The idea behind using federal tax reduction incentives to spur green vehicle sales and production for the US market had merit when it was introduced decades ago. The general goals were to make the pricey cars more attainable for mainstream buyers and give automakers some time to reduce the cost of extremely expensive EV battery technology. It’s easy to say both goals have been achieved. Here's our look at why adding more federal EV tax incentives is ridiculous given today's American car market.

Are Affordable Electric Vehicles Available Now Without New Federal Tax Incentives?

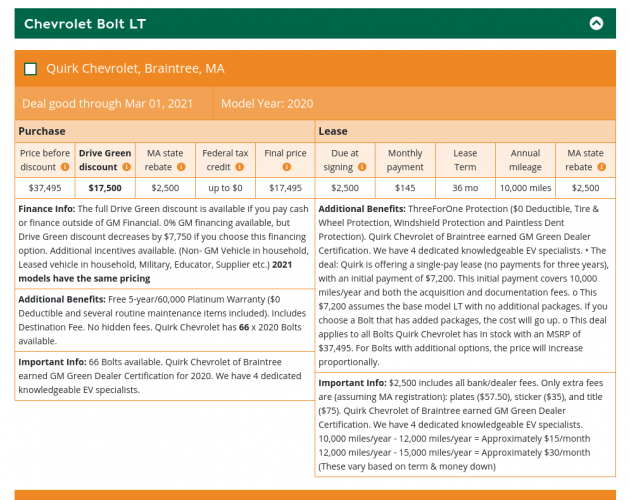

There is no doubt that electric vehicles are now available to the masses at a very affordable cost to the consumer. The Chevy Bolt no longer qualifies for federal tax incentives, GM being among the first automakers having reached its maximum volume for them to apply. Why would GM need new tax incentive support to provide a low-cost entry electric vehicle with class-leading range? The current Chevy Bolt is available in all US markets and it presently sells for less than $20K in its LT trim. After state incentives like those in Massachusetts, buyers can take home a new Bolt for as little as $17,500. There is no equivalent gasoline-powered vehicle in the Bolt’s class that costs less.

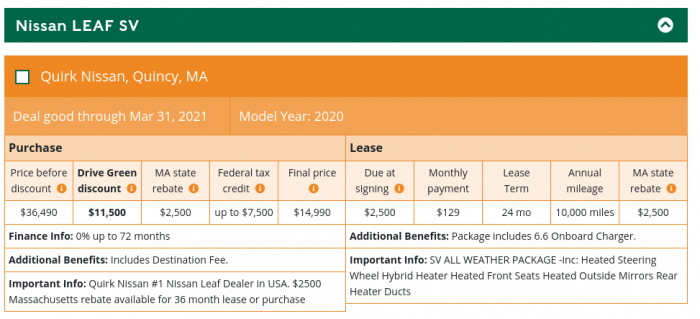

The Nissan Leaf Plus is also available for a cost to the consumer with current EV incentives for near $20K. The base Leaf has a price after existing state and federal rebates in Massachusetts of $14,990 (NEW, not used!). These are cars that reviewers find much to like about, at prices already less than similar gasoline-powered cars. Those who want more choices can look for a Kia Niro EV, Hyundai Ioniq EV, both of which also are priced in the low $20Ks.

Related Story: Republicans Include Electric Vehicle Tax Benefit In New Tax Law

Those shoppers for whom an at-home charger is not available can choose multiple plug-in hybrid-electric options with prices in the low $20Ks. The Prius Prime and Hyundai Ioniq PHEV are easy-to-name examples. Both have costs in the low $20Ks today.

Without any changes to the current tax incentives, there are at least five brands offering low-cost to the consumer electric vehicles. Why are new tax incentives needed to cover this end of the marketplace?

Many Brands Are Going Electric Anyway

Well over a year ago, GM’s President stood at a podium and announced that “GM’s all-electric future was now.” He went on to elaborate on how GM had already made the decision to shift to all-electric vehicles and then detailed all of the plans for new and repurposed factories GM was building. By all reports, those plans are ahead of schedule. GM announced a refreshed Bolt this past month and added a Bolt EUV with more room for family buyers. Up next will be EV SUVs and trucks from Hummer and also GM’s own brands. If GM is selling low-cost EVs now and already has committed to going all-EV in the immediate future, why does GM need a tax incentive change in 2021?

GM is not alone. Jaguar has announced that by mid-decade, just four years from today, Jaguar will only offer battery-electric vehicles. Today, its excellent I-PACE is not just a great Jaguar EV, but a great Jaguar. It was the template from which Tesla and Ford built the Model Y and Mach-E.

Rivian is planning to launch its R1T all-electric truck in June. Rivian is doing so with or without any changes to the federal tax code. The company will already enjoy a decade of huge tax incentives from the current EV tax law. Aptera, Lucid, Bollinger, Fisker, and others are all also planning to launch all-electric vehicles this year and all of them will already have massive tax incentives under the current tax code that will last many years.

States Are Planing to Mandate All Vehicles Be Electric - Will ALL Cars Have Big Tax Breaks?

One by one, the US states are setting expiration dates for internal combustion-powered vehicles. If the states are going to make all cars EVs, then why do we need to add tax incentives? Why do the automakers need this corporate welfare if Tesla has already shown that building EVs can boost stock prices and be done profitably?

States Are Throwing Support Behind EVs

Although lower carbon emission levels from vehicles is a good thing, air pollution is mostly local. So why don't states with local air pollution problems support EVs with price supports? In fact, they do. California has for over a decade, many other states such as Massachusetts offer thousands in EV incentives and in New York, Assemblymember Patricia Fahy's bill recently introduced legislation (bill A.4761 ) to provide a $35,000 EV tax incentive. You read that right. A tax incentive worth 50% more than affordable EVs actually cost.

Why Do Sold-Out Electric Vehicles Need Additional Incentives?

The three hottest electric vehicles in America today are the Tesla Model Y, Ford Mustang Mach-E, and the Toyota RAV4 Prime. All sell out before they arrive on the delivery lot. There is no inventory and buyers cannot get enough of these crossovers priced from the mid $30Ks to the $60K range. Why do EVs need added incentives if the ones that are being launched today and over the past year are selling out?

Why Do EVs That Sell Above Sticker Price Need Tax Incentives?

Many buyers are finding dealer markups above MSRP for the RAV4 Prime. Mustang Mach-E buyers have posted window stickers with $10K markups. Why do vehicles in such high demand that shoppers will pay over sticker prices for them need added tax code support?

Tesla sells every vehicle it produces in America and has never suffered from excess inventory. Discounts on Tesla vehicles are so rare it is big news when they are offered. Tesla, Toyota, and Ford all have customer waiting lists for their EVs spanning months. Why do automakers with waiting lists for EVs need more help?

Should American Tax Dollars Subsidize Imported Electric Vehicles?

Will American unions cheer for extended incentives on vehicles that automakers build in low-cost labor markets outside of America? The Mustang Mach-E is imported from Mexico. Jaguar’s I-PACE, the Toyota RAV4 Prime, all of Kia and Hyundai’s EVs, and Mitsubishi’s Outlander PHEV are all built exclusively outside of America. The PoleStar 2 is imported from China. Why should Americans directly subsidize the profits of automakers who opt not to use American labor to build EVs?

Should Americans Subsidize Performance Vehicles?

Tesla and Ford presently sell electric performance electric vehicles in the US. Tesla's most recent update to the model line is an ultra-high-performance variant of its $130K Model S. One of its upcoming cars is a supercar Roadster Tesla says will be capable of a sprint to 60 MPH faster than any other car. There is no “need” to go 0-60 MPH in under 2 seconds. It is almost impossible to find a place in America where it is legal to do so. Should the American tax code be altered to boost the profits of automakers for the further development of pricey electric performance vehicles?

Related Story: About Two-Thirds Of Electric Vehicle Tax Credits In 2018 Went to Luxury Car Buyers - Over Half Went To Tesla Buyers

Should Luxury-Priced EVs Be Subsidized By New Taxpayer Incentives?

The current tax code allows millionaires and billionaires to enjoy tax breaks when they buy pricey EVs. When the Rivian and Lucid products arrive, they will not offer any family vehicles priced below $40K. These will all be high-performance luxury vehicles and they will all come with a $7,500 federal tax incentive for the well-heeled buyers who will proudly display their commitment to stopping climate change by driving a fancy luxury EV. With such examples of the way the good intentions that EV tax incentives have gone off the rails, do we really need more such incentives for a longer period of time?

New changes to the current tax code that subsidizes EVs will primarily impact two automakers. They are Tesla and GM. Tesla already sells every EV it makes at a profit (if its SEC filings are to be believed) and has the largest stock valuation of any global automaker. In anticipation of the coming tax incentive changes, Tesla increased its prices by up to $10,000 this week. GM is planning huge, massively powered vehicles for wealthy individuals. Why do these two automakers need changes to the tax code in order to succeed?

Since low-cost family EVs are already being sold with a sub-$20K cost to budget shoppers, why are changes needed to the tax code to "help EVs?" Feel free to offer your opinions in the comments below.

John Goreham is a long-time New England Motor Press Association member and recovering engineer. Following his engineering program, John also completed a marketing program at Northeastern University and worked with automotive component manufacturers. In addition to Torque News, John's work has appeared in print in dozens of American newspapers and he provides reviews to many vehicle shopping sites. You can follow John on Twitter, and view his credentials at Linkedin

Set as google preferred source

Comments

I am a big EV fan, and own a

Permalink

I am a big EV fan, and own a pair of longer range EVs, but fully agree that we have passed the need for large subsidies. I would support a smaller (5K) incentive for low cost EVs to migrate the less weathy parts of the country. This would then apply to cars with an MRSP of under $25,000 with some reasonable income limits (say family income of under 100K).

That seems very reasonable,

Permalink

In reply to I am a big EV fan, and own a by Doug (not verified)

That seems very reasonable, Doug.

My take is that the big

Permalink

My take is that the big discounts are so that automakers can grow the sell of EVs to a much larger percentage than ICE vehicles as quickly as possible, then use the low take rates of ICE vehicles as the reason to stop making them.

And they'll spin it as "that's what everyone wants", when the truth is they just stacked the deck to get the outcome they wanted. Then, once there's no real competition to EVs, the incentives will go away and prices will rise.

I haven’t determined where

Permalink

I haven’t determined where the authority to take money from some, by force, to be given to others, lawfully originates. The described action is theft – not significantly

different than being mugged in a dark alley.

Most people point to the

Permalink

In reply to I haven’t determined where by Mark Day (not verified)

Most people point to the sixteenth amendment to the US constitution passed in 1909 to answer that.

If the 16th amendment is

Permalink

In reply to Most people point to the by John Goreham

If the 16th amendment is meaningful, then where is the Amendment giving control of the auto industry to bureaucrats,

i.e., fuel economy, emissions, “safety”, etc.?

Any long-lasting subsidy is

Permalink

Any long-lasting subsidy is not fiscally sound. A subsidy should be designed to steer companies and individuals in a specific way to achieve a specific goal. I would certainly argue that the current credit is only reaching the wealthy, and that might have been alright in the beginning. But we have not reached mass adoption fast enough to stave off the oversupply of CO2 we have pumped into the atmosphere in the last 200 years. If we had an asteroid hurtling toward the earth that was destined to destroy even ten percent of life as we know it, I would hope people would not be arguing over the fiscal responsibility of stopping it. This is what it comes down to. Steering investments to stop the asteroid.

An outstanding way to explain

Permalink

In reply to Any long-lasting subsidy is by Mark (not verified)

An outstanding way to explain it, Mark. Thank you for adding this perspective. My feeling is that if think the situation is that dire, we should simply mandate all vehicles meet a specific MPGe or carbon target by 2025 and let the automakers work out the details without more fiddling with tax-based price adjustments. After all, Tesla is profitable without tax incentives, its stock soaring, and it only makes EVs. GM and Jaguar are already committed to a similar plan without any changes to the tax code needed. Automakers have had decades of price supports to bridge the technology gap. And yet, we still see new V8 gassers being launched.