News Update on 4/21/2011, 12:25 pm ET: The 3-day work-week has been confirmed. Please read "Toyota announces production cuts in June" by Patrick Rall of TorqueNews.com

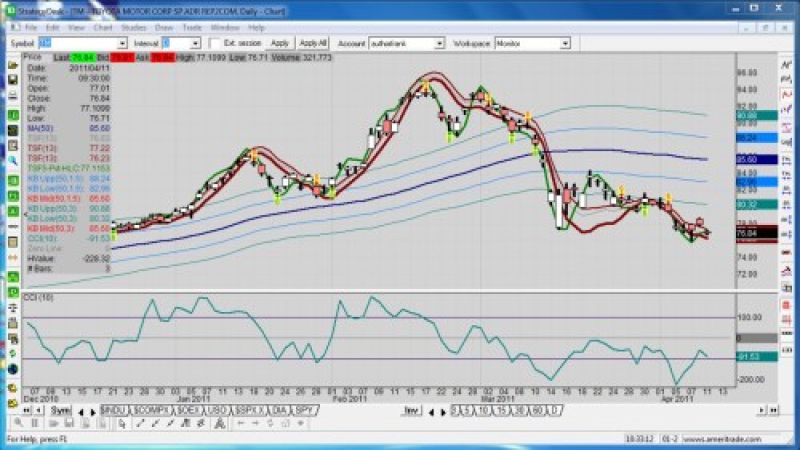

The stock chart has shown a downtrend ever since the earthquake. And the recent news may indicate the schedule could last through June, according to one assessment on CNBC.

Another fact is, Bloomberg reported Toyota Motor Corp. (NYSE: TM), the world’s largest carmaker, may lose production of an estimated 35,000 vehicles at its 13 North American factories between March 11 and April 25 simply due to a shortage of key components from Japan.

Furthermore, Bloomberg reported the Toyota City, Japan-based company plans to suspend production on April 15, 18, 21, 22 and 25 at its plants beyond the U.S., that will include Canada and Mexico.

Toyota Stock

As an auto stock tracker, Torque News reports mainly on events that affect production on automakers. From a fundamental analysis viewpoint, any production cutbacks, regardless of the reason, has a negative affect on earnings and the price of stock going forward. Such is the case with Toyota stock which traded above 90.

For the record, Toyota stock had shown a pattern of higher highs and higher lows after the U.S. government announcement that Toyota electronics were not the cause of unintended accelerations. Since that time, though, the earthquake in Japan has affected production for key parts being shipped around the world from Japan.

Since the stock’s double top at the end of February in the 94 range, Toyota stock has languished down to its present level below 77. The chart shows the stock trading well below its 50-day moving average, a key technical tool that traders use to define bullish and bearish positions.

For the record, the 10 day CCI indicator (Commodity Channel Index), has been below the zero line since early March. For traders, the CCI will have to move above the zero line to be bullish.

Disclosure: Frank Sherosky, creator of the chart and author of "Awaken Your Speculator Mind" does not hold any stock or option positions in this equity at this time.

---------------------------------------------------------------------------

About the Author: After 39 years in the auto industry as a design engineer, Frank Sherosky now trades stocks and writes articles, books and ebooks via authorfrank.com, but may be contacted here by email: [email protected]

________________________________________________

Additional Reading:

Jobs Report not affecting auto industry as much as dollar, earthquake and oil

GM $30M investment in Pontiac Stamping Plant targets Chevy Sonic and Buick Verano

Volkswagen transparent factory in Dresden symbolizes quality build of Phaeton

Auto industry compromise with expensive EVs fails the masses

Scuderi Air-Hybrid Engine technology setting up to challenge electric hybrids

Cella Energy achievement may make hydrogen fill-up a reality

Stop-start technology to advance more micro hybrids by 2016

Four alternate engine technologies for 2011 and beyond

Set Torque News as Preferred Source on Google