In a stunning strategic reversal that reverberated through the automotive world this week, Ford Motor Company announced a major pivot away from its ambitious electric vehicle (EV) plans. The Dearborn-based automaker is canceling a highly anticipated three-row electric SUV and a next-generation electric truck, instead choosing to double down on its core strengths: hybrids, internal combustion engine (ICE) trucks, and commercial vans. This massive course correction comes with a staggering price tag—approximately $19.5 billion in special charges and writedowns—and signals a significant reality check for the broader U.S. EV market.

The Billion-Dollar Course Correction

The decision to shelve these large EV projects is a direct response to a market that has not evolved as quickly as many automakers had hoped. Ford CEO Jim Farley has been blunt about the challenges, noting that "buyers don't want expensive EVs." The company's dedicated EV division, "Model e," has been a significant financial drain, reporting a loss of $1.1 billion in the second quarter of 2024 alone, and projected to lose between $5 billion and $5.5 billion for the full year.

The $19.5 billion charge includes writedowns on manufacturing assets and other costs associated with the cancelled programs. This is a clear admission that the initial, capital-intensive push into large, premium EVs was a miscalculation. Instead of these large vehicles, Ford will now focus its future EV development on a new, flexible "Universal EV Platform" designed for smaller, more affordable models, with the first vehicle expected in 2027.

The image below provides a visual summary of this dramatic strategic shift.

Hybrids as the New Hero

While the retreat from large EVs is a headline-grabber, the more significant story is Ford's full-throated embrace of hybrid technology. This is not a defensive move but a pragmatic one based on hard data. In 2024, Ford's hybrid sales have seen explosive growth, far outpacing both its EV sales and the company's overall sales.

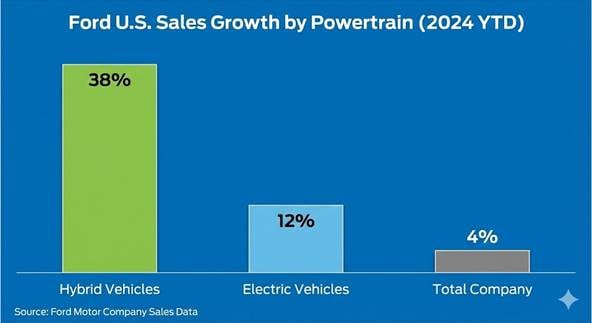

According to Ford's own sales data, hybrid vehicle sales were up 38% year-to-date in 2024, compared to a 12% increase for EVs and a modest 4% growth for the company as a whole. The success of models like the F-150 PowerBoost hybrid and the Maverick hybrid has proven that consumers are eager for electrified vehicles that offer better fuel economy and performance without the range anxiety and high upfront costs of a full EV.

The chart below clearly illustrates this sales trend, highlighting the strong consumer preference for Ford's hybrid offerings.

This shift to hybrids is likely to be a successful strategy in the near-to-medium term. It allows Ford to leverage its existing manufacturing infrastructure and expertise in internal combustion engines while still offering products that meet tightening emissions regulations and consumer demand for more efficient vehicles. It also provides a crucial bridge for consumers who are not yet ready to make the full leap to an all-electric vehicle.

A Ripple Effect Across the US Market

Ford's move is not happening in a vacuum. It reflects a broader industry-wide reckoning with the pace of EV adoption. Other major players like General Motors have also adjusted their EV production targets and delayed model launches in the face of slower-than-expected demand. The initial euphoria surrounding the EV transition has given way to a more sobering reality of high battery costs, charging infrastructure challenges, and consumer price sensitivity.

This pullback by legacy automakers could have significant implications for the U.S. EV market's long-term trajectory. It may signal a slower, more gradual transition to full electrification than previously anticipated. However, it also opens a potential window of opportunity for pure-play EV manufacturers like Tesla and Rivian, who may face less direct competition in certain segments in the short term. The changing political landscape, with potential shifts in government incentives and regulations, further complicates the picture.

The Financial Reality Check

To understand Ford's predicament, one must look at its recent financial performance. The company's Q2 2024 earnings painted a stark picture of a house divided. While the Model e EV division was bleeding cash, the company's traditional business units were generating substantial profits. The Ford Pro commercial division, for instance, reported an EBIT of $2.56 billion, and the Ford Blue internal combustion and hybrid division posted an EBIT of $1.17 billion.

The profits from these legacy businesses are essentially subsidizing the losses in the EV division. This financial reality made a course correction inevitable. By cutting its losses on large, unprofitable EVs and refocusing on its profitable core businesses and growing hybrid segment, Ford is aiming to stabilize its finances and create a more sustainable path forward. The company now expects its Model e unit to achieve profitability by 2029, a more realistic timeline than its previous, more aggressive goals.

Can the Blue Oval Weather the Storm?

Despite the negative headlines surrounding the EV cancellations and the massive financial charge, Ford is well-positioned to weather this storm. The company's strength lies in its diversified portfolio and its market-leading position in high-margin trucks and commercial vehicles. The F-Series remains America's best-selling truck, a title it has held for nearly half a century, and the Ford Pro division is a powerful profit engine that shows no signs of slowing down.

Ford's survival in the EV pivot is not a question of if, but how. By making this difficult but necessary decision, the company is demonstrating a willingness to adapt to market realities. The shift to hybrids is a pragmatic play that plays to Ford's strengths, and the development of a new, lower-cost EV platform shows that the company has not abandoned its electric ambitions entirely. It is simply choosing a more prudent and financially viable path to get there.

Wrapping Up

Ford's strategic pivot is a watershed moment for the automotive industry. It is a clear signal that the road to electrification will be longer, windier, and more expensive than many had predicted. For Ford, the $19.5 billion charge is a painful but necessary pill to swallow to correct past missteps and realign its strategy with consumer demand. By refocusing on its profitable trucks, expanding its successful hybrid lineup, and developing more affordable EVs, Ford is making a calculated bet that a balanced approach is the key to long-term success in a rapidly evolving market. This move may seem like a step backward to some, but it could very well be the step that ensures the Blue Oval's future.