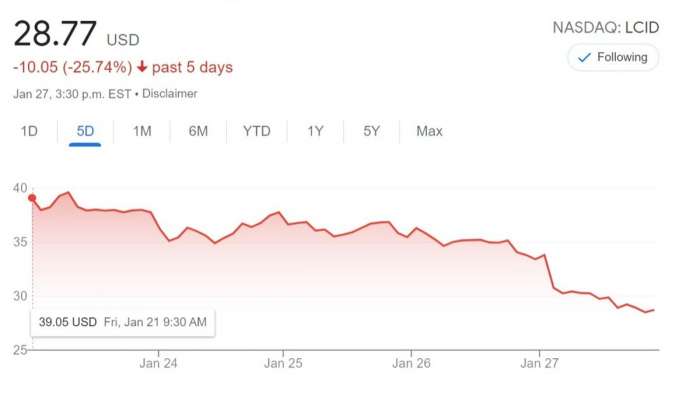

It hasn't been a good Thursday for Lucid Motors, or any of the other major players in the EV market for that matter. Down more than 13% by the end of regular trading, today has been the latest in a series of blows that has seen more than 25% stripped from the Air manufacturer's stock price in the past five days. From the halcyon days of mid-$50s prices seen at the tail end of November 2021, LCID has fallen as low as $28.80 in recent sessions.

Electric Slide

Lucid isn't alone in its current misery, with fellow EV makers Rivian, Nio, and top dog Tesla seeing similar drops in share value over the past few days. Rivian and Tesla are both down by around 15%, while Nio has it slightly worse than Lucid and has seen a 27% fall over the same period. Tesla's slide comes despite reporting its tenth consecutive profitable quarter and exceeding analyst predictions in its Q4 2021 results.

Why It's Happening

As The Motley Fool's Rich Smith recently pointed out, Lucid could be damned either way by Tesla's results. If Musk and Co. report good results and strong sales it means that Tesla has taken an even greater market share and left fewer EV buyers for Lucid, while negative results are emblematic of wider problems affecting the EV industry as a whole.

Despite the positive numbers from Tesla's Q4 earnings presentation, these problems reared their heads with reports of supply chain issues, no new models launching in 2022, and the scrapping of a rumored $25,000 vehicle for the Chinese market. Perhaps reality is catching up to valuation hype, and the issues of profitability and chip shortages are adding to the EV sell-off.

Nasdaq Down

This all comes as the Nasdaq-100, which tracks the largest non-financial US companies and which Lucid joined on December 20th 2021, has fallen by 15% this month. Then, of course, there are issues like the SEC investigation into Lucid's SPAC merger, and the delivery delays being reported by some owners, which could also be causing price uncertainty.

What do you think the future of the EV market looks like? Is this a minor speed bump, or could the issues currently plaguing EV manufacturers be with us for a while? Let me know in the comments below, and thanks for reading.

Images by Lucid Motors and Google licensed under CC BY 2.0.

James Walker is an automotive journalist at Torque News focusing on Lucid Motors. If it's got wheels he's interested, and he's looking forward to seeing what kind of cars the EV revolution brings us. Whether it's fast, slow, new, or old, James wants to have a look around it and share it in print and on video, ideally with some twisty roads involved. You can connect with James on Twitter, Instagram, and LinkedIn.

Set Torque News as Preferred Source on Google