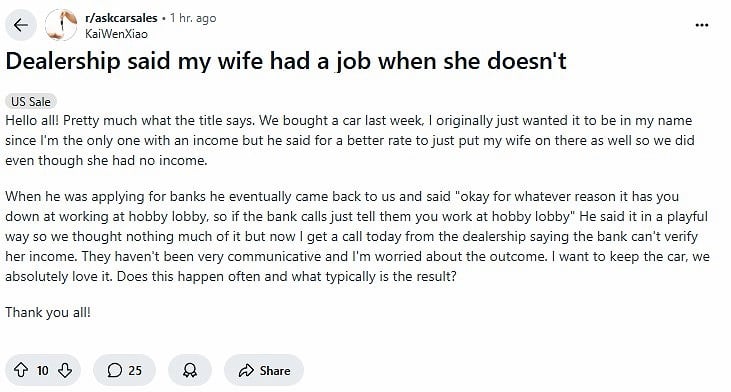

An interesting (but worrisome) recent Reddit/askcarsales forum features an OP requesting advice about whether he should be worried about whether or not he will be allowed to keep a car he bought last week after committing banking fraud with a car dealer who encouraged him to sign financing paperwork claiming his spouse has a job at Hobby Lobby when she is actually unemployed:

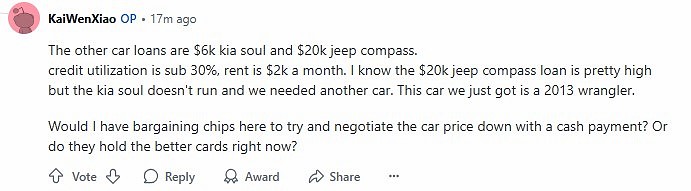

Further down in the thread comments, we learn that the car dealership sold a 2013 Jeep Wrangler to the couple for $15,000 and resorted to some creative paperwork to make the financing happen when the couple already had two car loan payments and limited income.

Honestly, my credit is 683, my income is $110k and the car was only $15k. I didn't think it was too low to get an approval but his reasoning was because we have 2 car loans already. One of our cars was totaled after a theft and we have been waiting for the money to come in from court to pay it off ―OP

Post Comments Fail to See The Seriousness of the OP's Real Problem

Most of the comments in the thread recognize that, at the very least, the OP is implicated in fraud under the guidance of the car dealer.

If you're telling the 100% no-nonsense truth, the dealer is committing textbook fraud, and if you signed the documents, you're in on it ―Medium-Complaint-677

However, the more disturbing part of the thread is that advice is lackadaisical regarding the real issue the OP may face.

For example:

The dealer AND OP conspired to commit fraud. OP - you signed a credit app that included the job details and a little line saying "I attest everything here is true to the best of my knowledge"

You probably won't get in trouble for it, but if a bank wants to, they could refer this for prosecution. And I'm sure there is a state AG who would love the publicity of taking down a predatory "stealership" and wouldn't mind painting you as part of the crime ring ―wildcat12321

Stop scaring him. This happens more often than we'd like to admit, but customers are never prosecuted lol. Anyhow, the bank is more likely willing to rewrite the loan at a higher rate than go through the trouble of prosecuting anyone, let alone a dealership that sends them several loans per month ―HamsterDowntown3010

A quick search online shows that, according to the JUSTIA legal website (a website offering a wide range of free legal information and resources), yes, this is fraud:

The prosecutor also must show that the defendant had one of two purposes. They must have sought to defraud a financial institution, or to obtain money or other property under the control of the financial institution through false or fraudulent pretenses, representations, or promises ―Justia.com (bank fraud)

Why This Matters

We do not know with certainty whether the OP's handle is his actual name; however, assuming it is, he appears to be of Asian heritage, more specifically, Chinese.

However, even if the name and situation are a ruse, it serves as a timely warning for car shoppers buying from a less-than-honest dealer.

If the assumption is correct, the OP is either a Green Card carrying non-citizen, a naturalized citizen, or a "Born in the USA" U.S. citizen.

In today's political climate, it really does not matter.

If he is a Green Card citizen, he can assuredly be deported.

If he is a Naturalized Citizen, suffice it to say that at the very least, yes, a naturalized citizen can be deported following a revoking of their citizenship.

In light of the Trump administration, the question of whether a "Born in the USA" U.S. citizen can be deported is unclear for reasons we will not go into. If you do not think it can happen―you have not been paying attention to the news lately.

Here is a short NBC News video clip from 2 weeks ago as an update to this question:

Could the Trump Admin Deport U.S. Citizens?

The implication of the government's position is that not only non-citizens but also United States citizens could be taken off the streets, forced onto planes, and confined to foreign prisons with no opportunity for redress if judicial review is denied unlawfully before removal―Justice Sonia Sotomayor

The concern is that the OP could become a questionably unwitting victim, having placed his trust in a car dealer who encouraged him to skirt the law to make a sale.

Moreover, online forum advice that does not recognize the seriousness of the situation is not making matters any better for the OP should the bank take issue with the falsified loan application.

Rather than worry about whether the OP will be able to keep his car, comments should be focused on telling him that it is time to lawyer up to avoid potential life-changing persecution and prosecution.

If you are a lawyer or know someone who is a lawyer and is willing to comment on this forum thread, please let us know their thoughts on the matter in the comments section below.

For additional law-related automotive news, here are a few for your consideration:

- Sell My Car To My Brother To Help The Family? What Could Possibly Go Wrong?!

- Car Was Taken For A Joyride And Wrecked By A Car Dealership Employee ―Lawyer Offers Advice on How to Avoid Attorney Fees and Make a Killing When Your Car is Damaged by a Dealership

- Toyota Dealer Scams Himself into Prison

- Uber Can Legally Leave You Crippled and Broke Warning

COMING UP NEXT: Tesla Vandal in Minneapolis Causes $20,000 In Damages, Receives No Charges ―This Might Be a Good Thing

Timothy Boyer is an automotive reporter based in Cincinnati who currently researches and works on restoring older vehicles with engine modifications for improved performance. He also reports on modern cars (including EVs) with a focus on DIY mechanics, buying and using tools, and other related topical automotive repair news. Follow Tim on Twitter at @TimBoyerWrites as well as on Facebook and his automotive blog "Zen and the Art of DIY Car Repair" for useful daily news and topics related to new and used cars and trucks.

Image Source: Deposit Photos

Set Torque News as Preferred Source on Google