Automakers rarely offer open and forthcoming thoughts about battery-electric vehicle profitability, but in an interview with CNBC, Paul Jacobson, General Motors' Chief Financial Officer, has done just that. Although he tried to sound optimistic about EVs and did speak the party line about GM’s EVs being in a good position relative to the competitive landscape, he said out loud what most automakers would only say quietly and off the record. EVs are unprofitable, future hopes for profitability were tied to an expansion of EV demand, and EV demand is now expected to evaporate. The section of the interview related to electric vehicles interview begins this way:

CNBC Host: “Paul, you took a special item impairment charge, basically $1.6 billion for your EV business. Did you make money on EVs? Were you profitable, making money on EVs in the third quarter?”

Mr. Jacobson: “No.”

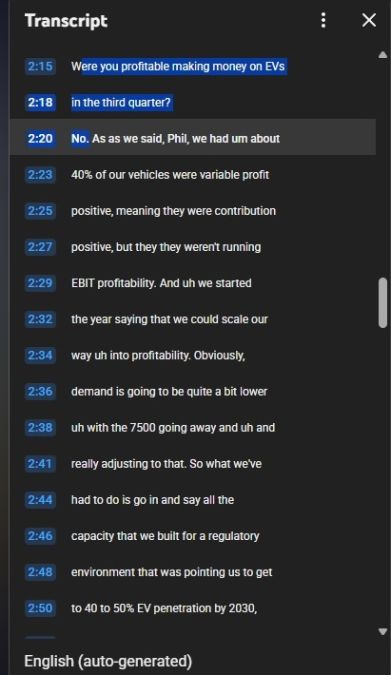

You should watch GM’s CFO quickly expand the answer, but here is a transcript of what he said immediately after the question.

This is a stark admission that almost three decades after GM’s EV1 was launched, the company has still not found a way to make a profit on battery electric vehicles. Particularly since GM’s President, Mark Reuss, said in early 2017, “...we're going to be the first company to (produce) electric vehicles that people can afford at a profit.” Twenty-nine years since GM’s first battery-electric vehicle was delivered to consumers and eight years since its president promised to be first to EV profitability, and the company is still not making a profit on EVs?

Bear in mind that during the quarter in which GM’s CFO admitted to losing money on EVs, the federal government was subsidizing EVs with $7,500 tax incentives, and offering even larger back-end subsidies in the form of mandated ZEV credits. These were coupled with state incentives that were as high as $5,000. Even with subsidies of 30% or more, EVs were still losing money for GM and its shareholders.

Now the federal incentives are gone. Here’s the most essential part of the information Mr. Jacobson offered:

Obviously, demand is going to be quite a bit lower, uh, with the 7500 going away and uh and, really adjusting to that. So what we've had to do is go in and say all the capacity that we built for a regulatory environment that was pointing us to get to 40 to 50% EV penetration by 2030, that's likely not going to be there. So by going in and really re-evaluating our footprint, uh and, our total capacity for what demand is going to naturally uh grow to over the next several years, uh we've had to pull that back a little bit and that's the reason for the restructuring charge. What that will do is allow the vehicles to uh be able to improve in their profitability, and we think it gives us a longer runway to be able to get there.

GM’s Profitability Timeline Grows Longer

The host then seeks to add some clarity to the convoluted answer offered by Mr. Jacobson, asking, “And so just to be clear here, that's further out in terms of full profitability, or you're not putting a timeline at this point?” Mr. Jacobson replied as follows:

That's correct. You know, as what we saw this year, you know, we had originally talked about improving our profitability by two to four billion dollars this year on electric vehicles. that was going to be subject to some pretty significant uh EV penetration and share growth uh going forward. But as we see demand is um is going to come down, um, with the cessation of the $7,500 (federal tax incentive). We've got to streamline that capacity.

Translating this into plainer language, Mr. Jacobson is saying that GM relied on subsidies to create artificial demand for EVs. The company based its profitability estimates on this artificial demand for growth of EVs, but now the demand is expected to “come down,” to use his exact words. Therefore, GM must cut its battery-electric capacity and expenditures to stop the bleeding. It just took a $1.6 billion hit, and may move to cut more EV capacity. For example, killing its Canadian-made BrightDrop EV van product line.

Throughout this overview, we’ve opted to use YouTube’s transcript of the conversation, rather than listen and try to translate some of the unclear words. Please do give the interview a listen yourself to form your own impression. We’ve dropped direct links to the source lower in the story.

GM Admits to Losing Money On EVs Despite Decades of Taxpayer Subsidies

Our takeaway from this interview is that a major automaker, often called one of the leaders in electric vehicles, has admitted that it is not making a profit on fully-electric automobiles, and was not profiting even when full EV subsidies were in effect.

Prediction for Q4 and 2026 - EV Market Share Drop

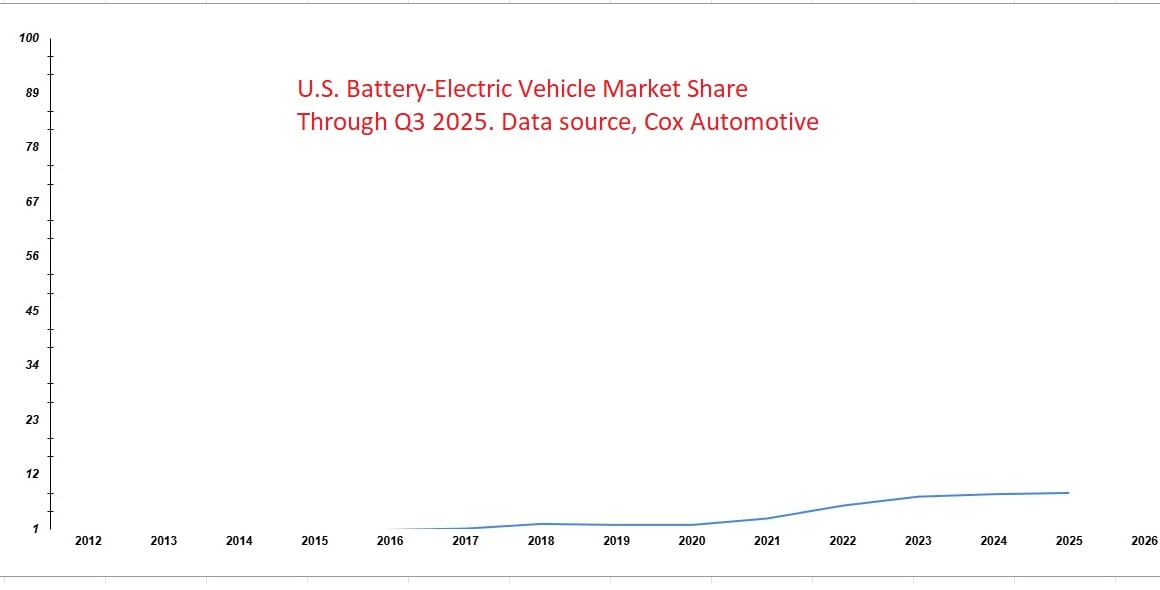

The bigger news from this interview is that GM has officially stated that it expects to see battery-electric vehicle demand “come down” going forward. Our analysis of the U.S. battery-electric vehicle market indicates that market share will rapidly decline to levels not seen since 2022.

Before the feeding frenzy in Q3, when federal subsidies were still in place but scheduled to end on September 30th, U.S. EV market share had leveled off to around 8%. That means that 92% of American shoppers opted not to buy an EV when shopping for a new vehicle. We predict that in Q4, about 96% of shoppers will opt not to buy an EV, and that in 2026, it will likely hover around 95% of shoppers opting not to buy a BEV. We expect the EV share to end up at about 7.5 to 8% for all of 2025 at year's end and to be about 5% in 2026.

The Future - Battery-Electrics Down, More User-Friendly Green Vehicles Up

Please do not take this prediction as our preference or our wishes. Also, don't assume we mean green vehicles will be less popular moving forward. To the contrary, electrified vehicles such as hybrids from automakers like Toyota, Hyundai, Kia, and Ford will continue to gain traction. Hybrids have already outpaced EVs in both total numbers sold and rate of growth. That will continue, and plug-in hybrid-electric vehicles will play in the fringe space between “hybrid” and “BEV.”

We will offer our readers two easy ways to watch the interview with General Motors Chief Financial Officer, Paul Jacobson. The links below will take you directly to the interview. We prefer the YouTube version, since one can view the running transcript on the right side of the screen. It helps sort out some of the unclear wording.

TikTok

YouTube

Do you think other automakers will come forward with honest predictions about EV profitability, or will automakers aside from Tesla pretend there is money to be made in U.S.-market battery-electric vehicles? Tell us your thoughts in the comments below.

Top of page image courtesy of Chevrolet media page, transcript screenshot of CNBC interview courtesy of YouTube.

John Goreham is the Vice President of the New England Motor Press Association and an expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. He is a member of the Society of Automotive Engineers (SAE int). In addition to his fourteen years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can connect with John on LinkedIn and follow his work on his personal X channel or on our X channel. Please note that stories carrying John's by-line are never AI-generated, but he does employ grammar and punctuation software when proofreading and he also uses image generation tools.

Comments

And there lies the problem…

Permalink

And there lies the problem and why Tesla is in a great position. Profitability.

Excellent point, Tim. It…

Permalink

In reply to And there lies the problem… by Tim Lauro (not verified)

Excellent point, Tim. It will be very interesting to see how Tesla's profitability looks if automakers are not required to purchase/trade ZEV credits in the future. Or at least for the coming three years and four months.