The Surprises

- The industry-leading solar pricing (at $1.49/watt after tax credit) and training of many more installers allowed them to grow solar installations by 111% from last quarter. This includes both the solar panels and the revolutionary Solar Roof. The Solar Roof deployments almost tripled. The key innovation that allowed them to grow the solar panel business is they sell it online, instead of paying thousands of dollars for in-person salespeople. The key innovation that allows them to deploy more solar roofs is they have greatly reduced the installation time, to as little as a single day..

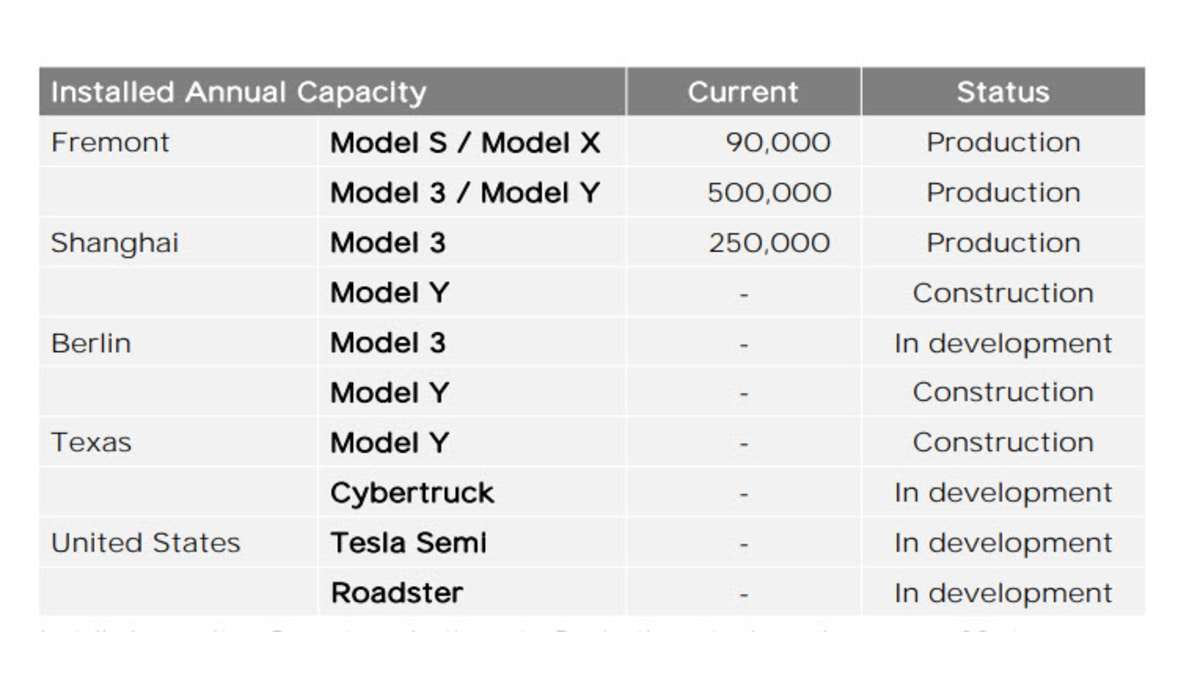

- Tesla has increased the combined Model 3 and Y production capacity from 400,000 cars a year to 500,000 at their Fremont factory and increased the Model 3 capacity from 200,000 cars a year to 250,000 at their Shanghai gigafactory. This continued expansion of their production capacity is at speeds the industry has never seen before.

- The company received $397 million dollars from other manufactures for regulatory credits. Many countries or regions have emissions standards and many of them (especially Europe) allow companies to sell credits if they sell more electric cars and less gas and diesel cars than required (since Tesla doesn't sell any gas or diesel cars, they always have credits to sell).

- Tesla's stock was up so much in the quarter, that the board of director's determined that Elon Musk will likely receive 3 more tranches of the 12 he has an opportunity to get over the next 10 years. In order to receive any compensation, Elon has to grow the company quickly and increase the value of the stock. The requirements are so steep for the tranches that receiving 1 a year would be exceptional, but to reach 3 in a quarter is really surprising. It required a large increase in revenue, sustained 12 trailing earnings before interest, taxes, depreciation, and amortization of $4.5 billion dollars. This $300 million credit that Wall Street should have expected, but didn't, cut quarterly earnings in half.

- Tesla's continued to innovate on building their cars, increasing their gross margins an astounding 2.5% in a quarter and 4.6% over last year. In addition, Tesla is doing a great job keeping sales and general expenses under control, even as sales continue to grow at incredible rates.

Tesla is setup to quadruple sales over the next 3 years

For Tesla to take sales from 500,000 cars this year to 2 million a year in 2023, they need to expand supply and ensure demand for their cars. What is surprising is they don't really need any new products to get there. Let's look at their 4 plants.

- The Fremont factory is very crowded inside (I've toured the factory 2 years ago) and there isn't much room to expand, since Tesla doesn't own the land around the factory. In addition, Tesla was not happy with the county government shutting them down for so long for COVID 19. I don't expect to see much more than 500,000 cars produced from this factory ever, but 500,000 is a lot!

- The Shanghai gigafactory is expanding quickly and I expect by 2023, they will have the capacity for at least 300,000 Model 3 and 300,000 Model Y cars a year. They may have the capacity for a new smaller car also.

- The Berlin gigafactory will start production by June 2021, but I expect little volume in 2021 since they are working the bugs out of a totally new way of building cars. Even in 2022, they may only be able to build 200,000 cars. But by 2023, the factory should be able to build close to 500,000 as they ramp production quickly for Model Y and Model 3.

- The Austin gigafactory will surprisingly also start production of the Model Y in 2021. Similar to Berlin, I expect little production in 2021 and a modest 200,000 in 2023, but by 2023, they should have the capacity for 500,000 Model Y, Model 3, and Cybertrucks.

Conclusion

So by 2023, they not only have the capacity to build 2 million vehicles, but they have ensured that they are innovating, so they should be able to reduce the price of all their vehicles by about $8,000, gradually over the 3 years (4 small $2,000 cuts). In this time, gas and diesel cars from competitors will go up about $3,000 (car prices have been going up about 3% or $1,000 a year). For example, a Toyota Camry starts at about $24K today and a fully loaded version is about $39K. The Tesla Model 3 starts at about $38K and goes to about $60K (without FSD). Even today, the Model 3 competes well with the Camry in the total cost of ownership. With the Camry predicted to cost $27K to $43K and the Model 3 predicted to cost $30K to $50K in 2023, it's easy to see more people choosing the Model 3, with similar purchase prices, vastly better ownership costs, and far better driving performance. This brings Tesla down from the entry-level luxury market to the mainstream market, greatly expanding their addressable market. So an affordable ($35,000) electric crossover and an even more affordable ($30,000) sedan available in the 3 major markets (US, China and Europe) are all Tesla needs to sell 2 million cars.Telsa will also have the Cybertruck, Model S, Model X, and Roadster, but none of those will sell near the volume of the Model 3 or Y. BMW, by contrast, produces 14 models to sell a similar number of cars.

Check out the following recent articles of mine.

What I'll be watching for tomorrow on the Tesla 3Q Earnings Call

Tesla Lowers Model 3 Prices in Norway, Australia & New Zealand

First Pictures of Refreshed 2021 Tesla Model 3 Surface

Paul Fosse is a Software Engineer delivering financial data marts using massively parallel databases (Exadata and GreenPlum) for a major healthcare insurer and a lifelong lover of cars. From the time I saw the 1972 Volkswagen Dasher review in Consumer Reports, I knew the industry would convert to front-wheel drive. Now I am excited to have a front-row seat to the industry's biggest transition in generations, the transition from gas and diesel cars to electric vehicles. I ordered my first EV (Nissan Leaf) in 2010 and now own a 2018 Tesla Long Range Model 3 and have a Cybertruck and a Model Y on order. Contact me on Twitter at Paul Fosse with tips for new stories. Full disclosure, I'm a Tesla Shareholder.