This week, Ford Motor Company peeled back the curtain on its most "audacious" project to date: the Universal EV (UEV) Platform. Internalized under the code name "Project T3" and led by a skunkworks team of former Tesla and Apple engineers, the platform represents a "first-principles" rethink of how an electric vehicle is born. Unlike the F-150 Lightning—which was essentially an electric heart transplanted into a gas-powered body—the UEV platform is a clean-sheet architecture designed to do one thing: slash manufacturing costs to the bone.

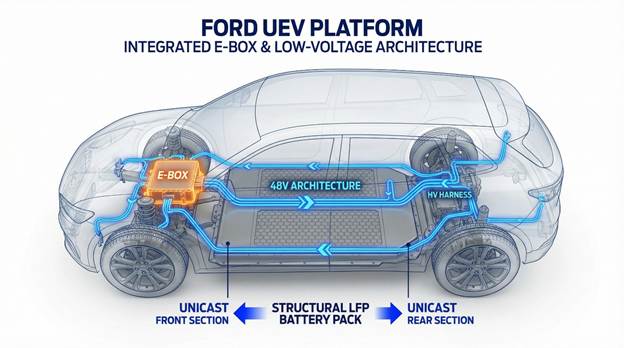

The star of the show is a mid-size electric pickup, slated for a 2027 launch with a targeted starting price of roughly $30,000. Ford executives, including CEO Jim Farley, describe this as a "reset" for the brand's EV business. To hit this aggressive price point, Ford is employing "unicasting"—a process that replaces 146 individual structural parts found in the current Maverick with just two massive aluminum castings. This isn't just a minor tweak; it’s a manufacturing revolution that reduces assembly time by 15% and eliminates thousands of fasteners and feet of heavy wiring.

Why $30K is the Magic Number for the "New Normal"

For years, the industry has chased early adopters willing to drop $80,000 on "lifestyle" electric trucks. However, as interest rates climbed and early-adopter demand cooled, the "affordable" truck crown—once held by the $20,000 Maverick—slipped away under the weight of $50,000 average transaction prices.

A $30,000 price target is the "holy grail" for three specific reasons:

- Parity with Internal Combustion: It brings the EV pickup into direct price competition with gas-powered mid-size trucks like the Toyota Tacoma and Ford’s own Ranger.

- Psychological Accessibility: For many American households, $30,000 represents the upper limit of a "standard" car payment.

- The "Work Truck" Utility: Fleet buyers, who are the backbone of Ford’s "Ford Pro" division, require a low total cost of ownership (TCO). A $30K EV, coupled with LFP (Lithium Iron Phosphate) batteries that can be charged to 100% daily without degradation, makes the math for contractors and delivery fleets finally work.

The Competitive Landscape: Who is Ford Fighting?

Ford isn't entering an empty ring. By 2027, the mid-size electric pickup space will be a dogfight. Here is how the $30K Ford stacks up against its primary rivals:

The most significant threat may not be domestic. As Ford navigates 2026, it is eyeing Chinese EV giants like BYD with a mix of fear and respect, even reportedly discussing tech partnerships to stay competitive on battery costs.

Market Potential: From Louisville to London

The potential for a $30,000 electric truck is massive, but the geography of that demand is split.

- Domestic Market: In the U.S., the "Maverick-sized" segment is exploding. American buyers want the utility of a bed without the "garage-busting" size of an F-150. Ford’s decision to build this in Louisville suggests a high-volume play aimed at the heart of the American suburb.

- Overseas Market: This is where the Universal EV platform truly earns its "Universal" name. In Europe and South America, the F-150 is too large for many roads. A mid-size pickup with a tight turning radius and high efficiency is the perfect "global" vehicle. If Ford can export this platform, they could reclaim market share in regions currently being cannibalized by Chinese imports.

Is Ford Leading the "Detroit Three" Pivot?

While General Motors and Stellantis have also been forced to "right-size" their EV ambitions, Ford appears to be the most transparent about the pain—and the plan.

- Ford: Taking nearly $20 billion in charges to pivot from "luxury EVs" to "affordable EVs" and hybrids. They are leading in manufacturing innovation (unicasting and 48V architecture).

- GM: Relying on the Ultium platform, which is scalable but has faced software and production bottlenecks. They are focusing heavily on the $35,000 Chevrolet Bolt relaunch.

- Stellantis: Currently in a costlier "reset" phase, having canceled projects like the Ram 1500 REV to stem losses.

Ford’s "Bounty Hunter" approach—where engineers are rewarded for cutting pennies and grams out of the vehicle—signals a cultural shift toward efficiency that its rivals are only beginning to replicate.

The Roadmap to Success: What Ford Must Get Right

For this $30,000 pickup to be a "Tesla-killer" and not a financial anchor, Ford must execute on three fronts:

1. Extreme Aerodynamics

Traditional pickups are "bricks in the wind." Ford is targeting a drag coefficient 15% lower than any current truck. They need to convince buyers that a "teardrop" shaped bed (inspired by F1) is a feature, not a bug.

2. Software-Defined Everything

The vehicle must use the new "E-Box" central computer. By moving to a 48V system, Ford can eliminate 22 lbs of copper wiring. If the software is buggy at launch, the hardware won't matter.

3. Battery Independence

Ford’s Michigan-based LFP plant must hit full capacity by 2026. Relying on imported cells will expose the $30,000 price point to the whims of trade wars and tariffs.

Wrapping Up

Ford's deep dive into the Universal EV platform is more than just a tech briefing; it’s a survival strategy. By targeting a $30,000 price point for a mid-size electric pickup, Ford is finally addressing the "affordability gap" that has stalled EV adoption. Through radical manufacturing techniques like unicasting and a relentless focus on aerodynamic efficiency, they are attempting to build a vehicle that is "as fast as a Mustang" and as practical as a RAV4. If they can stick the landing in 2027, Ford won't just reclaim the affordable truck crown—they might just provide the blueprint for the entire American auto industry's future.

Disclosure: Images rendered by Artlist.io

Rob Enderle is a technology analyst at Torque News who covers automotive technology and battery developments. You can learn more about Rob on Wikipedia and follow his articles on TechNewsWord, TGDaily, and TechSpective.

Set Torque News as Preferred Source on Google