2022 was very much like all prior years for American-market battery-electric deliveries. Tesla delivered an unknown number of BEVs, but it is clear the company leads based on third-party data (registration info). Then there are the also-rans. Companies that have an outstanding ability to generate news about EVs but who barely build any. One departure from prior years is that both Chevrolet and Ford managed to make meaningful steps forward.

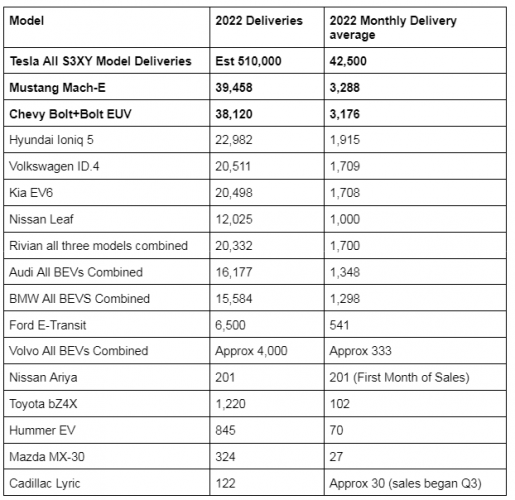

One metric that has been easy to use is the 2,000-per-month delivery average. Since the modern age of EVs began around 2010, only Tesla has been able to manage a delivery rate of more than 2,000 BEVs per month, and it has only done it for a handful of the past years. No other automaker has maintained that tiny benchmark volume. We rely on Troy Teslike on Twitter for our Tesla estimates. His estimate of Tesla’s total US BEV deliveries for 2022 is 510,000 units, which means that Tesla outpaces GM and Ford by greater than 10X. If Tesla provided this information, we would include the exact info. Tesla only provides global deliveries and groups models together.

In 2022, Both Chevrolet and Ford surged forward. Chevy’s Bolt and Bolt EV line combined totaled 38,120 units. The Bolt line was off the market in prior years due to a recall. Ford’s Mustang Mach-E line totaled 39,458 units of its consumer-focused BEV. Ford’s Mach-E deliveries were up a solid 45% over 2021 deliveries. We should also note that Ford delivered 6,500 E-Transits in 2022. That is a big step ahead for the company. We have seen E-Transits in operation near our Massachusetts office. Ford’s E-Transit has 73% of that segment.

With both Ford and Chevrolet now delivering BEVs at a pace above 3,000 units per month, each has begun to put a meaningful distance between themselves and other rivals offering BEVs in the U.S. market. Here is a quick chart showing the 2022 BEV delivery totals based on information contained in manufacturers’ year-end delivery reports. If you don’t see a model listed, it is likely because it was not reported or the number was far below these.

Plug-in hybrid crossovers have expanded in terms of models offered, but market leaders like Toyota’s RAV4 and Mitsubishi’s Outlander PHEV dropped in deliveries compared to the prior year.

EV advocates like to highlight the positives, and manufacturers certainly provide them with all the press releases on future products needed to keep them busy. However, only one brand presently has any real volume of BEV deliveries in America, and it is limited to just two luxury-priced models (Models 3 and Y). The truth is, if any of the BEVs sold by any other manufacturer, with the exception of the Mach-E and Bolt line, were not a product being supported by government mandate and/or taxpayer subsidies, they would immediately be canceled since their minuscule delivery volumes do not come close to justifying their existence.

Another reality is that manufacturers are having no problem moving EVs from production to driveways. Quite the contrary. Consumers have shown a willingness (eagerness?) to pay markups on almost all BEVs and PHEVs. The demand for BEVs so far is much higher than the availability of BEVs. You may notice that we don't use the term “sales” in this report. That is because no manufacturer of BEVs needs to actively “sell” them. They build them, and consumers fall all over themselves to snatch them up. This begs the question, “Why don't manufacturers build more BEVs?” Maybe you can answer that question in the comments section below.

Here is a punch list of our takeaways from the analysis of the 2022 Model Year BEV delivery data:

-Only Tesla builds a meaningful volume of BEVs

-Chevy and Ford both trail Tesla, and both offer a model line with deliveries in excess of 3,000 units per month.

-Hyundai, Kia, and VW are all still below 2,000 units per month per model.

-Automakers aside from Toyota don't even bother to report PHEV deliveries. Despite consumers showing a willingness to pay markups for PHEV models.

-Ford so far has captured the bulk of the commercial BEV van market in the U.S., not Rivian.

Image of Ford Mustang Mach-E by John Goreham.

John Goreham is a long-time New England Motor Press Association member and recovering engineer. John's interest in EVs goes back to 1990 when he designed the thermal control system for an EV battery as part of an academic team. After earning his mechanical engineering degree, John completed a marketing program at Northeastern University and worked with automotive component manufacturers, in the semiconductor industry, and in biotech. In addition to Torque News, John's work has appeared in print in dozens of American news outlets and he provides reviews to many vehicle shopping sites. You can follow John on TikTok @ToknCars, on Twitter, and view his credentials at Linkedin

Re-Publication. If you wish to re-use this content, please contact Torque News for terms and conditions.

Set Torque News as Preferred Source on Google