Tesla recently made the largest price cuts ever seen in the US. As a result, we are hearing from several sources that the demand has been up in Tesla stores for its vehicles and that inventories are down.

This news about Tesla Model Y inventory serves as further evidence of the company's rapid growth and success. Despite the global economic downturn caused by the pandemic, the company has managed to maintain its success, remaining one of the most popular electric vehicle manufacturers in the world. This is largely due to the company's commitment to innovation and its dedication to creating high-quality products that are both affordable and reliable.

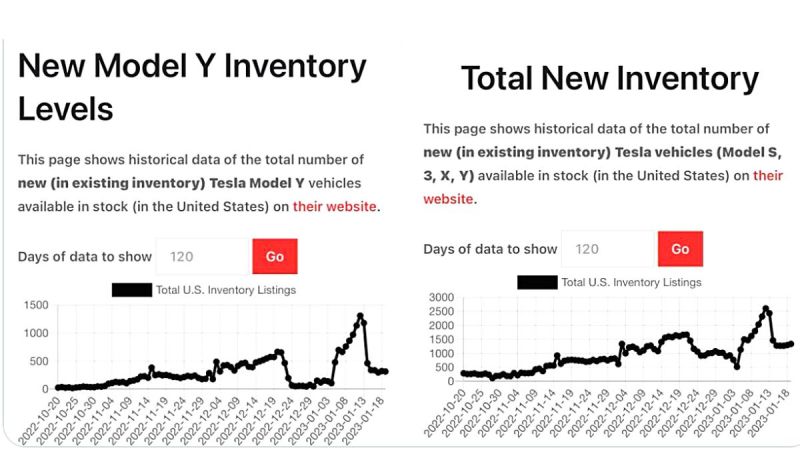

$TSLA US Model Y inventories down by 2/3 and total inventories (S3XY) down 50% since last week’s price cuts. This suggests 1Q volumes could be 450K+ (vs Street at 427K). https://t.co/0z8ubte5xR pic.twitter.com/JrkYzGDqI6

— Gary Black (@garyblack00) January 19, 2023

The reduction in inventories is also a sign of the company's ability to manage its resources effectively. As demand for Tesla cars has surged, the company has been able to adjust its production and inventory levels accordingly, ensuring that customers always have access to the latest models. This is a testament to the company's ability to anticipate and respond to changes in the market.

It is also worth noting that Tesla's success is not just limited to the US. The company has been able to expand its presence in other countries, such as China, where it has been able to tap into a larger customer base. This has allowed the company to reach a wider audience and gain even more success. In fact, Tesla China is reportedly seeing huge demand after the recent price cuts in the country.

Overall, the news from Tesla is a positive sign for the company, as well as for the electric vehicle industry as a whole. It shows that the industry is continuing to grow and that Tesla is continuing to lead the way. This will hopefully encourage other companies to invest in the industry and help to drive further innovation.

Tesla's recent price reductions may reduce profits, but the company's plan to increase manufacturing capacity and production will help the bottom line. Thanks to economies of scale, increased production and sales will help to offset any losses from the price cut, as long as the company continues to improve and streamline production. Additionally, if inflation stays low and the economy continues to improve, costs should come down even further, helping Tesla's bottom line in the long run. In summary, Tesla's decision to reduce prices may hurt their profits in the short term, but it can help in the long run if the company can continue to increase production and efficiency.

Armen Hareyan is the founder and the Editor in Chief of Torque News. He founded TorqueNews.com in 2010, which since then has been publishing expert news and analysis about the automotive industry. He can be reached at Torque News Twitter, Facebok, Linkedin and Youtube.

Image source: Screen Shot from Garry Black's tweet chart.

Set as google preferred source