Volvo is a brand committed to electrification. This should be no surprise to anyone who follows the brand closely. Volvo was one of the original brands that committed to going hybrid and battery-electric. They made the pledge so early that the media needed time to catch up with Volvo and understand what the terms Volvo had adopted even meant. Back in 2017, when Volvo announced plans to "electrify" its entire fleet, people were unsure whether that meant all battery-electric or a mix. It meant a mix. Let’s look at which powertrain type sells the best for Volvo as of the end of December 2025, eight years after its decision to move away from conventional powertrains. And to be clear, by “sells” we mean vehicle deliveries to buyers. After we have an understanding of the trend Volvo is experiencing, we’ll ask readers to tell us if they think more battery-electric vehicles will help or hurt Volvo financially.

Volvo’s Many Markets - China

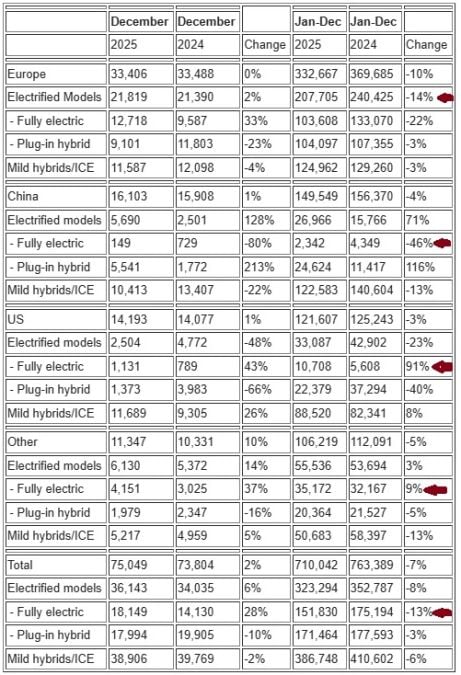

Volvo is a Swedish/European brand that is owned by a Chinese company. Many Volvo cars are made in China. I have one in my driveway today. An early-production EX30. One would think Volvo would be crushing it in China, but as of the last report, China was not the highest-delivery market for Volvo, despite being the largest global market. And Volvo’s Chinese-market deliveries are declining. Interestingly, it is the battery-electric (fully-electric) models that pulled down the deliveries, having declined by 46% in China in 2025.

In China, Volvo’s deliveries are nearly all Mild Hybrids/ICE. That is Volvo’s own term for the powertrain type. Of the 156,000 vehicles Volvo delivered in China in 2025, 141,000 were its “least” electrified ones. With its battery-electric models experiencing a steep decline, will eliminating the Mild Hybrid/ICE options somehow help Volvo in China? Why would one think so?

Volvo’s Many Markets - USA

In the USA, 82,000 of the 125,000 vehicles Volvo sold were its least electrified ones. Battery-electric model deliveries for Volvo in America grew in 2025; they nearly doubled, but Volvo still averaged fewer than 1,000 BEVs per month in the U.S. through 2025. Although Volvo’s overall deliveries were down for 2025, its least-electrified models grew a solid 8%.

Volvo’s Many Markets - Europe

In Europe, Volvo saw significant sales declines in all areas for 2025. Every powertrain type has lower year-over-year deliveries. Fully-electric declined the most (-22%). By contrast, Mild Hybrids/ICE declined by just 3%. In this market, Volvo’s three powertrain choices are about evenly split. With its battery-electric models experiencing a steep decline, will eliminating the Mild Hybrid/ICE options somehow help Volvo in Europe? How does that math out?

Volvo’s Many Markets - Other

In the rest of the world, which is a pretty big overall market grouping for Volvo, deliveries were also down for 2025. In this market, a bit more than half of Volvo’s vehicles delivered were Mild Hybrids/ICE.

Volvo Heading Into 2026 - Volvo Battery-Electric Vehicles vs. Mild Hybrid/ICE

At the end of 2025, Volvo sold more Mild Hybrid/ICE vehicles than battery-electric by a margin of 411,000 to 175,000. Fully-electric deliveries were down by 13% in 2025, and it was not the US market that crashed Volvo's BEV sales. Volvo is beginning to phase out its Mild Hybrid/ICE powertrains and is only building battery-electric vehicles as new models going forward. The question is, will Volvo regain those lost Mild Hybrid/ICE deliveries with new battery-electric models or just continue to shrink overall and sell fewer cars with more electrification? Tell us your prediction for 2026 in the comments below.

John Goreham is the Vice President of the New England Motor Press Association and an expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. He is a member of the Society of Automotive Engineers (SAE int). In addition to his fourteen years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can connect with John on LinkedIn and follow his work on his personal X channel or on our X channel. John employs grammar and punctuation software when proofreading, and he sometimes uses image generation tools.