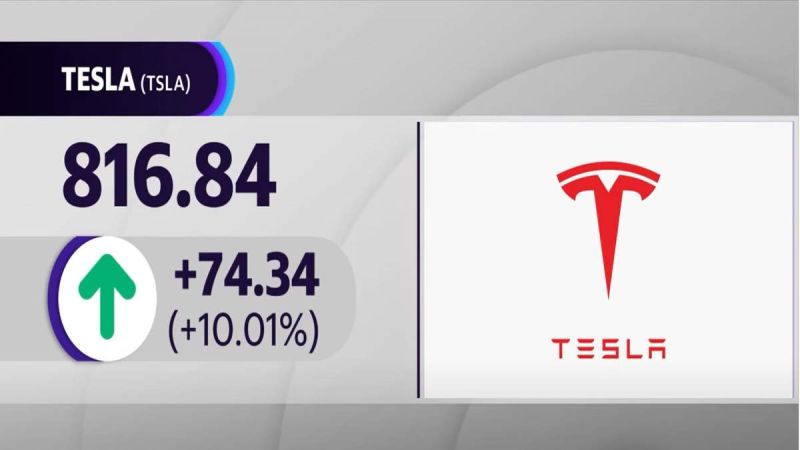

Tesla Stock Popped Today - Here's Why

Tesla stock has gone up by almost 10% today, after an earnings call where they had a one month shut down of Giga Shanghai.

Some people are asking why Tesla stock would be up so much after this earnings report. One of the biggest surprises was lower operating expenses than usual. Their sale of Bitcoin helped this and was a smart move by management.

There was a slight negative reported that automotive gross margin minus the regulatory credits, that was 26.2%. This was inline with what most analysts predicted. There was a slow ramp of Giga Berlin and Giga Texas that impacted this number.

However, as Tesla reaches volume production in Giga Berlin and Giga Texas, you are going to see this automotive gross margin continue to go up and up and surpass what it has ever done.

Tesla is shooting for 1.4 million vehicles delivered this year. That means they need to deliver 840,000 vehicles for the remainder of the year. Q3 and Q4 are going to be big quarters.

The Bad News Is Over

It seems most of the bad news for Tesla is over. Giga Shanghai is no longer shut down. They've sold most of their Bitcoin, and they are primed for success this year and beyond. There continues to be a long backlog for Tesla vehicles, despite a difficult global economic environment.

Tesla has managed to keep operating expenses in check and has shown great discipline in how it is managing its money. There is also a macro situation going on with the economy, with some wondering if we are in a recession, or if we are ready to break out.

It's important to separate high growth companies from the rest of the market. It is possible that the high growth stocks like Tesla has bottomed out already. If the FED has to halt their rate increases, this benefits high growth stocks.

There is a 6 to 12 month outlook for Tesla that most of Wall Street uses to gauge a company. You will see Tesla exiting 2022 with an over 2 million vehicle per year run rate. I think it will be even higher than that because we are at 1.9 million right now.

Tesla will continue to increase their operating profit, net income, and total revenues. I think we'll see a much higher multiple on Tesla - right now it's at about 110 for a price earnings ratio.

What do you think about Tesla's rise in share price? Will Tesla continue to go up?

For more information, see this video by Dave Lee:

Leave your comments below, share the article with friends and tweet it out to your followers.

Jeremy Johnson is a Tesla investor and supporter. He first invested in Tesla in 2017 after years of following Elon Musk and admiring his work ethic and intelligence. Since then, he's become a Tesla bull, covering anything about Tesla he can find, while also dabbling in other electric vehicle companies. Jeremy covers Tesla developments at Torque News. You can follow him on Twitter or LinkedIn to stay in touch and follow his Tesla news coverage on Torque News.

Set Torque News as Preferred Source on Google