Over the past few months, automotive and mainstream media have made pricing claims giving the impression that Tesla’s recent price changes have brought the brand’s overall averages to a point lower than the industry average transaction price for cars. That is incorrect and easy to prove false.

KBB/Cox Automotive has been tracking new vehicle sales average transaction prices, called ATP, in America for 13 years. The data KBB/Cox provides in its free-to-access press releases is not exact, but the values the company uses are obtained in a very consistent manner, according to Mark Schirmer, Director of Corporate Communications at Cox Automotive, with whom Torque News spoke at length on the topic.

The Tesla Price Reporting Flim Flam

The odd Tesla headlines are exemplified by one from Bloomberg on February 21st. The punchy headline is “Tesla Undercuts Average US Car by Almost $5,000 in EV Shakeout.” The teaser sentence under the headline is “Elon Musk’s latest US price drop brings Tesla’s electric-vehicle premium to a record low.” The impression these headlines seem to communicate is that one can buy a Tesla for less than the cost of an “Average US Car.” This is not the case.

Following the publication in Bloomberg, Fortune, NotaTeslaApp, and Inside EVs, all ran storied with basically the same message

It's Never Been Cheaper to Buy a Tesla?

The first sentence in the Bloomberg story is "It’s never been this cheap to buy a Tesla." Yet, on July 9th, 2017, the same publication called the newly-introduced Tesla Model 3 a "$35,000 electric gamechanger." And on March 1st, 2019 the publication ran a story saying, "Elon Musk has fulfilled a decade-long goal with the $35,000 Model 3." It seems obvious that this is not the cheapest time to buy a Tesla, given that its least expensive product is in now priced in the mid-$40Ks and was reportedly priced nearly $10K lower at a prior point in time.

Average Transaction Prices For New Cars vs. Tesla ATPs

According to KBB/Cox Automotive, the average transaction price for a new car in February 2023 was $44,206. By “Car,” we mean sedan or coupe. The Tesla Model 3 is a Car because it is a sedan. The Toyota Camry is a Car, and the Hyundai Elantra is a Car. When discussing ATPs, these should not be confused with the word “Vehicle,” which includes SUVs and Pickup Trucks. Terms matter when discussing ATPs. The reason is simple; The last three full-size pickup trucks Torque News tested all had sticker prices of around $80K. However, average cars cost dramatically less. The overall ATP in America includes all vehicles, not just the lower-cost car segment.

In the story with the big punchy headline, the author uses the term Car in the headline, and then in the second paragraph, switches "Car" to the word "Vehicle" to make the point that Tesla prices undercut something.

Tesla Pricing and ATP For Cars

Tesla does not offer any vehicle at a starting price lower than the $44,206 ATP for cars. So how can Tesla possibly be undercutting the "average ATP for cars" by $5,000? It cannot.

Intentionally Confusing?

The logic used to give the impression that “Tesla Undercuts Average US Car by Almost $5,000” is this: The authors of the story found Tesla’s cheapest possible product. They then artificially lowered its price by ignoring the destination and ordering fees, which are included in a given model’s ATP. They then compared this imaginary lowest-cost Tesla Model 3 car to the average ATP of all vehicles (including trucks and SUVs). During the month of February when these odd stories began to appear, the average ATP in America for all vehicles combined was $49,388, according to KBB/Cox.

The least expensive automobile that Tesla advertised for sale in February STARTED at $44,630. Hence the claim of undercutting the average “Car” by $5,000. There are multiple problems here.

First, the comparison is two different values. ATP is the average price paid by the consumer at the point of purchase. It is not the starting price of a brand or even of a given model. The lowest base trim price has little to do with average transaction prices. Within a given model or brand, the actual average price the consumer pays is the average transaction price. Tesla Model 3 cars start at about $44,630 and rise in cost to over $73,000. The ATP for the Model 3 car is someplace between these numbers, likely in the high $50ks. By definition, it cannot be $44,630.

We asked Mr. Schirmer at KBB/Cox if he could explain the important difference between the ATP of a segment and the lowest-cost base price of a vehicle within it. Here is what he told us:

“The Kelley Blue Book average transaction price (ATP) is an estimate built by the data scientists at Cox Automotive to provide price estimates for the basket of specific vehicles sold in a given month. It is NOT simply a presentation the lowest-priced model multiplied by the sales volume. Rather, the Kelley Blue Book ATP considers a number of factors to provide a clear perspective on the vehicle mix built and sold in a given month. The number is often far higher than a given model's “base price,” as most automakers focus production and sales on higher-trim models, which are often more popular with buyers. For example, the 2022 Honda Civic has an advertised base price of $22,500, whereas the Kelley Blue Book ATP is $29,286 in February, which we believe is more reflective of the actual group of Civics sold in the U.S. in February.”

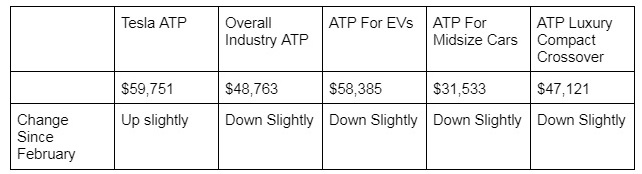

As you can see, the (incorrectly- lowered) base price of a Tesla Model 3 has no meaningful comparison to the industry ATP for all vehicles. So how does Tesla’s brand ATP compare to averages supplied by KBB/Co data? Let’s have a look using the most up-to-date data as of March 9th from KBB/Cox:

Tesla’s ATP is higher than the overall industry ATP for all vehicles, higher than the average ATP for all EVs, dramatically higher than the ATP for midsize cars like the Model 3, and much higher than the ATP for compact crossovers similar to the Model Y. Rather than “undercut” any of the average transaction prices listed, Tesla is either higher, much higher, or drastically higher than other categories.

Tesla Model 3 Starting Prices vs. Starting Prices For “Average Cars”

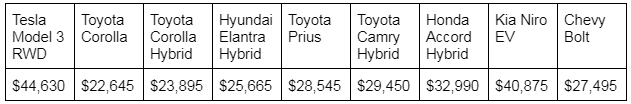

Now let’s look at the starting prices of some vehicles which are the approximate size of the Tesla Model 3. Remember, the headline said, “Tesla Undercuts Average US Car by Almost $5,000….” We created a selection of “Average US cars,” and then we also added the Kia Niro and Chevy Bolt battery electric vehicles to our chart as well. Our prices include destination fees and ordering fees since the consumer pays those to the manufacturer or dealer.

As you can see, the “Average US Car” is actually priced in a range from half that of Tesla’s cheapest car to about 50% less in price. And there are popular EVs that are much more affordable than anything produced by Tesla.

Federal Tax Incentives

Tesla’s Model 3 now benefits from the latest round of federal income tax incentives. However, less than half of American taxpayers will derive any benefit from the new incentives. Even with the incentives, Tesla’s Model 3 is still higher in price than all of the “Average US cars” on our list.

Conclusions

By selectively mixing up the words “Car” and “Vehicle” in a discussion about ATPs, along with comparing a brand’s lowest cost entry model to the average translation price for the market overall, it is possible to provide readers with the false impression that Tesla vehicles are “undercutting” something. We will leave it to our readers to decide why this is happening at so many news outlets.

Top of page image of Tesla retail location by John Goreham.

In this story, we refer to KBB/Cox. We do this because the parent company is Cox, and the branded data is published by KBB. Prior to publication of this story, Torque News reached out to Tesla via its press contact email, [email protected], and invited Tesla to verify the ATP for the Tesla brand as well as the lowest Model 3 price.

John Goreham is an experienced New England Motor Press Association member and expert vehicle tester. John completed an engineering program with a focus on electric vehicles, followed by two decades of work in high-tech, biopharma, and the automotive supply chain before becoming a news contributor. In addition to his ten years of work at Torque News, John has published thousands of articles and reviews at American news outlets. He is known for offering unfiltered opinions on vehicle topics. You can follow John on Twitter, and TikTok @ToknCars, and view his credentials at Linkedin

Set as google preferred source