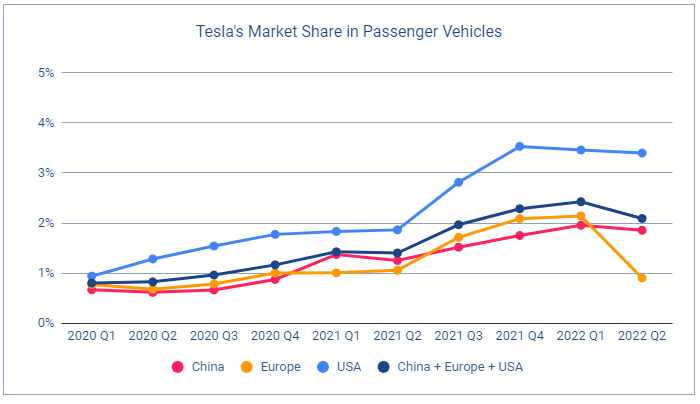

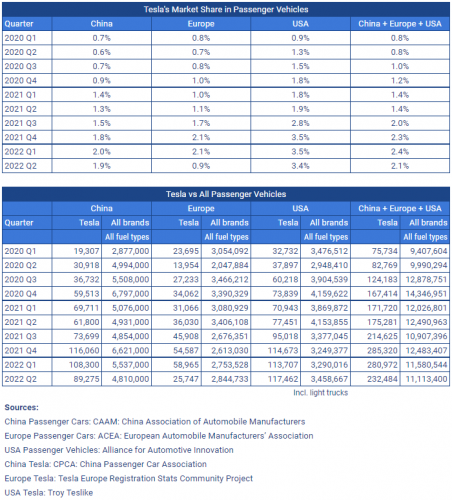

Data tracking Tesla’s market share from quarter to quarter show an unexpected trend. Since Q4 2021, now a year ago, Tesla has seen its market share first slow, then decline. Not just in the U.S. market. Not Just in Europe. Not just in China. Rather, the data indicate that Tesla’s market share is declining in all major markets simultaneously.

TroyTeslike is an online resource for Tesla data we like to follow. This is a source that is decidedly pro-Tesla and pro-EV, so when the data are unkind to the EV world, we feel it is more trustworthy than some other sources.

Background Story By Inside EVs (July 2022): Tesla's Market Share Exceeded 3% In US/Canada In Q2 2022

During the past nine quarters, TroyTeslike’s data show Tesla’s market share rose dramatically in some markets. While still tiny by any standard, the fact that Tesla’s share rose from less than 1% in the U.S. vehicle market to over 3% in about 18 months was big news. It indicated that if the trend continued, Tesla could soon be a company with a U.S. market share meaningfully larger than some notable big-name automakers (VW, for example). However, the curve has now bent in the wrong direction.

We reached out and communicated with TroyTeslike. Our intent was to gain an understanding directly from the source to include in our story. TroyTeslike first wished to point out that the data about to arrive in a few weeks for Q3 and in a few months, Q4, could show how this trend is progressing. It could show a resurgence in market share for Tesla. Or, it may show that the “downward” trend is not just a few quarters in duration, but rather, a year or more.

TroyTeslike also explained that it is no mystery why Tesla’s share dropped. It is because a key factory that supplies the most important and most expensive sub-system of the Tesla models that the company relies on for volume of deliveries was hit hard by COVID. “All Model 3 Standard Range battery packs used at Fremont come from Giga Shanghai,” explained TroyTeslike. “So, Fremont was affected.” TroyTeslaike added, “Also, all battery packs Giga Berlin uses come from Giga Shanghai too. Therefore Giga Berlin was affected too. Of course, Covid shutdowns mostly affected Giga Shanghai too, and they affected exports from China to Europe.”

This is a very viable explanation for Tesla’s strong market share growth to have stalled or declined. However, every automaker leans heavily on China for parts, and isn’t Tesla supposed to be an “All-American car company?” How long will foreign supplier shortage excuses be somehow overlooked for Tesla but not for other manufacturers?

With each passing quarter or year, Tesla fans excitedly share news of the company’s latest milestones in deliveries. Of course, increased deliveries are always a reason to celebrate. However, Tesla is a company in its growth period focused on a market segment that is also seeing growth. So, growth is pretty much to be expected.

Tesla’s growth is a bit unusual for a car company, though. It is all dependent on the Model Y, and to a lesser degree, the Model 3. The X and S are not growing meaningfully and declined in past years, as we we detailed in our prior report, Tesla Model S/X Deliveries Drop By Half to Hit All-Time Low. More importantly, Tesla’s Cyberruck was “launched” years ago, but none have been delivered. The new Roadster is now rather old and also has never been shipped. The EV Semi tractor, which we truly hope succeeds, is unseen on the roadways. And the affordable Model 2 was always a pipedream pushed by publications with a rendering artist to keep busy. Can Tesla sustain its growth on the back of a $70K crossover?

What do you think Tesla’s market share will look like as all automakers begin to emerge from the shortage crisis in 2023? Will Tesla’s share grow, stay at around 3% in the U.S. for the coming year, or decline? Tell us in the comments below.

Image of Tesla retail space with Model Y and Model 3 by John Goreham. Tesla 2022 market share charts courtesy of TroyTeslike. You can follow TroyTesla on Twitter @TroyTeslike.

Data from which market share graphs were derived:

John Goreham is a long-time New England Motor Press Association member and recovering engineer. John's interest in EVs goes back to 1990 when he designed the thermal control system for an EV battery as part of an academic team. After earning his mechanical engineering degree, John completed a marketing program at Northeastern University and worked with automotive component manufacturers, in the semiconductor industry, and in biotech. In addition to Torque News, John's work has appeared in print in dozens of American news outlets and he provides reviews to many vehicle shopping sites. You can follow John on TikTok @ToknCars, on Twitter, and view his credentials at Linkedin

Re-Publication. If you wish to re-use this content, please contact Torque News for terms and conditions.

Set as google preferred source

Comments

This article missed the

Permalink

This article missed the obvious. Tesla's production is running at full capacity and there's a waiting list so long that on some models, Tesla isn't taking new orders. People already have to wait until next year. Production will pick up as new factories open.

The reason for Tesla's market share has nothing to do with demand. It has to do with supply.

Pretty sure that "Market

Permalink

In reply to This article missed the by Haggy (not verified)

Pretty sure that "Market share not having to do with demand" has been true for every brand, every model for over two years. That's why the story never mentions demand. Thanks for commenting.