Tesla Finally Offering $7,500 EV Point of Sale Tax Credit

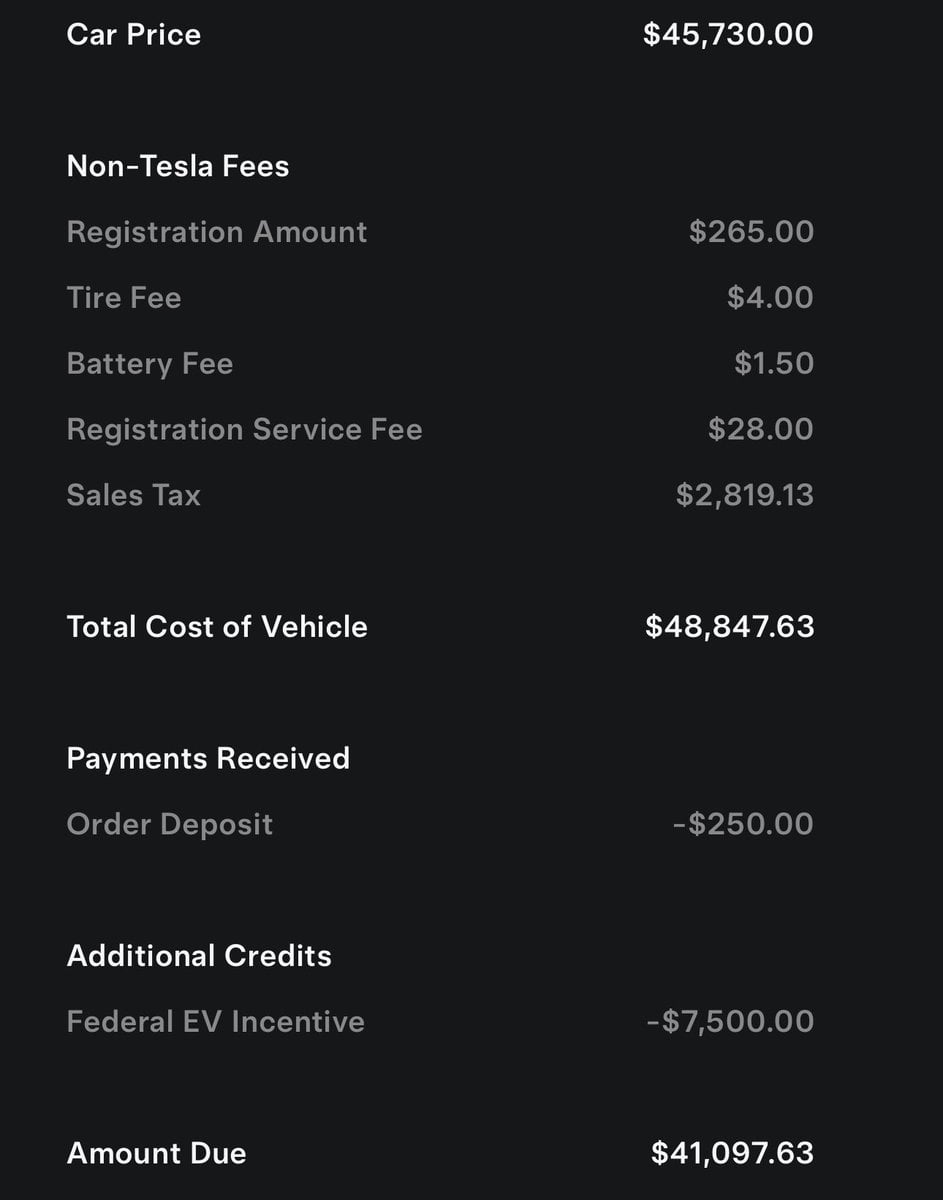

Someone was dropping the ball on the $7,500 EV point of sale tax credit, however, that no longer appears to be the case as announced by Sawyer Merritt On X who has seen "about ten people with existing orders show him it's live". Tesla has also officially updated its website.

Tesla is now officially offering the $7,500 EV tax credit as a point of sale rebate in the U.S., for about 250 million Americans.

A "Cyber Roadster" Is Almost Done Being Built From a Crashed 2018 Dual-Motor Tesla Model 3 That Cost $14,000https://t.co/cbEkaZDBJU$TSLA @Tesla @torquenewsauto #cyberroadster #cybertruck #roadster #custombuild

— Jeremy Noel Johnson (@AGuyOnlineHere) January 12, 2024

If you want to get the $7,500 discount directly off the purchase of a Tesla vehicle, you must click the "Yes" button during your order to take advantage of the credit.

Not all Tesla vehicles apply, for instance, the Model 3 variants for RWD and Long Range do not qualify, nor the Model S (any variant) and Model X Plaid.

All Model Y variants, the Model 3 Performance, and the Model X AWD qualify. The Model X has seen an increase in demand and this should boost that.

Here is the full list of vehicles that qualify. For some strange reason, the 2023 Model Y RWD doesn't qualify:

It is believed that the AWD Cybertruck will qualify when it releases.

You May Also Be Interested In: Cybertruck Sound System Is Epic: "This Is One of Those Vehicles That You Spend $100K On the Sound System, And It Also Comes With a Truck"

The EV Tax Credit At Point Of Sale Is Finally Here

The same income limits that applied in 2023 still apply in 2024. You can use your modified adjusted gross income (AGI) from the year you take delivery or the year before, whichever is less.

As long as your modified AGI is below the income threshold in one of the two years, you can use the full $7,500 point of sale rebate regardless of your tax liability, and the IRS won't require you to pay back any amount.

These are the current income requirements:

* Buy if for your own use, not for resale

* Use it primarily in the U.S.

Your modified adjustable gross income may not exceed:

* $300,000: Married couples filing jointly

* $225,000: Head of Household

* $150,000: All other filers

The price caps for each vehicle are:

* Model 3 Performance: $55,000

* 2024 Model Y Rear-Wheel Drive: $80,000

* Model Y Long Range: $80,000

* Model Y Performance: $80,000

* Model X Dual-Motor: $80,000

It's also important to note that if you file your taxes the following year, and it turns out you didn't meet the income requirements to take advantage of the tax credit, you must reimburse the IRS for the difference in the credit.

Tesla Insurance Premiums Are Shocking: From 2022 to 2023 In My Tesla Model 3 RWDhttps://t.co/yKHKJuL0WF$TSLA @Tesla @torquenewsauto #model3 #insurance #teslainsurance #premiums #costs

— Jeremy Noel Johnson (@AGuyOnlineHere) January 10, 2024

The IRS says this about claiming the credit:

To claim the credit for vehicles placed in service before January 1, 2024, file Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit (Including Qualified Two-Wheeled Plug-in Electric Vehicles) with your tax return.

Starting January 1, 2024, credit eligibility and amount will be determined at the time of sale using the IRS Energy Credits Online website. The dealer will complete and submit the time-of-sale report online, and it will be accepted or rejected in real time. The dealer is required to provide you with a copy of the time-of-sale report, and you will need it to claim the credit.

If the vehicle qualifies for a credit, you have two options:

- You can claim the credit on your tax return for the year in which it was placed in service using Form 8936.

- You can transfer the credit to the dealer so that they can apply the credit amount to your final purchase cost. This essentially allows you to receive the benefit of the credit at the time of sale. The dealer will be reimbursed by IRS. You must still fill out Form 8936 reporting your eligibility for the credit and your decision to transfer the credit to the dealer.

Note that if the vehicle qualifies but you do not qualify for the credit for any reason (e.g., your modified adjusted gross income exceeds certain thresholds), you must reimburse IRS for any difference in the credit for which you are eligible and the benefit you received from the dealer. Dealers are not required to verify the eligibility of the buyer at the time of sale. It is your responsibility to ensure that you meet all buyer requirements. The dealer is, however, required to provide the modified adjusted gross income requirements for your information.For more information, see IRS updates frequently asked questions related to new, previously-owned and qualified commercial clean vehicle credits.

This should help boosts Tesla's sales of the Model Y this year and even, to a lesser extent, the Model S and Model X.

At this point in time, it's unknown if prior orders this year will be able to take advantage of this point of sale retroactively or not.

You can learn more about the U.S. EV tax credit here: https://fueleconomy.gov/feg/tax2023.shtml#requirements

In Other Tesla News: "A Few Other Products Coming Too" Says Elon Musk, In Addition To Compact Car, FSD, Robotaxi, and Tesla Bot

What do you think about the U.S. $7,500 EV tax credit now being point of sale? Is this going to boosts Tesla's sales?

Share this article with friends and family and on social media - or leave a comment below. You can view my most recent articles here for further reading. I am also on X/Twitter where I post more than just articles daily, as well as LinkedIn! Thank you so much for your support!

UPDATE: Tesla has now updated its website to show the $7,500 Fed point-of-sale credit (rebate).

"Eligible customers who take delivery of a qualified new Tesla and meet all federal requirements are eligible to receive $7,500 off the purchase price. Applied at time of delivery.… https://t.co/hZ3bRoSFjf pic.twitter.com/BbyXMMLDRp— Sawyer Merritt (@SawyerMerritt) January 12, 2024

Hi! I'm Jeremy Noel Johnson, and I am a Tesla investor and supporter and own a 2022 Model 3 RWD EV and I don't have range anxiety :). I enjoy bringing you breaking Tesla news as well as anything about Tesla or other EV companies I can find, like Aptera. Other interests of mine are AI, Tesla Energy and the Tesla Bot! You can follow me on X.COM or LinkedIn to stay in touch and follow my Tesla and EV news coverage.

Image Credit & Article Reference: Sawyer Merritt

Set Torque News as Preferred Source on Google