The road to an all-electric future was never going to be a straight line, but recent bumps have felt more like tank traps for legacy automakers. The latest shockwave comes from General Motors, with reports confirming plans to cut approximately 1,700 jobs at its Fairfax Assembly plant in Kansas. This move, tied directly to adjusting production schedules for the Chevrolet Bolt EV and other models, is a stark illustration of the friction between aggressive EV ambitions and the cold reality of current market demand.

While the human cost to the workforce is the most immediate and painful aspect of this news, the strategic implications ripple far beyond Kansas City. This isn't just a local retooling hiccup; it's a significant indicator of a broader industry recalibration that is forcing Detroit's giants to tap the brakes on their electric dreams.

The Fairfax Shakeup: Why is This Happening Now?

On the surface, the job cuts at Fairfax are a mechanistic result of product lifecycles. The plant is ceasing production of the current Chevrolet Bolt EV and EUV, which have been modest successes but are built on older battery architecture. GM is also winding down production of the gasoline-powered Cadillac XT4 at the facility. The primary goal is to retool the plant for the next-generation Bolt, which will be built on GM’s advanced Ultium platform, and to prepare for future Cadillac models.

However, the depth of the cuts—affecting roughly two-thirds of the plant's workforce, according to reports from sources like Automotive News—signals more than just a routine model changeover. It reflects a necessary, albeit painful, pause. The gap between the end of the current Bolt and the start of the next-gen EV is a chasm GM must bridge. Furthermore, softer-than-anticipated demand for existing models has likely exacerbated the need for such drastic staffing adjustments during the transition period.

The Long View: A Strategic Retreat or a Necessary Pivot?

For GM, this move represents a critical pivot from an "all-in at all costs" mentality to a more pragmatic, profitability-focused approach. CEO Mary Barra has made it clear that while the destination remains an all-electric future, the path to get there must be economically viable.

Long term, this is likely a smart, if painful, play. By biting the bullet now to retool for the Ultium-based Bolt, GM is investing in a future where it can produce profitable, affordable EVs at scale. The current Bolt was a great proof of concept, but it was never going to be the high-margin, mass-market vehicle GM needs to sustain its business. The Fairfax transition is the physical manifestation of GM's strategy to move from EV novelty to EV profitability. However, it also carries a significant risk: GM is effectively leaving the affordable EV segment vacant until the new Bolt arrives, a gap competitors will be eager to exploit.

The Detroit Narrative: GM Isn’t Alone in Tapping the Brakes

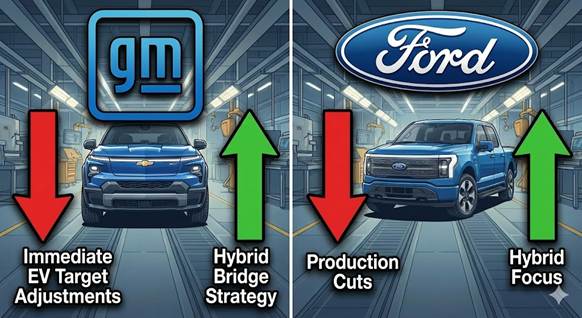

It is crucial to view GM’s actions within the broader context of the American automotive industry. GM is not an outlier; it is part of a clear trend. Its cross-town rival, Ford, has made similar strategic adjustments in recent months.

Facing slower-than-expected adoption rates, Ford has cut production shifts for the F-150 Lightning, its flagship electric truck. Furthermore, Ford has delayed some of its massive battery plant investments and has openly stated it will lean more heavily into hybrid vehicles as a "bridge" technology for consumers not yet ready to go fully electric.

Both GM and Ford are responding to the same market signals: high interest rates, charging infrastructure anxiety, and vehicle prices remain significant barriers to mass EV adoption. The initial wave of early adopters has bought their EVs; the next phase of converting the mainstream buyer is proving far more difficult and slower than Detroit’s optimistic projections suggested.

The Global Stage: What This Means for US EV Competitiveness

The optics of GM’s retreat, however temporary, are challenging on the global stage. As US legacy automakers tap the brakes, international competitors are accelerating.

Tesla, despite its own recent stock market fluctuations and price cuts, continues to dominate the US EV market and is aggressively expanding its global footprint with its new plant in Mexico. More menacingly, Chinese automakers like BYD are growing at an astonishing pace, producing high-quality, affordable EVs at a scale that Detroit is currently struggling to match.

The Fairfax situation highlights a critical vulnerability for GM and the US auto industry: the difficulty of transitioning century-old manufacturing behemoths versus the agility of newer, EV-first companies. While GM recalibrates its factories and supply chains, it risks losing valuable market momentum and mindshare. The longer it takes for GM to get its affordable Ultium-based vehicles on the road, the wider the door opens for Tesla to consolidate its lead and for Chinese manufacturers to potentially gain a foothold in North America.

Wrapping Up

The 1,700 job cuts at GM’s Fairfax Assembly are a stark reminder that the EV revolution is not a guaranteed, smooth transition. It is a complex, capital-intensive industrial pivot fraught with market uncertainties. For GM, this is a painful but likely necessary step to align its production reality with current demand while preparing for a more profitable electric future. But in the hyper-competitive global EV landscape, time is a luxury Detroit does not have. The success of this strategic pause depends entirely on how quickly and effectively GM can complete the Fairfax retooling and deliver the next-generation Bolt to a market hungry for affordable electric options.