on profitable ICE sales in the short term, while simultaneously accelerating its long-term EV capabilities. Investing in more diverse EV offerings, particularly more affordable models, could also have broadened its appeal and captured a larger segment of the nascent EV market. Furthermore, aggressive investment in charging infrastructure or innovative battery technologies could have differentiated GM and cemented its leadership in the EV space. The current strategy risks GM becoming a follower rather than a leader in the electric future.

Wrapping Up

GM's reported decision to pivot from EV motor production to V8 engine investment is a high-stakes gamble. While it may offer a short-term financial reprieve by shoring up its highly profitable truck and SUV segments, it raises serious questions about GM's long-term competitive viability. In a world rapidly accelerating towards electrification, this move could leave GM playing catch-up, potentially sacrificing future market share and innovation leadership for immediate gains. The true test will be whether this strategic detour allows GM to build a stronger foundation for its electric future, or if it merely delays the inevitable challenges of a transforming industry.

Disclosure: Image created with Midjourney

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on Forbes, X, and LinkedIn.

Set as google preferred source

Comments

No profit to be made on the…

Permalink

No profit to be made on the V8 ICE engine now either - failure rate, recalls on engines and transmissions and tail gates etc.. will probably cost big bucks by the time they replace thousands of engines under warranty.

Why should GM invest…

Permalink

Why should GM invest billions in a product nobody wants to buy?

Playing the short term game…

Permalink

Playing the short term game with no consistency and enduring plan on the long term is what has many traditional OEMs in a tight spot in the first place.

Would like to see GM develop…

Permalink

Would like to see GM develop an efficient Hybrid that hardly pollutes, doesn’t need charging, is reasonably priced, and can be kept for many years, unlike today’s overpriced EV’s.