EV Tax Credits Are Coming Back - How Tesla Benefits

There is another proposal of a slimmed down version of the Build Back Better bill and is about $433 billion in spending and about $739 billion in revenue raised. Let's see how this benefits Tesla.

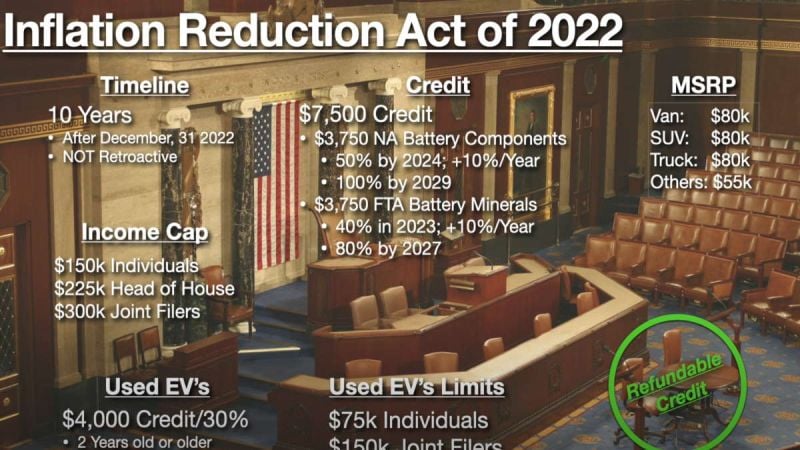

What is included in the latest version of the tax credit bill? Let's outline what it says:

Timeline

* The timeline for the bill is until December 31, 2022

* This credit is NOT retroactive - you won't get it for EVs you bought in 2022 and had delivered this year

The Credits

* There is a $7,500 credit for an EV.

* $3,750 is for 50% of NA battery components must be made in North America by 2024

* This goes up 10% per year to 100% by 2029

* Another $3,750 is for FTA battery minerals and 40% being made in North America by 2023

* This goes up 10% per year until 80% in 2027

Prices that Qualify

For MSRP prices - before taxes

* A van up to $80,000

* An SUV up to $80,000

* A truck up to $80,000

* All others up to $55,000

Income Qualifications and Caps

* $150,000 for single individuals

* $225,000 for heads of household

* $300,000 for joint filers

Used EVs

* Used EV's get a $4,000 credit or up to 30% of the cost - whichever is less

* Must be at least 2 years old

* Cannot exceed a $25,000 prices

* Must be bought from a dealer

* Income up to $75,000 for individuals; $150,000 for joint filers

This is a refundable credit, which will be realized at the time of purchase.

How This Affects Tesla

Tesla will be affected by this bill for the RWD Model 3 with LFP batteries, which is about $46,500 right now, as well as with both versions of the Model Y - the performance and the long range, which are still less than $80,000 and SUV vehicles.

I don't think the Cybertruck will be at $80,000 or less at this point, but perhaps I'll be surprised. If it doesn't get below $80,000, it won't qualify for a tax credit.

Tesla doesn't have a demand problem and these tax credits will take Tesla to the moon as stated a while ago.

What do you think about the proposed tax credit bill? Is this good for Tesla?

For more information, see this video by Bearded Tesla Guy:

Leave your comments below, share the article with friends and tweet it out to your followers.

Jeremy Johnson is a Tesla investor and supporter. He first invested in Tesla in 2017 after years of following Elon Musk and admiring his work ethic and intelligence. Since then, he's become a Tesla bull, covering anything about Tesla he can find, while also dabbling in other electric vehicle companies. Jeremy covers Tesla developments at Torque News. You can follow him on Twitter or LinkedIn to stay in touch and follow his Tesla news coverage on Torque News.

Set Torque News as Preferred Source on Google

Comments

Good for Tesla? Seems likely.

Permalink

Good for Tesla? Seems likely. Good for Tesla buyers? I don't see how. Won't Tesla simply raise prices (again and again), knowing consumers will have a rebate in hand? This looks to me like a way to increase the purchase price of a car using unnecessarily-complex math and excluding many upper-working-class households from the rebate program. If you make $151,000 you get no rebate. If you make $149,000 you get $7500 on qualifying purchases? How is global warming reduced by excluding the folks most likely to have money to buy one or two EVs?

What's also not clear if

Permalink

In reply to Good for Tesla? Seems likely. by John Goreham

What's also not clear if Tesla base model will even qualify because it has LPF battery made in China.