Cox Automotive / KBB has just updated the January average transaction prices (ATPs) by brand, and the picture is not pretty for Tesla. The average price paid by a consumer for a Tesla has plummeted by over 20% year over year. This is almost unprecedented in automotive history. No other brand suffered a decline in price anything like what Tesla has seen over this same time period. By contrast, shoppers have been paying more for Toyota vehicles this past January than they did 12 months ago.

Related Story: Auto Dealers Jacked Up Prices During the 2020-2023 Vehicle Shortage - And So Did Tesla

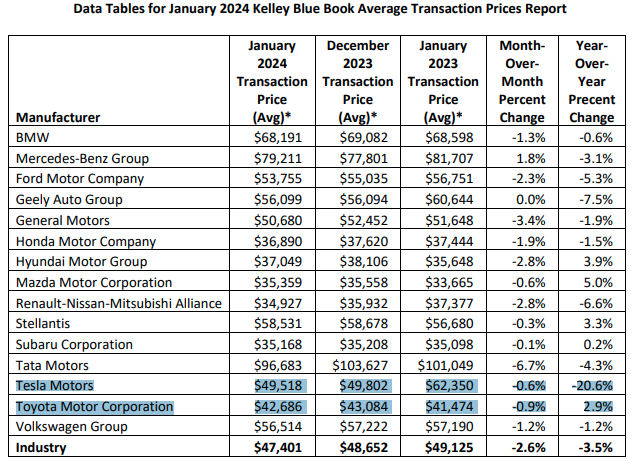

The data compare the average transaction prices overall for each brand. Tesla’s average transaction price dropped from $62,350 in January of 2023 to just $49,518 last month. That is a whopping 20.6% decline. The total industry average is about a 3.5% decline.

While Tesla has had to slash prices to move vehicles, Toyota has seen its average transaction prices go up. The world’s leader in green vehicle technology recently added two new and rather pricey models, each with multiple green hybrid powertrain options. Toyota’s average transaction price in January of 2023 was $41,474. Last month, the brand’s ATP was $42,686. That is a 2.9% increase. Toyota is earning more per transaction this year than last, and Tesla is earning dramatically less per transaction.

Over the past year, prices have trended downward and automakers have started to offer price incentives once again. “Prices have been trending downward for roughly six months now as automakers are sweetening deals to keep the sales flowing,” said Erin Keating, executive analyst for Cox Automotive. Toyota, Mazda, Subaru, Stellantis, and Hyundai bucked the trend and saw their brand’s overall ATP increase. However, within the individual brands there are some incentives being offered. For example, Hyundai was recently highlighted by EV-advocacy publication Elektrek for offering up to $15,000 off certain Ioniq5 EV trims.

“First and foremost, the overall narrative is unchanged – EV prices have come down significantly in the U.S. in the past year, led by price cuts at Tesla,” said Mark Strand, senior director of Business Intelligence at Cox Automotive. “Our newly revised EV pricing data more accurately reflects the real-world pricing of electric vehicles in the U.S. With new EVs launching into the market seemingly every month, our pricing models have to be continually updated and revised to capture a clear picture of the market.”

Tesla offers the easiest example of EVs to point to, but almost every automaker now has vehicles equipped with battery-electric, plug-in hybrid-electric, and hybrid-electric powertrains across their portfolios. Cox Automotive offered a snapshot of the staggering incentives automakers are resorting to in order to continue moving EVs off lots.

-In January of 2023, VW ID.4 carried an average incentive package equal to approximately 6% of ATP; last month, incentives jumped to nearly 17% of ATP.

-Nissan’s Leaf saw incentives jump throughout the past year from 8% to nearly 18%; Ariya incentives are higher still.

-Hyundai Ioniq5 incentives climbed from less than 3% in January 2023 to more than 18% last month.

Here is a link to Tesla's discounted new vehicles page.

Cox summarized the industry’s use of added incentives by saying, “...higher inventory and slowing sales have pushed automakers and dealers to layer on the discounts in an effort to spur sales.”

The most recent data provides more evidence of the softening of the EV market. More and more vehicles with battery-electric powertrains will continue to be delivered. They must. BEVs are mandated by multiple states, including California, the country’s largest automotive market. However, automakers are apparently suffering declining profits and dropping ATPs as a result of these EV mandates.

You can read the Cox/KBB summary here.

John Goreham is an experienced New England Motor Press Association member and expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. In addition to his eleven years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can follow John on Twitter, and connect with him at Linkedin.

Chart of average transaction prices courtesy of Cox/KBB. Top of page image by John Goreham.

Set Torque News as Preferred Source on Google

Comments

I see Tesla price drops as…

Permalink

I see Tesla price drops as being only good news for EV buyers. Especially when the $7500 federal subsidies bring the base Model Y net price down to $35,500, which is unprecedented. Tesla always had a thick profit margin, which resulted in better profits. But they are now trading some of that profit margin for a more competitive market position and better sales, in this market with higher interest car loans reducing sales overall. Admittedly, Toyota did edge out Tesla with a slightly better profit margin for 2023, but Tesla's Model Y became the best selling vehicle in the world at the same time. Which is a remarkable achievement.