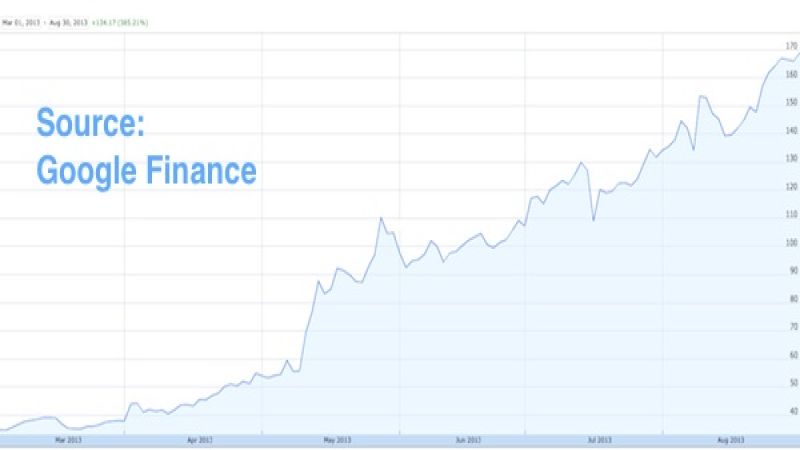

On Friday, shares of Tesla Motors (TSLA) had a last minute surge to close at $169/share, nearly breaking through the $170/share level. The stock has more than quadrupled in value since March, less than 6 months ago, thanks to a string of good news. In a CNBC interview recently, DoubleLine Capital's Jeffrey Gundlach said it wasn't a good idea to short-sell TSLA even though the gains look irrationally excessive.

Normally one of the signs where it's safe to short-sell a stock is when exuberance has pushed the stock price beyond credibility. In theory one sells a stock short when they believe the stock is overvalued, because they'll then make money when the stock price eventually falls.

If Tesla is caught up in a hype bubble, the stock price should deflate once the bubble is burst, right? Hence, by that reasoning one should short-sell TSLA.

That's what we asked the other day: Tesla's rising stock price either hype or predicts car industry disruption

A few days before that, Elon Musk said in an interview "Our stock price is obviously far too high" before going on to explain that with the current price for Tesla Motors stock, the company has to truly and deeply disrupt the automobile industry in order to live up to investor expectations.

So then why does an investor of Gundlach's caliber suggest it's not a good idea to short-sell TSLA when signs indicate it's a good idea? “I’m scared to death to short Tesla,” Gundlach said speaking on CNBC. “It’s a cultish stock and who knows where it goes?”

That's one reason to not short-sell TSLA even if you think it's caught in a hype bubble. How far do you think the bubble go?

Set Torque News as Preferred Source on Google