The automotive landscape in early 2026 feels less like a traditional market and more like a high-stakes geopolitical chessboard. At the center of the board is Ford Motor Company, an American icon currently bruised by an 8.2 billion net loss in 2025, driven largely by the "brutal" costs of its electric vehicle (EV) transition and nearly 2 billion in annual tariff expenses.

In a move that has sent shockwaves through Washington and Detroit alike, CEO Jim Farley is reportedly lobbying the U.S. government to allow a "watershed" integration of Chinese battery technology and software into domestic production. The request is simple in theory but explosive in practice: to compete with the likes of BYD and Tesla, Ford believes it must stop trying to reinvent a wheel that China has already perfected.

The Competitiveness Gap: Can America Catch Up Without Help?

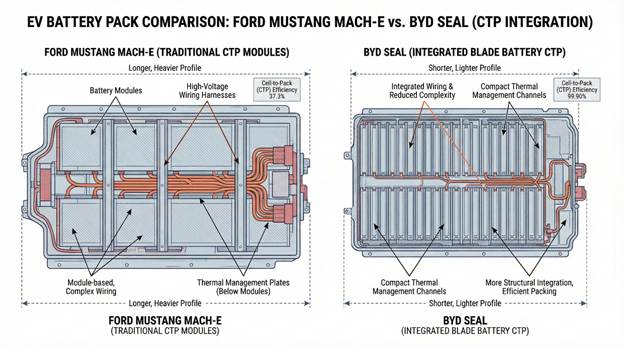

For years, the narrative of the American EV transition was one of "onshoring"—building a self-reliant supply chain that bypassed Chinese dominance. However, the reality on the factory floor has been a humbling experience for the Blue Oval. Farley has been candid about the "shocking" disparities revealed when Ford engineers tore down Chinese EVs, discovering that Western wiring looms were over a kilometer longer and hundreds of dollars more expensive than their Eastern counterparts.

Currently, China controls nearly 80% of the world’s battery cell manufacturing capacity. By leveraging Chinese Lithium Iron Phosphate (LFP) chemistry—specifically from giants like CATL and potentially BYD—Ford aims to slash battery costs by up to 30%. This isn't just about padding margins; it’s about survival. Without access to these mature, low-cost supply chains, Ford’s upcoming $30,000 "Universal EV" platformremains a financial impossibility.

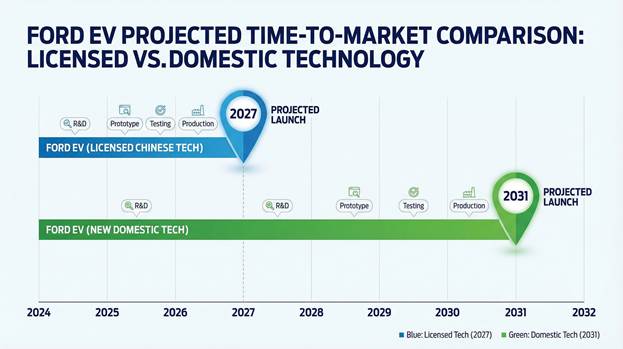

U.S. EV competitiveness is currently a paradox. We have the innovation and the brand loyalty, but we lack the "industrialized" efficiency of the battery ecosystem. Allowing Chinese tech in is an admission that the U.S. is currently in a "catch-up" phase. If the government grants this request, it could provide the breathing room Ford needs to scale its BlueOval Battery Park in Michigan using licensed expertise, eventually "Americanizing" the processes over the next decade.

The Trade War Wall: Can This Work in 2026?

The primary hurdle isn't engineering; it’s the intense animosity between Washington and Beijing. The U.S. Department of Commerce recently finalized rules effectively barring Chinese software and hardware in connected vehicles, citing national security risks ranging from data privacy to the theoretical ability to remotely disable fleets.

Farley’s proposal essentially asks the government to differentiate between "Chinese-owned" and "Chinese-licensed." Under the reported framework, Ford would maintain majority control of the factories and the data, essentially using Chinese tech as a "black box" component.

However, the political climate is frigid. Lawmakers have already warned that such partnerships "diminish Ford’s status as an iconic American company". For this to work, Ford must prove that the "software" it wants to import is limited to battery management systems (BMS) rather than the infotainment suites that keep security hawks awake at night. It is a razor-thin tightrope walk.

The Upside: A Global Powerhouse Reborn

If Ford successfully navigates these regulatory rapids, the domestic and overseas benefits would be transformative.

- Domestically: Ford could finally deliver on the promise of the affordable EV. A $30,000 electric pickup would allow them to capture the "meat of the market" that currently views EVs as luxury toys. It would also stabilize the Model e division, which lost 4.8 billion in 2025.

- Overseas: In Europe and Asia, Ford is already fighting a losing battle against BYD and Geely. By using the same battery tech as their rivals but pairing it with Ford’s superior vehicle dynamics and brand trust, they could reclaim market share. Access to Chinese tech allows Ford to "speak the language" of the global supply chain, making their vehicles modular and easier to service worldwide.

The Downside: The Cost of Failure

What happens if the U.S. government says "No"? The outlook for Ford would be significantly grimmer.

Without Chinese LFP tech, Ford would be forced to rely on more expensive Nickel Cobalt Manganese (NCM) chemistries or wait years for domestic LFP alternatives to reach the same scale. This delay would likely result in further multi-billion dollar writedowns and the potential cancellation of more EV programs.

Failure here would effectively cede the affordable EV market to Tesla and, eventually, to Chinese manufacturers who find ways around tariffs (such as manufacturing in Mexico). Ford could be relegated to a "niche" player in the electric space, forced to retreat back to internal combustion engines (ICE) and hybrids for longer than the market may allow, ultimately risking its status as a global automotive leader.

Wrapping Up

Jim Farley’s gambit is a pragmatic, if politically unpopular, acknowledgment of the current global economy. By requesting permission to use Chinese battery technology and software, Ford is attempting to bridge the gap between American industrial pride and the cold reality of global manufacturing costs. If successful, this move could secure Ford’s place in the electric future by making "Built in America" synonymous with "Affordably Electric." If it fails, the Blue Oval may find itself walled off by the very trade barriers meant to protect it, watching from the sidelines as the rest of the world plugs in.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on TechNewsWord, TGDaily, and TechSpective.

Set as google preferred source