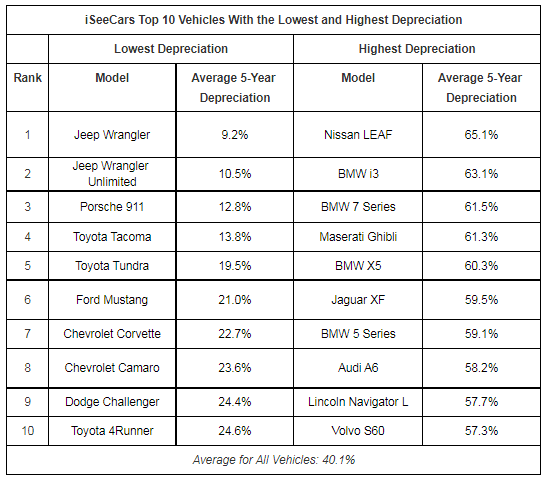

With the ongoing vehicle shortage upsetting the used car market, iSeeCars’ researchers investigated which models had the highest and lowers five-year depreciation. The results showed that the Jeep Wrangler has the best value retention and the least depreciation of any model in the U.S. used vehicle market. “We’ve seen record high used car prices over the past 15 months as a result of the microchip shortage, and that has slowed down the average depreciation rate across all vehicles,” said iSeeCars Executive Analyst Karl Brauer. “Vehicles that have historically maintained their value well have depreciated even less this past year, but even in today’s market some cars continue to drastically drop in value.”

The study analyzed more than 8.2 million car sales to identify models with the lowest and highest loss in value after five years. The vehicle that had the best value retention was the Jeep Wrangler which tops the list of vehicles with the lowest depreciation, at 9.2 percent over five years, compared to 40.1 percent average. “Jeep Wranglers are known for retaining their value due to their enthusiastic fanbase, as well as their durability and performance across all terrains, especially off-road,” said Brauer. “ Jeep Wranglers also have maintained their iconic design, so even older models don’t appear dated.”

Traditionally, Toyota’s trucks and SUVs are neck and neck with Jeep for the top retained value spots. This year is no different. “Toyota trucks have a well-earned reputation for reliability and quality, and the in-demand Tacoma is the best-selling midsize truck in the country,” said Brauer. “These indestructible trucks can be workhorses or dependable family haulers, which widens their appeal and helps boost resale value.”

The two vehicles that depreciate most are the Nissan Leaf battery-electric vehicle and the BMW i3 EV. Both earn tax incentives when purchased new, so the depreciation is a bit higher than it might be were the tax incentives not part of the purchase calculation. Following the Leaf and i3 is a long list of vanity cars (pricey sport/luxury models) that historically depreciate like yesterday’s news.

To view the full results, please check out iSeeCars’ study summary page.

Top of page image by John Goreham. Re-use with permission only.

John Goreham is a long-time New England Motor Press Association member and recovering engineer. John's interest in EVs goes back to 1990 when he designed the thermal control system for an EV battery as part of an academic team. After earning his mechanical engineering degree, John completed a marketing program at Northeastern University and worked with automotive component manufacturers, in the semiconductor industry, and in biotech. In addition to Torque News, John's work has appeared in print in dozens of American news outlets and he provides reviews to many vehicle shopping sites. You can follow John on TikTok @ToknCars, on Twitter, and view his credentials at Linkedin

Re-Publication. If you wish to re-use this content, please contact Torque News for terms and conditions.

Set Torque News as Preferred Source on Google