Plug-in vehicles and tax planning

As we start the last third of the year, people’s minds normally turn to the holidays. However, we should be taking a look at our income tax situation and include planning for next Spring’s tax season.

In my day job as a vehicle salesperson, specializing in plug-in vehicles, I am constantly amazed to see how little understanding there is about the federal government’s Income Tax Credit for EVs and plug-in hybrids. I’ve even had tax professionals give incorrect guidance to their clients, so here’s a bit of info:

First, not everyone can get the full $7,500 tax credit.

If you’re a retiree and have minimal tax burden, you may not qualify for the full amount. The reason is the IRS will not credit more than your entire tax bill. As an example, let’s say your entire tax burden is $4,000 per year. That $4,000 is all you can get back as a tax credit. In fact, some leasing incentives would be far better for you than just $4k, so it’s important to know what your tax burden has been.

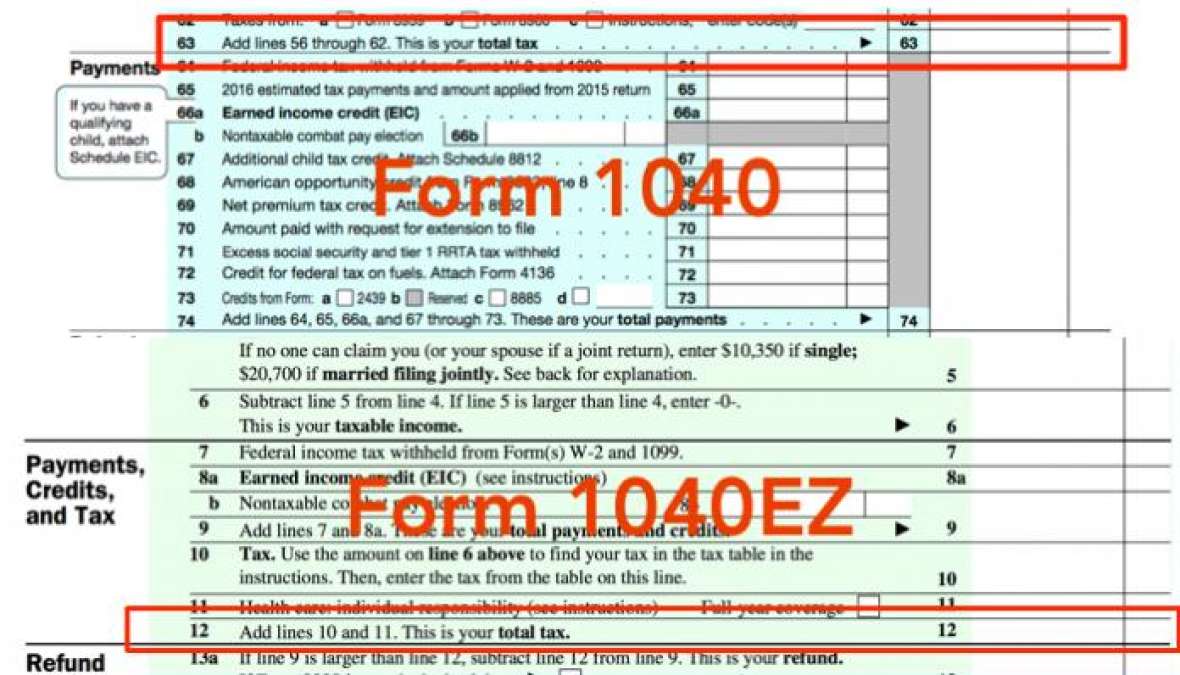

THE MOST IMPORTANT THING: The amount of the credit, for which you qualify, has NOTHING to do with how large a refund you get, after filing your taxes. It also has nothing to do with the size of the check you have to write to the IRS, because not enough was withheld from your paycheck. It has to do with your entire tax owed, AFTER ALL OTHER DEDUCTIONS AND CREDITS HAVE BEEN ACCOUNTED FOR. To see if you would be able to get the entire tax credit, look at your tax return from last year. On line 12 on form 1040EZ or line 63 on form 1040 (see images) is your tax, after deductions. On form 1040, lines 64 through 74 show payments and credits that have been made, so those may have an impact on total tax burden as well.

IF (and this is very important) your income and deductions/credits have not changed substantially from last year, these lines on last year’s form will give a good indicator of whether you can get the entire credit. If you tax was over $7,500, odds are good you’d get the entire tax credit.

I am not a tax professional, so make sure you check with your tax preparer to make sure this advice is sound, for you.

HERE’S WHY THAT LAST SENTENCE IS IMPORTANT. You may have a $15K tax burden, but you also own a house, for which you get deductions for real estate taxes and mortgage interest you paid. You have three children, for which you’ve claimed deductions. You have an IRA, to which you make contributions, just before filing your taxes. All these deductions reduce your taxable income and therefore, your income tax. Out of the theoretical $15K in income tax burden, these deductions may reduce your income tax to less than $7,500. If so, you would not be able to get the entire tax credit.

Second, the credit is only issued for purchases.

The tax credit is paid to the original purchaser and not to those who choose to lease or to buy a pre-owned vehicle. In the case of leasing, the leasing company is the owner of the vehicle and therefore it gets the tax credit.

Third, tax credits and tax deductions are very different.

Let’s discuss this as well. The tax credit is not like a tax deduction. A tax deduction is subtracted from your taxable income, NOT your tax. By reducing your income $1,000, you may only reap a benefit of $250. The benefit is your income tax rate multiplied by your deduction. In the example above, the person fell into a 25% tax bracket, so the $1,000 income deduction resulted in taxes being lowered by only $250 (25% X $1,000). A tax credit, on the other hand, is subtracted from your income tax, not your income. That means an income tax credit of $7,500 would reduce your income tax by the full $7,500.

Fourth, not all plug-in vehicles qualify for the full credit.

The tax credit is dependent on battery pack size. The federal government has posted a guide to show the amount of tax credit available by vehicle model. It is located here. As it shows, many of the plug-in vehicles qualify for the full $7,500, like the Chevy Volt and Bolt EV, Nissan Leaf or Toyota Rav4 EV. However, many do not qualify for the full amount, like the 2012-2015 Prius plug-in ($2,500), the 2017 Prius Prime ($4,502) or the BMW i8 ($3,793). When comparing plug-in vehicle pricing, it is important to know the credit associated with each vehicle you’re considering. Subtract the credit, from the MSRP, to get an “apples-to-apples” comparison of pricing.

Fifth, the tax credit does not last forever.

The tax credit is going away. When a manufacturer sells their 200,000th vehicle, which qualifies for the tax credit, the tax credit (for that manufacturer) is phased out over the following year, first getting cut in half for six months, then in half again for the final six months. The first three manufacturers to be affected appear to be General Motors (Cadillac ELR, Spark EV, Volt & Bolt EV), Nissan (Leaf) and Tesla Motors (Model S, Model X, Model 3). General Motors & Tesla may hit 200,000 vehicles about a year from now. Nissan, depending on buyers’ reaction to the newly redesigned Leaf, may last a couple quarters longer. In the meantime, the current administration may change the program or eliminate it altogether. Only time will tell.

Finally, it’s not a point-of-sale discount.

Unfortunately, the government decided to offer a tax credit, meaning your individual tax situation (as outlined above) has an impact on the amount you would receive. Due to this, the dealers cannot reduce the price of the vehicle $7,500. You have to wait, until the year after you make your EV or hybrid purchase, to file your income tax return and receive your tax credit. This means your vehicle loan is $7,500 higher than your actual vehicle cost, which increases your monthly payment. Unless you plan on keeping your vehicle until the loan is retired, I highly recommend paying the $7,500 toward the vehicle loan. Your EV instantly depreciated $7,500, when you purchased it. Most people know that they can go buy a brand new EV and get the $7,500 tax credit. Why would they pay you a penny more than the price minus the $7,500? Unless you want to be upside-down on your car loan for a very long time, do not think of the tax credit as free money. It was intended to reduce your initial investment, to make the EV or hybrid more competitive against gasoline-powered vehicles, until economies of scale and battery advances make them competitive without government assistance.