Shoppers have begun to post comparisons of electric vehicles side by side with text expressing confusion and frustration over why one EV earns a tax credit and another does not. In some cases, the confusion has spread to electric vehicle advocacy media. Much of the confusion stems from a lack of understanding of why certain EVs now qualify for a federal tax incentive.

Today’s Goals and Objectives For EV Tax Incentives

The new EV tax incentive law that went into effect late last year has two main goals. First, the EV tax incentives are an indirect financial payoff to American automotive unions that helped elect President Biden. Don't take our word for it. In a summit at the White House applauding EV leaders, union leaders were invited, and President Biden thanked the UAW for its financial support during his campaign. President Biden’s remarks included, “I want to say something else up front: I’m standing here because, about 180 years ago, when I first got elected to the Senate, Gov — (laughter) — the UAW elected me.” and when referring to the most recent election, he thanked UAW President Ray Curry directly, saying, “The UAW brung me to the dance.” Tesla, the clear leader in American and global electric vehicles, was not invited to the event.

If you doubt the union aspect of the new EV tax law, remember the original bill that became law added a $4,500 tax incentive on top of the $7,500 incentive if the vehicle was made in a union factory. That was so blatantly ridiculous it was removed. Instead, the individual models that would be eligible were configured as best as could be to cover American union-made EVs.

The second objective is income redistribution. It’s not just certain EVs that qualify for tax incentives but also certain shoppers. If you are hard-working and have earned a high income, you are likely not eligeble. This is accomplished in the new EV tax incentive law by simply excluding the folks who have the most money to pay for pricey EVs. If you earn over a certain amount, say what a doctor alone might earn or a nurse and a state trooper might earn together in one household, you cannot take advantage of any EV tax incentives. Perhaps a conventional gas-powered vehicle is the better option for those families. Furthermore, the new law places limits on pricey EVs. Expensive ones are simply excluded. If the main goal of the EV tax incentives was to reduce emissions and spur purchases of EVs over gas-powered cars, encouraging folks with lots of money to buy a lot of pricey EVs might seem like a slam dunk.

It’s easy to understand why the folks who wrote the new law wanted to exclude the folks we want to punish in America - the hard-working and successful - but the law’s income redistribution goals come with a real head-scratcher. It also excludes low-income earners. Those who don't earn enough money to take advantage of the tax deduction from their taxable income also don't get any incentive. So, the law excludes both high earners and also low earners.

EV Tax Incentive Goals Proven In a Single Example

Steven Loveday is a principal at Inside EVs. He’s been an EV expert and content creator for a long time and has the respect of all of his peers (including your author). He recently created a great story that highlights how a plug-in hybrid Ford, which Mr. Loveday calls a “polluter and a gasser,” is eligible for a tax incentive, but a similarly-sized purely electric Ford model is not. As it turns out, the model Mr. Loveday says does qualify is made by employees represented by the United Auto Workers in Kentucky. The fully-electric vehicle is not made in a plant with UAW representation of workers and is not eligible. . My Loveday concludes, “As it currently stands, while the credit may help consumers afford more efficient vehicles, it's not set up to help the environment…” Mr. Loveday tells the tale better. Be sure to read his well-written story here.

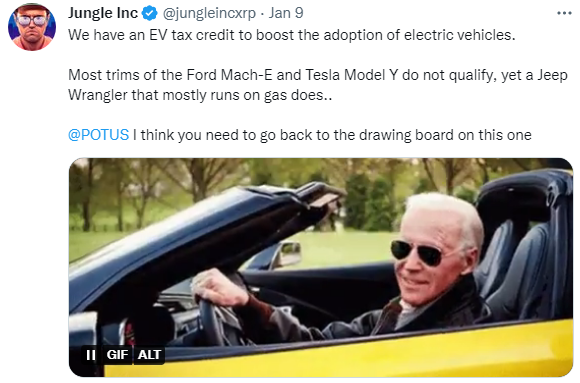

Twitter is now filled with examples of models that folks feel should qualify vs. models that should not but do. Here is a great example: This post is perfect because it compares two purely electric models to one that uses gas. Can you guess which one is made in a union plant? Yup, the gas-powered one that qualifies. The tax credit clearly pays back union political donations. It was not intended to save the environment.

Particulars On the EV Tax Incentive

Only your tax preparer can tell you if you may qualify as an individual for EV tax incentives, so we won’t dive too deeply into the financial aspects of the new law. As to which cars the EV tax incentive applies to, it depends on a few things. Where the car is made, when, and where its battery comes from. All of that is pretty hard to track, so we won’t bother with a list of models. After all, the list changes based on time. You can run the vehicle identification number on a government-provided website to see if it qualifies. If you are ordering an EV, best of luck with that since your VIN has not yet been created for checking. You’ll just have to guess.

The Old Law’s Goals Were Met

The old EV tax incentive law had a couple of goals, and they had to do with the environment and corporate welfare. The idea was that EVs were not going to be popular priced at what automakers would have to charge, so they would get a subsidy to make them more of a value. One that shoppers could accept and would agree to. The companies would be able to sell the EVs easier and at higher prices.

These goals proved to be met, and then some. EVs over the past three years have all been sell-outs. There have been no EVs on dealer lots awaiting buyers—quite the contrary. Many EVs were purchased by shoppers willing to pay massive markups. $20K was not uncommon. Every EV produced over the past few years of the last EV tax incentive’s coverage period was sold out and back-ordered for many months. We had a great comparison to see if the subsidies mattered. Tesla. That particular brand ran out of its EV tax incentives early on, yet Tesla models were the ones in the highest demand. They sold tremendously well with zero subsidies alongside models that were getting subsidies of as much as $7,500.

Here Are Some Resources To Help You Understand the Finer Details of EV Tax Incentives

NPR - Buying an electric car? You can get a $7,500 tax credit, but it won't be easy

Observer - Popular Tesla Models Are Not Eligible For Biden’s New Electric Vehicle Tax Credits

Kiplinger - Tax Credits for Electric Vehicles Are About to Get Confusing

No income redistribution or political donation payoff scheme is perfect. The EV tax incentive plan now in use isn’t either. But it does its best to ensure that the most successful and least successful EV shoppers are excluded, and that plants that have UAW representation are rewarded with taxpayer subsidies on the vehicles they produce. Feel free to tell us your thoughts on the new EV tax incentive program in the comments below.

Image of Escape PHEV courtesy of Ford. Image of President Biden in a gasoline-powered car courtesy of Twitter and Jungle Inc.

John Goreham is a long-time New England Motor Press Association member and recovering engineer. John's interest in EVs goes back to 1990 when he designed the thermal control system for an EV battery as part of an academic team. After earning his mechanical engineering degree, John completed a marketing program at Northeastern University and worked with automotive component manufacturers, in the semiconductor industry, and in biotech. In addition to Torque News, John's work has appeared in print in dozens of American news outlets and he provides reviews to many vehicle shopping sites. You can follow John on TikTok @ToknCars, on Twitter, and view his credentials at Linkedin

Re-Publication. If you wish to re-use this content, please contact Torque News for terms and conditions.

Set Torque News as Preferred Source on Google

Comments

John G, your article really

Permalink

John G, your article really goes into the weeds. Shorter version: "When a self-governing people confer upon their government the power to take from some to give to others, the process will not stop until the last bone of the last taxpayer is picked bare."