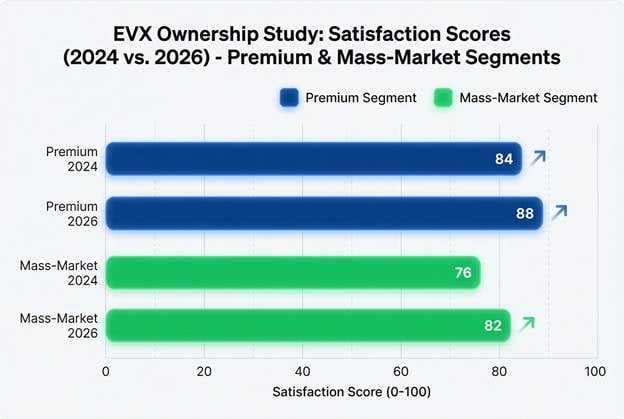

The obituary for the American electric vehicle market was written prematurely last September. When the federal tax credits for new EV purchases finally expired, skeptics predicted a catastrophic retreat to the safety of internal combustion. The "cool-down" did arrive in the sales charts, but today’s release of the 2026 U.S. Electric Vehicle Experience (EVX) Ownership Study tells a far more compelling story: those who actually own these cars have never been happier.

According to the study, owner satisfaction has surged to an all-time high. The Tesla Model 3 has reclaimed its throne as the top premium EV with a staggering score of 804 out of 1,000. Meanwhile, the Ford Mustang Mach-E has solidified its position as the king of the mass-market category. This isn't just a win for two brands; it’s a fundamental shift in how Americans view the act of driving.

The Satisfaction Surge: It’s Not About the Subsidy

Why is satisfaction rising while the market is supposedly cooling? The answer lies in the "honeymoon phase" evolving into "long-term compatibility." In previous years, EV buyers were often early adopters willing to tolerate "growing pains"—spotty charging networks and software bugs—for the sake of the tech. In 2026, the tech has caught up to the promise.

Improvements in battery density and thermal management mean that 2025 and 2026 model-year vehicles are delivering more consistent range, even in the "winter range-anxiety" scenarios that used to haunt owners. Furthermore, the opening of the Tesla Supercharger network to other brands has been a seismic shift for mass-market owners. A Ford Mach-E owner now enjoys the same "plug-and-play" reliability that was once a Tesla-exclusive "walled garden." When the friction of ownership disappears, the inherent benefits—instant torque, quiet cabins, and never visiting a gas station—finally take center stage.

The ICE Age is Melting: What This Means for Gas Powered Cars

For traditional internal combustion engine (ICE) vehicles, these satisfaction numbers are a flashing red warning light. Historically, car loyalty was built on the "known quantity" of gas. However, the 2026 study shows that once a driver goes full battery-electric (BEV), they rarely go back.

The "cost of ownership" metric in the study highlights a widening gap. With gas prices remaining volatile and the maintenance requirements of modern, complex turbocharged engines increasing, the simplicity of a Model 3 or a Mach-E is winning the wallet. ICE vehicles are now being viewed not as the "reliable standard," but as the "high-maintenance legacy" option. This record-high satisfaction suggests that the "cool-down" in sales is a temporary pricing adjustment, not a rejection of the technology.

The Hybrid Trap: A Warning to Strategy-Shifters

In late 2025, several legacy automakers pivoted their strategies to favor Plug-in Hybrids (PHEVs) as a "bridge" to full electrification. The 2026 EVX data suggests this might be a strategic blunder. The study found that PHEV owners report significantly lower satisfaction than BEV owners—trailing by over 110 points in the premium segment.

"PHEVs still carry the maintenance burden of an internal combustion engine while offering a compromised electric experience. Owners are finding they want the 'full' experience, not a half-measure that requires both a charger and an oil change." — Industry Analysis, 2026 EVX Study.

Automakers doubling down on PHEVs risk building products that customers use as a gateway to leave their brand. If a consumer buys a PHEV and finds the electric side superior but the gas side cumbersome, their next purchase won't be another hybrid; it will be a Tesla or a Ford BEV.

The Used EV Gold Mine: Pricing Trends and Parity

Perhaps the most exciting fallout of this study is its impact on the used market. For years, used EV prices were a "race to the bottom" due to concerns over battery degradation. In 2026, the narrative has flipped. High satisfaction among first-owners is validating the long-term durability of these platforms.

As a flood of three-year-old off-lease EVs hits the market this spring, we are seeing a "stabilization" rather than a freefall. The high satisfaction scores are acting as a floor for prices. Buyers who were priced out of new EVs when tax credits disappeared are flocking to 2023 and 2024 models, realizing that a three-year-old EV with 804-level satisfaction is a better "value" than a brand-new gas car. 2026 is officially the "Year of the Used EV," where price parity with ICE vehicles has finally been achieved.

The Road Ahead: Why the Trend is Bulletproof

This improvement in satisfaction isn't a fluke; it's a momentum play. We are entering a virtuous cycle:

- Infrastructure Maturity: The National EV Infrastructure (NEVI) program is finally showing results, with ultra-fast chargers appearing at traditional rest stops.

- Software as a Service: Over-the-air (OTA) updates are now routine. Owners of a 2025 Mach-E are finding their cars actually get better over time, a concept foreign to the ICE world.

- Battery Health Transparency: New standardized "Battery Health Certificates" for used car sales are removing the last great fear for second-hand buyers.

Coming Events: Tailwinds and Headwinds

While the trend is positive, two major events in late 2026 could shift the needle:

- The Launch of "Generation 2" Budget EVs: If Chevrolet and Volkswagen can deliver the promised $25,000 long-range BEVs by Q4, mass-market satisfaction will skyrocket as the "affordability" barrier is demolished.

- Grid Stress Tests: Should a major summer heatwave lead to charging restrictions in California or Texas, we could see a temporary dip in satisfaction as "public charging availability" scores take a hit.

Wrapping Up

The 2026 U.S. EVX Ownership Study proves that the "EV revolution" has moved past the era of government-subsidized experimentation and into the era of consumer-led validation. With the Tesla Model 3 and Ford Mustang Mach-E setting the standard, the high satisfaction scores reflect a reality where the electric experience is simply superior to the alternative. As used prices stabilize and charging infrastructure becomes ubiquitous, the "cool-down" of 2025 will likely be remembered as the moment the market took a breath before the biggest sprint in automotive history.

Set Torque News as Preferred Source on Google