Parenting has its perks and its headaches. One shared headache any parent will agree to is when their kid needs a car; A typical situation an OP on a recent Reddit r/UsedCars forum found herself and her daughter in with a $690/month insurance payment on top of $400/month car loan.

Here's the mom's story in summary:

Tuesday my 18-year-old daughter bought a 2024 Toyota Corolla with 3,000 miles on it, I am the co-signer. Basically a brand new car.

Monday, while we were there, I called the car insurance place to get a quote to make sure she could afford the insurance and car payment.

I told the agent, "My daughter just bought her first car, and we need to add it to our claim." She said, "Well, since I'm also on the car, we will add it to my claim and my daughter as a driver later down the road." She quoted me 130 a month.

Perfect. I hung up and told the car salesman exactly that, and he said, "Yep, that's how you keep it affordable." We moved forward and bought the car on Tuesday.

Later that day, he texted me and said they needed my daughter's name to be the insured on the car. So I called State Farm. It's 690.00 a month…I about died.

The mom is upset because she feels that the car dealer knew that the $130 per month was inaccurate but allowed her to feel it was okay just to finalize the sale.

However, the mom's question is how she and her daughter should proceed.

She can't afford 690 a month, nor should she. She's never had a ticket, never been in a car accident. I don't really understand the whole young and dumb thing."

Majority of Comments to the Mom Were Unkind

Unfortunately for the mom, the forum comments took a life of their own and gave the mom a sound drubbing.

Just one out of many was some variation of this:

"Why are you buying an 18-year-old a basically brand new car? Were you able to afford the payment and insurance on a brand new car when you were 18? I was not able to afford a brand new car until I was 21 and had been working for 5 years. Why did you not call your insurance company and obtain a binder before signing the papers and accepting delivery of the new vehicle? It sounds to me like you did not do a very good job of being a mother and helping your daughter." ―z9vown

If there was one theme to the hate comments, it appeared to be that parents should not "enable" teenage drivers to own a new car and begin a life of paycheck-to-paycheck car debt. In short, a parent should see to it that the kid's first car should always be an affordable beater before eventually moving on to a new car sometime in the future.

Hey, I get it. I drove beaters while in the military and then college and post-graduate up till I turned 30 when my spouse and I bought our first new car―a Toyota Corolla.

But to begrudge someone with the means to own a new car is misplaced anger.

And it's not helpful to the OP asking for advice.

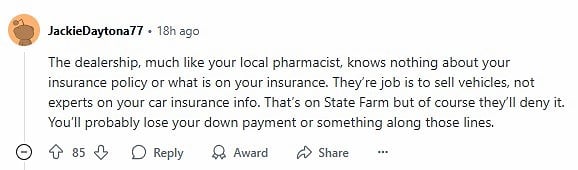

However, the mom did lash out at the car dealer; her anger was misplaced as well.

As it turns out, the insurance company quote was not atypical.

I got quoted a very similar price from State Farm. Check with National General. Was able to get a policy for about $360/month for the first year. After almost two years of driving, I'm down to $250/month (with an older experienced driver on the policy as well)." ―soaringphoenix04

The Mom and Daughter's Mistake

To be fair to some of the comments, there were mistakes made by the mom and daughter―Not adequately preparing themselves before buying the car.

1. It is a fact of life and statistics: Younger drivers pay more for car insurance than older drivers. The primary factors for teens receiving higher premiums include a higher likelihood of accidents, distracted driving, and riskier behaviors in general.

The fatal crash rate per mile driven for 16-19-year-olds is about three times higher than it is for drivers aged 20 and older. The risk is highest for 16-17-year-olds. ―Yahoo Finance

And, insurance premiums are based on multiple factors such as the state you live in, credit report history, sex, car model, demographics, etc.

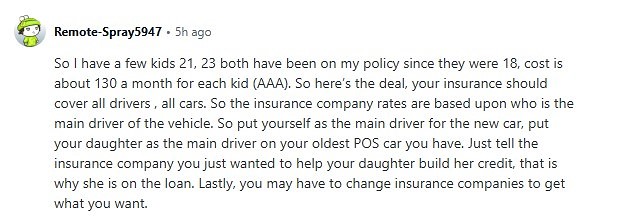

2. Younger drivers who OWN their car are going to pay substantially higher premiums than if the parent owned the car. If the mom had talked to other parents, she would have known beforehand that most parents save themselves and their kids a significant amount of money by having the car title in the parents' name and having their kid's insurance policy added to theirs.

The Solution to Mom's Problem

Several comments reiterated that mom needs to shop around and find a better deal for her daughter's insurance costs. This is good advice for not just a teen driver but everyone who drives regardless of their age or risk paying too much over time.

However, one especially helpful solution suggestion comes from thread poster cbradio1221:

Best bet is for you to buy the car from your daughter. As in takeover payments and remove her name from the title. The salesman should have warned you about putting it in her name before she's 25. Insurance will be borderline insane. She can still make the payments but the car will legally be yours so insurance will list you as primary driver. I bought several cars before I was 25 but not a single one was legally mine on paper."

To me, this is a win-win solution. The daughter gets to "keep" her car, and the mom does not have to worry about her daughter having to pay so much on insurance just because she is a teenager.

Like most parents I know, when it comes to kids and their cars, it is considered good parenting if you help them buy a car (under the parent's name, of course) with the proviso that the kid works and pays for their share of the insurance the parent wound up added to their premium―or some version of this depending on the family budget.

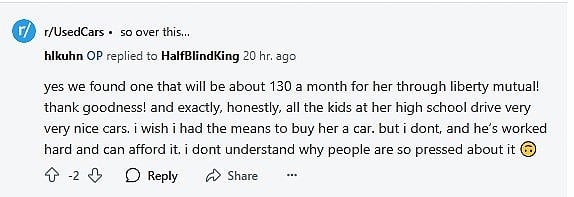

So, what did the mom do? It turns out she followed the "shop around for a better insurance deal" advice for her daughter, and now a financial tragedy has been successfully averted:

Are you a parent facing or having faced a similar situation? Or, do you have a better solution? Let us know about it in the comment section below.

For additional related articles about teens and cars, here are a few for your perusal:

- Insurance Companies Can Retroactively Cancel Your Policy After an Accident Warning

- Best Cars for Teens Recommended by Consumer Reports

Coming Up Next: The Toyota Rav4 Accessory From Costco That Looks Like It Was Made For a Rav4 ―"The Way It Fits Is Just So Perfect"

Timothy Boyer is an automotive reporter based in Cincinnati who currently researches and works on restoring older vehicles with engine modifications for improved performance. He also reports on modern cars (including EVs) with a focus on DIY mechanics, buying and using tools, and other related topical automotive repair news. Follow Tim on Twitter at @TimBoyerWrites as well as on Facebook and his automotive blog "Zen and the Art of DIY Car Repair" for useful daily news and topics related to new and used cars and trucks.

Image Source: Deposit Photos

Set Torque News as Preferred Source on Google